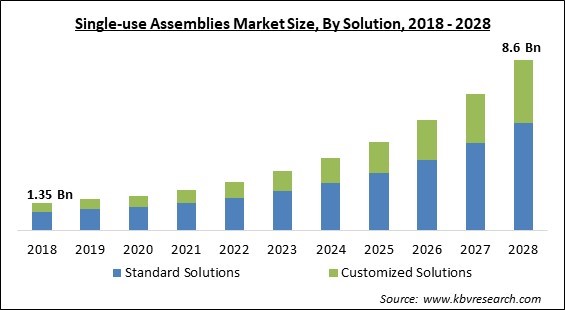

The Global Single-use Assemblies Market size is expected to reach $8.6 billion by 2028, rising at a market growth of 23.4% CAGR during the forecast period.

A single-use assembly is a ready-to-use, customer-specific all-in-one solution comprised of multiple plastic components that are combined into a single whole. Single-use assemblies consist of prefabricated plastic fluid pathways and self-contained goods. Typically ready-to-use and gamma-irradiated to maintain sterility, they are constructed from a variety of standard components and are gamma-irradiated to ensure sterility.

Sample bottles, filters, check valves, tubing, clamps, fittings, sterile connectors, and seals are among the most often used industrial goods. The expanding biologics market, continuing technological advancements in bioprocessing, rising biopharmaceutical R&D, and widespread acceptance of single-use assemblies by several CMOs are estimated to drive industry expansion throughout the coming years.

Sometimes, (bio)pharmaceutical and life science companies assemble their proprietary single-use process systems. Certainly, it needs to be executed securely. If the connection between components is not properly made, cross-contamination or leakage may occur. This might put the safety and quality of the final product in jeopardy and prolong the production process. Standardization of single-use models and assemblies would provide the biopharmaceutical industry with rapid, simple, and cost-effective solutions, as is commonly acknowledged.

As the biopharmaceutical business extends its use of single-use technologies, suppliers struggle to keep up with demand. A widely recognized standardization method for single-use items could help relieve these supply concerns. This would not only aid the industry by helping to ensure timely manufacturing, but it would also increase patients' access to necessary therapies.

The majority of businesses have ceased manufacturing or reduced it to an absolute minimum level. During the initial phase of the pandemic, governments' COVID-19-responsive measures, including lockdown and social isolation, led to the shutdown of production plants. With very few industrial operations permitted, the industrial sector's demand for numerous raw items has decreased dramatically. During the economic crisis, very few new Single-Use Assemblies were deployed by these industries, implying that these variables had a significant impact on the market for Single-Use Assemblies.

Due to the significant advantages of single-use solutions over conventional bioprocessing technologies, the popularity of single-use assembly is steadily increasing. These include quicker incorporation of single-use assembly components into the bioprocess cycle and a reduced likelihood of cross-contamination. Single-use assemblies are ergonomically intended to hold integrated single-use flow channels, allowing for a faster setup and a smaller footprint.

In the modern era, urbanization along with various other technological advancements within several sectors throughout economies all over the world is one of the major factors that is boosting the development of these countries. Various under-developed countries are emerging at a very fast pace in recent years. Moreover, emerging markets are anticipated to provide major development prospects for single-use assembly market participants. This is due to the presence of less severe regulatory policies as well as a low-cost and trained workforce in their respective pharmaceutical and biopharmaceutical industries.

Leachable are substances found in drug products due to leaching from containers, seals, and processing components, whereas extractables are molecules that may be extracted from source materials using proper solvents under rigorous laboratory conditions. Leachable can therefore be considered as a subset of extractable. Due to the usage of additives to promote stability and aid in the creation of material components, extractable and leachable are typically connected with elastomeric and polymeric materials.

Based on Product, the Single-use Assemblies Market is segmented into Bag Assemblies, Filtration Assemblies, Bottle Assemblies, Mixing System Assemblies, and Other Products. In 2021, the filtering assemblies segment garnered a significant revenue share of the single-use assemblies market. Increased regulatory standards and the need to reduce the risk of contamination have prompted mass and final fill processes to employ filtration assemblies.

On the basis of Solution, the Single-use Assemblies Market is bifurcated into Standard Solutions and Customized Solutions. In 2021, the standard solutions segment witnessed the highest revenue share in the single-use assembly market. The rise in the growth of the segment is attributed to the fact that standard solutions are widely adopted in the pharmaceutical and biopharmaceutical industries due to the benefits they provide, including manufacturing process e?ciency with reduced capital and operational expenditure, improved flexibility through the use of pre-qualified components to build assemblies, decreased implementation time, and increased production planning flexibility.

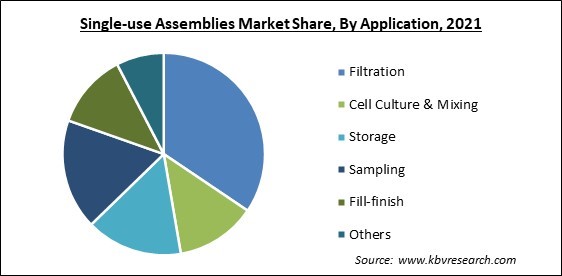

By Application, the Single-use Assemblies Market is segregated into Filtration, Cell Culture & Mixing, Storage, Sampling, Fill-finish Applications, and Other Applications. In 2021, the cell culture & mixing segment garnered a substantial revenue share of the single-use assemblies market. The growth of the segment is primarily driven by the increasing demand for biopharmaceuticals, supportive government regulations, and increased R&D expenditures. In addition, the increased demand for mammalian cell lines for upstream bioprocessing is moving the industry forward.

Based on End-User, the Single-use Assemblies Market is categorized into Biopharmaceutical & Pharmaceutical Companies, CROs & CMOs, and Academic & Research Institutes. In 2021, the biopharmaceutical & pharmaceutical companies segment procured the largest revenue share of the single-use assemblies market. The geriatric population's demand for biopharmaceuticals is rising since the aged are more susceptible to diseases/disorders that are treated using biologics. This has caused biopharmaceutical companies to place a greater emphasis on generating inexpensive, low-cost biologics.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2 Billion |

| Market size forecast in 2028 | USD 8.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 23.4% from 2022 to 2028 |

| Number of Pages | 292 |

| Number of Tables | 484 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Solution, Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By Region, the Single-use Assemblies Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the largest revenue share of the single-use assemblies market. The substantial proportion of the North American market can be due to the region's well-established biopharmaceutical industry, the extensive availability of single-use assemblies provided by regional market players, and the growing manufacturing of biologics and biosimilars.

Free Valuable Insights: Global Single-use Assemblies Market size to reach USD 8.6 Billion by 2028

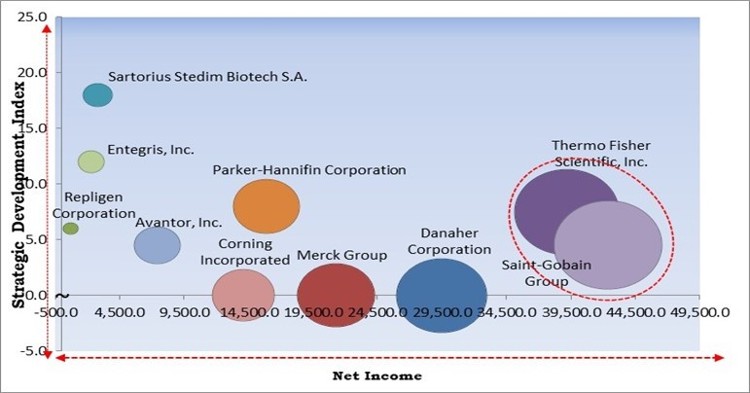

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Thermo Fisher Scientific, Inc. and Saint-Gobain Group are the forerunners in the Single-use Assemblies Market. Companies such as Sartorius Stedim Biotech S.A., Parker-Hannifin Corporation and Entegris, Inc. are some of the key innovators in Single-use Assemblies Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc., Sartorius Stedim Biotech S.A. (Sartorius AG), Danaher Corporation, Merck Group, Avantor, Inc., Parker-Hannifin Corporation, Saint-Gobain Group (CertainTeed), Corning Incorporated, Repligen Corporation, and Entegris, Inc.

By Solution

By Product

By End User

By Application

By Geography

The Single-use Assemblies Market size is projected to reach USD 8.6 billion by 2028.

Higher Deployment Along With The Reduced Risk Of Cross-Contamination are driving the market in coming years, however, An Increasing Number Of Concerns Regarding Leachable And Extractable restraints the growth of the market.

Thermo Fisher Scientific, Inc., Sartorius Stedim Biotech S.A. (Sartorius AG), Danaher Corporation, Merck Group, Avantor, Inc., Parker-Hannifin Corporation, Saint-Gobain Group (CertainTeed), Corning Incorporated, Repligen Corporation, and Entegris, Inc.

The Bag Assemblies segment acquired maximum revenue share in the Global Single-use Assemblies Market by Product in 2021 thereby, achieving a market value of $3.1 billion by 2028.

The North America market dominated the Global Single-use Assemblies Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.