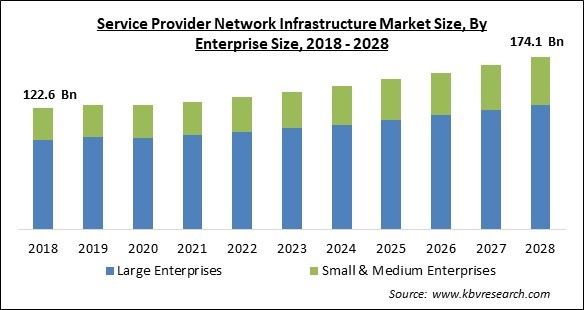

The Global Service Provider Network Infrastructure Market size is expected to reach $174.1 billion by 2028, rising at a market growth of 4.5% CAGR during the forecast period.

Service Provider Network Infrastructure refers to the hardware resources of telecommunications service businesses that enable wired and wireless network access and communication to transfer speech and data. The Network Infrastructure market lays the groundwork for the advent of technologies such as the Internet of Things (IoT), 5G, cloud-based process and data deployment, and Infrastructure-as-a-Service (IaaS). It provides a framework for these technologies as well as a network to connect them. Wireless applications and associated infrastructure are being driven by the broader change to flexible mobile use cases, both on the service provider and business sides.

Data correlation across numerous corporations, agencies, groups, persons, and locations is a specific strength of network service providers. As all government, commercial, and customer traffic must pass via a supplier backbone at some time, this provides a valuable source of correlation data. Since service providers monitoring internet traffic data on a big scale can often connect the observed activity with established patterns to which also occurrences like worms, the effort is worthwhile. Current computer network security measures such as intrusion detection and prevention are often less accurate in this regard.

Although not all network providers are well-known, they are critical to modern networking. Their high-speed infrastructure and services serve a downstream ecosystem that includes, among others, ISPs, cellular carriers, and virtual network operators, as well as providing a basis for all commercial IP services.

As long as no new technologies that don't rely on fiber in the ground emerge, the current Tier 1 ISPs would likely be the only ones investing in infrastructure in that market. Consider a company like Starlink, formed by Elon Musk and is a part of SpaceX. Starlink is creating a low-latency, broadband internet system to help users and would be supported by a constellation of low-Earth orbit satellites. Some of the largest ISPs have started making significant investments in 5G wireless communication due to the continued demand for higher speeds and an enhanced Internet experience.

The telecom industry is playing a crucial role during the COVID-19 pandemic to strengthen the digital foundation of nations. To provide and receive real-time information on COVID-19, every person and government, regardless of federal, state, local, or provincial level, has been in continual contact with one another in society. To stabilize the situation and provide necessary services to every person, healthcare, telecommunications, media and entertainment, utilities, and government institutions are currently working around the clock. For network management to be simple and convenient, network security solutions are necessary. As a result of country-level lockdowns, key industries such as manufacturing, automotive, textiles, transportation and logistics, travel & hospitality, and consumer products have been forced to close.

Greater network agility is required as a result of digital transformation for organizations to provide better consumer experiences. As part of the movement toward digital transformation, numerous businesses intend to implement new digital technology. Every firm has chosen a managed network services provider for its digital transformation journey as organizations advance their digital initiatives. Businesses can close the skills gap and expand into new markets with cutting-edge solutions by forming partnerships with the particular managed network service provider who can grasp their needs and opportunities.

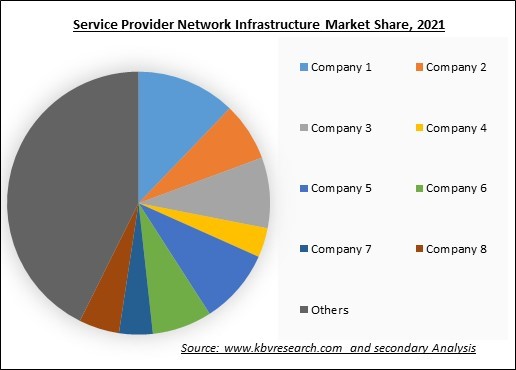

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches.

The cloud services are more affordable than keeping an on-premises data center and an expensive IT resource to manage the organizations’ whole network, Small and Medium-sized Enterprises (SMEs) and major businesses are now gradually implementing cloud-based services. Additionally, businesses want a network that makes it simple for users to access their infrastructures, apps, and other IT resources whenever they need them. As a result, the adoption of the virtual resource-sharing environment has increased due to these expanding needs.

The main challenge in this sector is how to provide clients with Network as a Service while maintaining necessary regulatory compliances. The market vendors must adhere to adequate safeguards and regulatory rules, which are essential for businesses to succeed commercially. To promote the expansion of NaaS solutions, cloud providers must adhere to strict scalability standards for storage, compute, and network resource sharing. These needs include increased security, company restructuring, mergers, and consolidations. At some time, the vendors can discover that it is challenging to keep their technology up to date, secure, and compliant with regulations.

Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. The large enterprises segment acquired the highest revenue share in the Service Provider Network Infrastructure Market in 2021. It is because businesses with more than 1000 employees are considered large companies. These businesses can create and implement new technology because they have enormous budgets. Such businesses also manage their operations efficiently. As a result, the major enterprises category contributes more to the market.

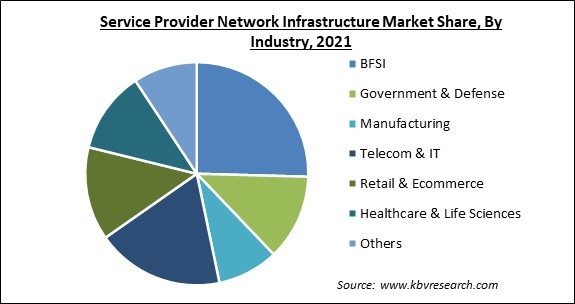

Based on Industry, the market is segmented into BFSI, Government & Defense, Manufacturing, Telecom & IT, Retail & Ecommerce, and Healthcare & Life Sciences. The telecom & IT segment witnessed a substantial revenue share in the Service Provider Network Infrastructure Market in 2021. It includes any company that installs cable and equipment, system operators, telecommunications service providers like Sprint, Verizon, AT&T, governmental organizations, or other tenants. The term "telecommunications service provider" (TSP) refers to a particular category of telecommunications service supplier that has historically offered telephone and related services.

Based on Technology, the market is segmented into Broadband Access & Optical Transport, Routers & Switches, Carrier IP Telephony, Microwave transmission & Mobile Backhaul, and Wireless Packet Core. The broadband access & optical transport segment garnered the highest revenue share in the Service Provider Network Infrastructure Market in 2021. It is due to the need for internet connectivity and optical transport technology rising as there are more and more people using the Internet. Continuous technological advancements that boost network speed are a defining feature of this equipment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 129.1 Billion |

| Market size forecast in 2028 | USD 174.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.5% from 2022 to 2028 |

| Number of Pages | 276 |

| Number of Tables | 402 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Enterprise Size, Technology, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia pacific region acquired a substantial revenue share in the Service Provider Network Infrastructure Market in 2021. Due to the fact that the sector has been heavily concentrated in nations like China and India in the past ten years, businesses are investing a lot of money in these regions to take advantage of their potential. They also have a large customer base. As a result of the rapid adoption of digital technology by governments and businesses, this region is expected to grow at a significant CAGR during the forecast period.

Free Valuable Insights: Global Service Provider Network Infrastructure Market size to reach USD 174.1 Billion by 2028

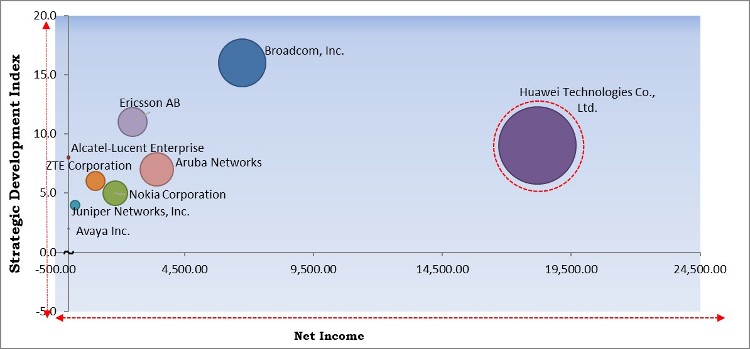

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Huawei Technologies Co., Ltd. is the major forerunner in the Service Provider Network Infrastructure Market. Companies such as Broadcom, Inc., Alcatel-Lucent Enterprise and Ericsson AB are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Huawei Technologies Co., Ltd., Juniper Networks, Inc., Broadcom, Inc., Alcatel-Lucent Enterprise, Avaya Inc., ZTE Corporation, Ericsson AB, Aruba Networks (Hewlett Packard Enterprise Company), and Nokia Corporation.

By Enterprise Size

By Industry

By Technology

By Geography

The global service provider network infrastructure market size is expected to reach $174.1 billion by 2028.

Global digital transformation is becoming more prevalent are driving the market in coming years, however, Network as a Service Market lacks standards limited the growth of the market.

Huawei Technologies Co., Ltd., Juniper Networks, Inc., Broadcom, Inc., Alcatel-Lucent Enterprise, Avaya Inc., ZTE Corporation, Ericsson AB, Aruba Networks (Hewlett Packard Enterprise Company), and Nokia Corporation.

The Information Technology (IT) segment dominated the Global Service Provider Network Infrastructure Market by Business Function in 2021, thereby, achieving a market value of $9.50 Billion by 2028.

The On-premise segment is leading the Global Service Provider Network Infrastructure Market by Deployment Type in 2021, thereby, achieving a market value of $15.9 Billion by 2028.

The North America is the fastest growing region in the Global Service Provider Network Infrastructure Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $10.1 Billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.