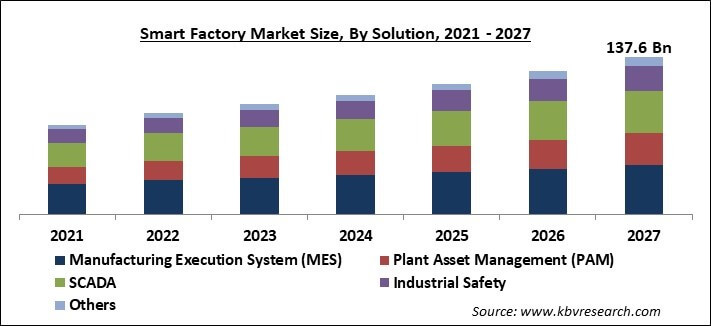

The Global Smart Factory Market size is expected to reach $137.6 billion by 2027, rising at a market growth of 9.9% CAGR during the forecast period. A smart factory is considered as a concept where equipment and machines are capable to enhance processes with the help of self-optimization and automation. The advantages of a smart factory go beyond the physical production of goods and into functions, such as planning, supply chain logistics, and even product development. The smart factory market is bifurcated by product type, into machine vision systems and industrial robotics, among others, and based on technology, into SCADA, PLZ, and HMI, among others.

The vendors of smart factory solutions are striving hard to create solutions that are capable enough to improve the quality and quantity of products made by the makers of foods and beverages. In the food & beverages manufacturing sector along with the companies involved in the processing, packaging, and distribution of food & beverages, high-quality standards hold great value. With the help of automation techniques, the food & beverages sector provides design flexibility, unique and integrated safety solutions, and sophisticated software tools for regulating the operations of machines. Food manufacturers are putting hefty investments in changing their conventional manufacturing units into advanced units. Therefore, the food & beverages industry is witnessing a high adoption rate of smart factory technologies and advanced manufacturing equipment.

Automation in the smart factories deploys different kinds of control devices like motors, sensors, drives, and switches & relays and network technologies like wired, wireless, and radio frequency identification (RFID). Integrated systems like Manufacturing Execution System (MES), Information Technology (IT) system, Programmable Logic Control (PLC), Enterprise Resource Planning (ERP), and Supervisory Control and Data Acquisition (SCADA) are made to fulfill the particular needs of a manufacturing facility. These industrial control systems are able to manage the process and simplify the flow of materials across the manufacturing line. Smart factories also deploy industrial robots like articulated robots, Cartesian robots, SCARA (Selective Compliance Assembly Robot Arm or Selective Compliance Articulated Robot Arm) robots, cylindrical and other robots for several manufacturing processes like welding, painting, heavy lifting, and conveyance, etc.

In 2020, the outbreak of the COVID-19 pandemic has created an adverse impact on the overall smart factory market, causing a lower shipment of components and solutions of smart factories and the revenues produced from them. Due to this, a decline was observed in the development trend of the market during the first quarter of 2020. However, this trend had been anticipated to disrupt in the next half of the year as the demand would increase because of the increasing concern for smart automation, energy, and resource efficiency.

The COVID-19 pandemic has considerably impacted the value chain of the smart factory market. The US, China, South Korea, and Japan, which have been negatively impacted by the pandemic, are responsible for a major share of the global smart factory manufacturing. The discrete industries and process industries are observing a reduced demand, which would remain the same for some time due to the worldwide slowdown.

Based on Component, the market is segmented into Industrial Sensors, Industrial Robots, Industrial 3D Printers and Machine Vision Systems. The industrial 3D printing segment would showcase the largest growth rate during the forecast period. The development of this segment is credited to the growing adoption in industries like aerospace & defense, automotive, semiconductor & electronics, and food & beverages. In the food & beverages industry, 3D printing technology is highly utilized to make molds for various kinds of food like hard candies, chocolates, and cakes. This supports the development of the market for industrial 3D printing for the food & beverages industry.

Based on Solution, the market is segmented into Manufacturing Execution System (MES), Plant Asset Management (PAM), SCADA, Industrial Safety and Others. The PAM segment would showcase the biggest growth rate during the forecast years. The development of this segment is due to the growing installation of PAM solutions in process and discrete industries to develop an exhaustive data repository associated with various equipment installed in these plants, right from their uptime performance to their life cycle cost evaluation.

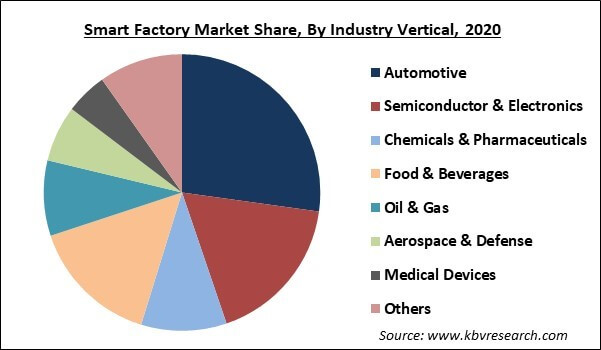

Based on Industry Vertical, the market is segmented into Automotive, Semiconductor & Electronics, Chemicals & Pharmaceuticals, Food & Beverages, Oil & Gas, Aerospace & Defense, Medical Devices and Others. The medical devices industry is boosted by development and technological innovations. The industry has observed major growth due to the development of cutting-edge medical devices with the help of novel technologies. In the medical devices industry, smart factory solutions assist enhance manufacturing processes, planning, third-party services, technology assessment, and remote support. Smart factory technologies also assist in decreasing the recalls and wastes and surge the profitability of the companies involved in the manufacturing of medical devices because of the accuracy in manufacturing.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 65.2 Billion |

| Market size forecast in 2027 | USD 137.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 9.9% from 2021 to 2027 |

| Number of Pages | 307 |

| Number of Tables | 435 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Landscape |

| Segments covered | Component, Solution, Industry Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America is quickly emerging as a hub for industries. Hence, there is a massive demand for refurbishing the existing infrastructure with modern technologies. Smart factors of the fourth industrial revolution may reveal the key to efficiency for makers. And every maker - those from already “running smart” to those not yet put investment in smart factory technologies can adopt the cutting-edge technologies that will yield business value.

Free Valuable Insights: Global Smart Factory Market size to reach USD 137.6 Billion by 2027

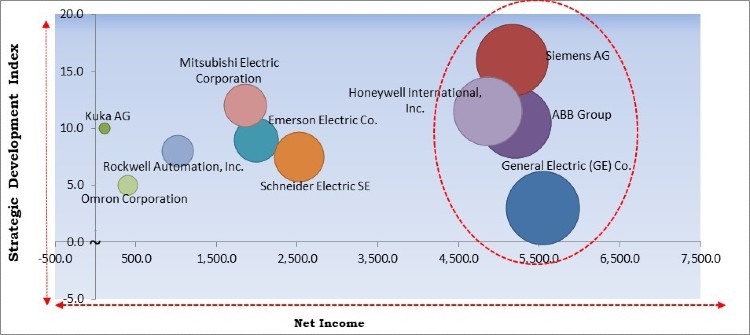

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Siemens AG, Honeywell International, Inc., ABB Group, General Electric (GE) Co. are the major forerunners in the Smart Factory Market. Companies such as Mitsubishi Electric Corporation, Emerson Electric Co., and Kuka AG are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Emerson Electric Co., General Electric (GE) Co., Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, Honeywell International, Inc., Mitsubishi Electric Corporation, Kuka AG, and Omron Corporation.

By Component

By Solution

By Industry Vertical

By Geography

The smart factory market size is projected to reach USD 137.6 billion by 2027.

The increasing number of advancements in wireless sensor networks and their adoption in smart factories are driving the market in coming years, however, Issues in the interoperability between information technology (IT) and operational technology (OT) have limited the growth of the market.

ABB Group, Emerson Electric Co., General Electric (GE) Co., Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, Honeywell International, Inc., Mitsubishi Electric Corporation, Kuka AG, and Omron Corporation.

The discrete industries and process industries are observing a reduced demand, which would remain the same for some time due to the worldwide slowdown.

The expected CAGR of the smart factory market is 9.9% from 2021 to 2027.

The automotive segment would garner the highest revenue share of the smart factory market, by discrete industry, throughout the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.