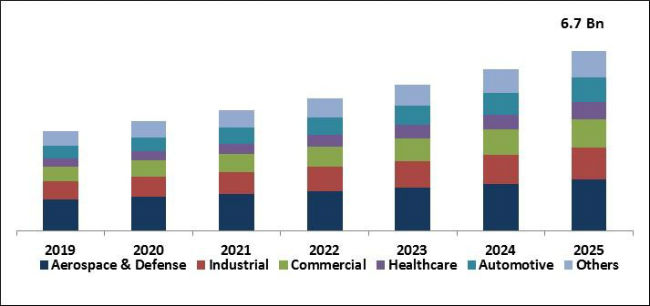

The Global Thermal Scanners Market size is expected to reach $6.7 billion by 2025, rising at a market growth of 10.3% CAGR during the forecast period. The Thermal Scan Monitoring System is an infrared imaging system designed to perform contact wire thermal imaging. The machine is powerful enough to stand outside a train wagon and has an image frequency that can display the lines at very high speed. In the range 40°C to 500°C the system is measured. The system can be paired with a Catenary Video Surveillance System that captures high-speed and high-resolution images of catenary color and integrates them with the device user interface thermal images.

Global Thermal Scanners Market Size

In addition to the increasing demand for additional advanced safety solutions, the rapid urbanization of the entire globe would lead to robust growth of the world thermal scanner industry. Infrared heat scanner detects passively absorbed infrared radiation from objects which is more concealed than other light-sourced active imaging systems. Due to its excellent concealment, good anti-interference, strong target detection capabilities and all weather conditions, the infrared thermal scanner is used in militarily recognized research, monitoring and guidance. It is used widely in weapons and equipment.

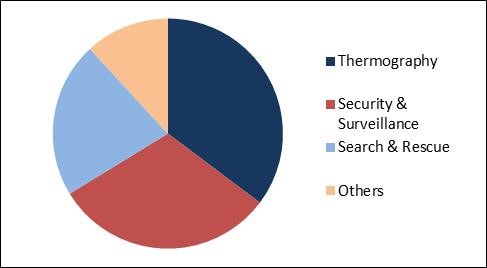

Thermal Scanners Market Share

Primary factors driving the growth of this market include increasing demand for mass screening thermal scanners at airports, rising government investments in the aerospace and defense industries, extensive research and development expenditure by businesses, governments and capital firms in the production of advanced thermal scanning technologies, and an increase in the use of thermal scanners in automotive industry.

A new type of coronavirus infection has recently occurred in Wuhan, Hubei and in many other regions. The developed mobile infrared thermal imaging screening systems can instantly screen for high fevers that may be caused by influenza and pneumonia in crowded areas. Its main features include non-contact quick body temperature screening, large area detection, long distance, smart alarm, high temperature measurement accuracy, fast response, infrared and visible image overlay measurement analysis.

Based on Type, the market is segmented into Fixed and Portable. Based on Application, the market is segmented into Thermography, Security & Surveillance, Search & Rescue and Others.Based on Wavelength, the market is segmented into Long-Wave Infrared, Medium-Wave Infrared and Short-Wave Infrared. Based on End User, the market is segmented into Aerospace & Defense, Industrial, Commercial, Healthcare, Automotive and Others. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

Free Valuable Insights: Global Thermal Scanners Market to reach a market size of $6.7 billion by 2025

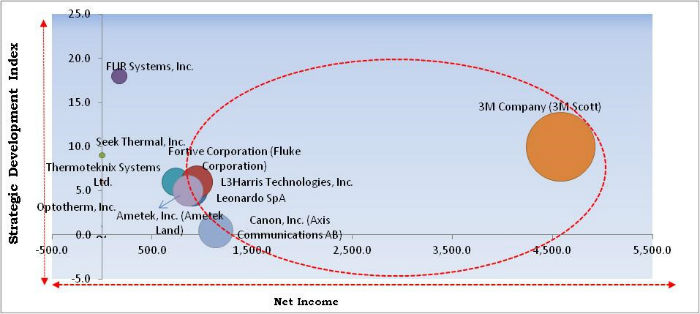

Thermal Scanners Market Cardinal Matrix

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix, 3M Company, L3Harris Technologies, Inc., Leonardo SpA, Canon, Inc., and Ametek, Inc. are the forerunners in the Thermal Scanners Market. Companies such as FLIR Systems, Inc., Seek thermal, Inc., Thermoteknix Systems Ltd., Optotherm, Inc., and Fortive Corporation are some of the key innovators in Thermal Scanners Market.

The market research report covers theanalysis of key stake holders of the market. Key companies profiled in the report include FLIR Systems, Inc., Fortive Corporation (Fluke Corporation), Leonardo SpA, L3Harris Technologies, Inc., Canon, Inc. , Axis Communications AB), 3M Company (3M Scott), Ametek, Inc. (Ametek Land), Thermoteknix Systems Ltd., Seek Thermal, Inc., and Optotherm, Inc.

» Partnerships, Collaborations, and Agreements:

» Acquisition and Mergers:

» Product Launches and Product Expansions:

Market Segmentation:

By Type

By Application

By Wavelength

By End User

By Geography

Companies Profiled

According to a new report published by KBV Research, The global thermal scanners market size is expected to reach $6.7 billion by 2025.

The market is expected to witness a boost due to Increasing demand for thermal scanners at airports for virus detection, Use of thermal scanners to diagnose defects in building structures, and Increasing adoption of thermal scanner in manufacturing industry. The market growth is expected to get affected due to Impact of the coronavirus on defence and aerospace industries.

Some of the key industry players are FLIR Systems, Inc., Fortive Corporation (Fluke Corporation), Leonardo SpA, L3Harris Technologies, Inc., Canon, Inc. , Axis Communications AB), 3M Company (3M Scott), Ametek, Inc. (Ametek Land), Thermoteknix Systems Ltd., Seek Thermal, Inc., and Optotherm, Inc.

The fixed device segment captured the highest market growth in 2019.

The North America is expected to hold the dominant market share by 2025. Due to the recent coronavirus infection epidemic in China, the Asia Pacific region would witness a boom in the application of thermal scanners in the security of airports.

The expected CAGR of thermal scanners market is 10.3% from 2019 to 2025.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.