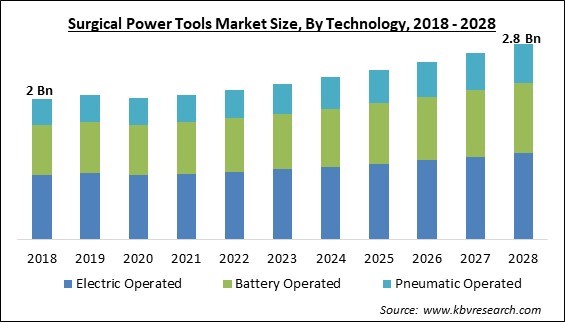

The Global Surgical Power Tools Market size is expected to reach $2.8 billion by 2028, rising at a market growth of 4.6% CAGR during the forecast period.

Surgical power tools are portable instruments that can cut, remove, shape, or soft tissue and ablate bone and other materials in surgical procedures using electrical, pneumatic, or ultrasonic power. These technologies are intended to lessen patient trauma, recuperation time, and the time and effort typically needed to do a particular surgery. For instance, power tools for surgery include drills, saws, and chisels.

These instruments are used in arthroplasty, ENT, plastic surgery, neurosurgery, orthopedic, and neurosurgical treatments. Compared to manual cutting instruments, surgical power tools offer greater accuracy and control, enabling more accurate cuts and better results. Surgery can be completed more quickly and efficiently with surgical power tools than manual ones. This could help to cut down on treatment time, lower costs, and lower the possibility of problems.

In orthopedic procedures like knee and hip replacement surgery, surgical power tools are frequently utilized to cut & shape the bone or remove diseased cartilage. To secure the prosthetic joint, the surgeon will employ power tools to drill holes into bone and implant screws and plates. To guarantee a snug fit for the prosthetic, the tools can also be employed to trim away any extra bone or cartilage and to round the edges of the bone.

Hence, the market's expansion is related to increased knee & hip replacement surgeries. The rise in the incidence of chronic diseases, the rise in the number of surgical procedures, and the rise in the population of elderly people are the main factors driving the growth of the surgical power tool market.

A large number of clinics & hospitals throughout the world have been reorganized to boost the hospital capacity for patients with COVID-19. However, it caused supply chain disruptions and put tremendous strain on the healthcare industry to meet the growing demands of patients with coronavirus infections. Some healthcare facilities suspended surgical procedures, including non-emergency elective surgeries, due to fast-rising hospitalization rates and a rise in COVID-19 patients. Despite this, it is projected that the demand for surgical power tools will increase due to rising healthcare investments in the post-pandemic era and a growing emphasis on bolstering the infrastructure.

According to the World Health Organization, the United Nations General Assembly has set the ambitious goal of halving road traffic-related deaths and injuries by 2030. Injury-related deaths on the road are the most significant cause of mortality for children & young adults aged 5 to 29. Every year, over 1,3 million people are killed in motor vehicle accidents. More than fifty percent of all road traffic fatalities occur among vulnerable road users, including cyclists, pedestrians, and motorcyclists. Moreover, 93% of global road fatalities take place in low- and middle-income countries, even though these nations possess nearly 60% of the world's vehicles. These elements would support the growth of the regional market.

World Health Organization estimates that 1 in 6 individuals worldwide will be 60 or older by 2030. There will be 1.4 billion people, up from 1 billion in 2020, who are 60 or older. The number of old aged people across the globe will double by 2050. Between 2020 and 2050, there will be 426 million more people who are 80 or older than today. Two-thirds of people over 60 will reside in low- and middle-income nations by 2050. Hearing loss, cataracts, refractive errors, osteoarthritis of the back and neck, chronic obstructive pulmonary disease (CO, diabetes, depression, and dementia are all common ailments in older people. This is expected to contribute to market expansion.

The persistent underinvestment in education & training of healthcare personnel in some nations, as well as the mismatch within education & employment strategies in relation to the needs of health systems and populations, contribute to the persistence of shortages. Using advanced medical technology and equipment necessitates the employment of highly qualified personnel who can operate these technologies and devices effectively. While the global shortage of qualified workers is projected to continue in the coming years, the market will fall.

Based on technology, the surgical power tools market is segmented into electric operated, battery operated, and pneumatic operated. The batter-operated segment covered a considerable revenue share in the surgical power tools market in 2021. Because they are convenient to use and don't require an electrical wire, battery-powered power tools are gaining popularity. In addition, battery packs can be sterilized using various techniques, including ethylene oxide gases, hydrogen peroxide gases, and gamma rays, which considerably minimize the danger of infection.

On the basis of product, the surgical power tools market is fragmented into surgical drill, surgical saw, reamer, power source and accessories. The surgical drill segment witnessed the largest revenue share in the surgical power tools market in 2021. The rising incidence of orthopedic problems such as spinal injuries, osteoporosis, and spinal anomalies drives the demand for surgical drill bits. Moreover, the growing incidence of sports injuries is driving the market. The most prevalent kind of sports injuries is bone fractures and dislocations. Fractures and other common sports injuries are typically treated with surgical drill bits.

By application, the surgical power tools market is bifurcated into orthopedic surgery, cardiothoracic surgery, spine & neuro surgery and others. The orthopedic surgery segment dominated the surgical power tools market with the maximum revenue share in 2021. Today, osteoarthritis affects a sizable portion of the global population. This group of patients needs orthopedic surgery. As a result, it is anticipated that the need for orthopedic surgery will rise in the near future. Moreover, the increasing need for orthopedic procedures to treat conditions such as osteoporosis and osteoarthritis also increases the demand for surgical power tools.

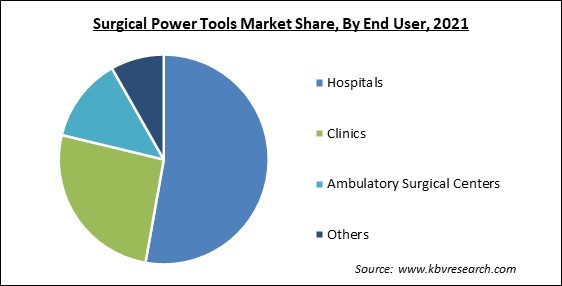

Under end user, the surgical power tools market is divided into hospitals, clinics, ambulatory surgical centers, and others. The ambulatory surgical centers segment acquired a substantial revenue share in the surgical power tools market in 2021. This results from the increasing popularity of aesthetic or cosmetic procedures performed at ambulatory surgical centers. In addition, it offers cost-saving benefits by shortening the patient's post-procedure stay. So, it is a suitable option for individuals who do not require extended hospital stays, thereby boosting market demand.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.1 Billion |

| Market size forecast in 2028 | USD 2.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.6% from 2022 to 2028 |

| Number of Pages | 279 |

| Number of Table | 485 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Application, End User, Product, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the surgical power tools market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led surgical power tools market by generating the highest revenue share. This is a result of an increase in the incidence of sport-related injuries, an increase in the number of surgical facilities, an increase in the availability of well-developed healthcare infrastructure, and the strong presence of the market for surgical power tools in the region. Furthermore, the availability of qualified neurosurgeons, well-established health care, and increasing awareness of minimally invasive surgeries fuel the market expansion in the region.

Free Valuable Insights: Global Surgical Power Tools Market size to reach USD 2.8 Billion by 2028

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson is the forerunner in the Surgical Power Tools Market. Companies such as Medtronic PLC, Zimmer Biomet Holdings, Inc. and Stryker Corporation are some of the key innovators in Surgical Power Tools Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Arthrex, Inc., B. Braun Melsungen AG (Aesculap, Inc.), ConMed Corporation, Johnson & Johnson, Medtronic PLC, Stryker Corporation, Zimmer Biomet Holdings, Inc., Nouvag AG, American Precision Industries, Inc. (Altra Industrial Motion Corp.), and GPC Medical Ltd.

By Technology

By Application

By End User

By Product

By Geography

The global Surgical Power Tools Market size is expected to reach $2.8 billion by 2028.

Surged cases of road accident injuries are driving the market in coming years, however, Dearth of trained professionals restraints the growth of the market.

Arthrex, Inc., B. Braun Melsungen AG (Aesculap, Inc.), ConMed Corporation, Johnson & Johnson, Medtronic PLC, Stryker Corporation, Zimmer Biomet Holdings, Inc., Nouvag AG, American Precision Industries, Inc. (Altra Industrial Motion Corp.), and GPC Medical Ltd.

The Electric Operated segment acquired maximum revenue share in the Global Surgical Power Tools Market by Technology in 2021 thereby, achieving a market value of $1.3 billion by 2028.

The Hospitals segment is leading the Global Surgical Power Tools Market by End User in 2021 thereby, achieving a market value of $1.5 billion by 2028.

The North America market dominated the Global Surgical Power Tools Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $977.4 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.