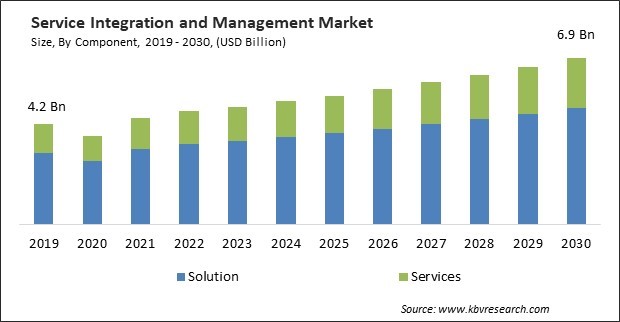

The Global Service Integration and Management Market size is expected to reach $6.9 billion by 2030, rising at a market growth of 5.0% CAGR during the forecast period.

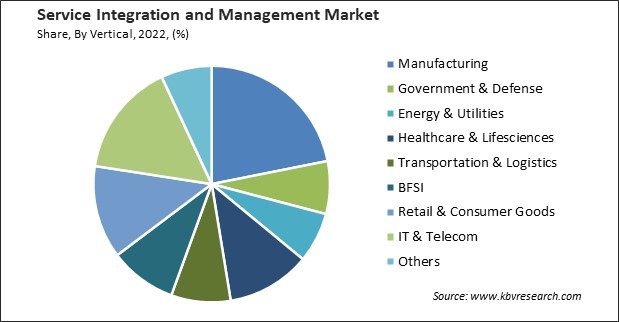

SIAM helps integrate various e-commerce platforms, manages online sales channels, and ensures seamless operations between online and offline retail. Thus, the retail & consumer goods segment acquired $600.4 million in 2022. The demand for SIAM in the retail and consumer goods segment arises from adapting to digital transformation, managing complex operations, enhancing customer experiences, optimizing supply chains, and remaining competitive in an evolving market landscape.

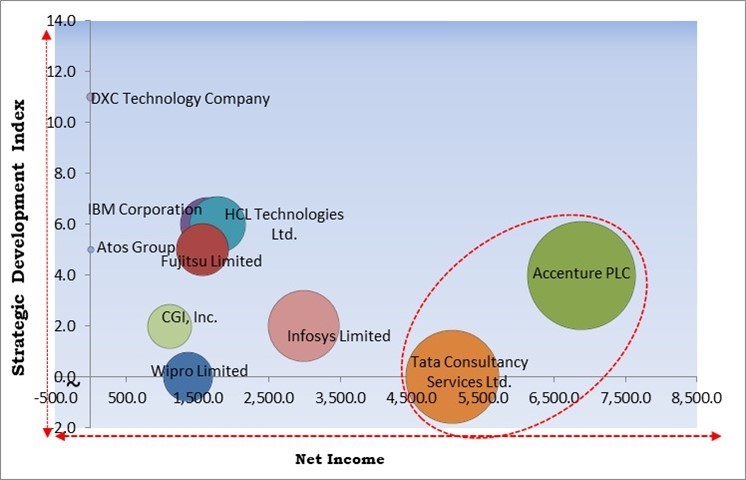

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November, 2023, Infosys Limited came into partnership with TK Elevator. Through this partnership, Infosys Limited would innovate and reshape the organization's application and IT landscape by employing an AI-first approach driven by Infosys Topaz. Additionally, In August, 2023, HCL Technologies Ltd. came into partnership with Verizon Business. Through this partnership, HCL Technologies Ltd. would enhance its portfolio with data-driven service models, improved efficiency, a seamless interface for lifecycle management, a comprehensive partner ecosystem, and collaborative innovation on an integrated platform.

Based on the Analysis presented in the KBV Cardinal matrix; Accenture PLC and Tata Consultancy Services Ltd. are the forerunners in the Service Integration and Management Market. In October, 2022, Accenture PLC came into partnership with Google Cloud, a US-based software development company. Through this partnership, Accenture PLC would enhance its capabilities, creating innovative solutions through data and AI, and delivering improved support to assist clients in establishing a robust digital foundation and transforming their businesses in the cloud. Companies such as Infosys Limited, HCL Technologies Ltd., IBM Corporation are some of the key innovators in Service Integration and Management Market.

The complexity of service administration across industries has increased, resulting in a renewed need for solutions that integrate and manage services. The growing demand can be attributed to many factors, encompassing many service providers in the transportation, hospitality industry, and on-demand sectors, alongside technological advancements that necessitate businesses to adopt digital solutions and accommodate shifting consumer preferences. The proliferation of diverse software applications, sources of data, and platforms has resulted from these factors, potentially adding to the intricacy of service management. SIAM can be a digital solution that streamlines business service management by centralizing these technological components. Therefore, the increasing complexities and dynamics in the various businesses are driving the growth of the market.

Due to multinational operations and globalization, the market has many new prospects. When businesses expand and establish a presence in multiple regions, managing their products and services, vendors, and adherence to local regulations present numerous obstacles. SIAM has the potential to serve as a beneficial remedy for these intricacies. This flexibility facilitates the optimization of processes and enables businesses to capitalize on prospects in untapped markets. Therefore, rapid globalization is driving the demand for the market.

The absence of adequately trained professionals poses a hindrance to the expansion and efficiency of the service integration and management market. SIAM is a multifaceted field that necessitates distinct abilities from its practitioners, including knowledge of technology integration, vendor coordination, service management, and project administration. As a result of SIAM's relative novelty as a concept, however, the number of professionals possessing the requisite expertise and experience in SIAM is restricted. Therefore, organizations encounter difficulties in locating and retaining suitable personnel, potentially impeding the effective implementation of SIAM. As the demand for SIAM professionals increases, there is fierce competition among organizations to attract and retain individuals with expertise in SIAM. This competition further exacerbates the scarcity of skilled talent. Therefore, the scarcity of skilled personnel is impeding market growth.

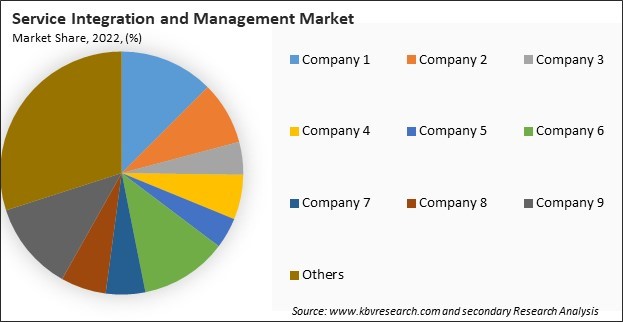

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Based on services, the market is categorized into integration & implementation, consulting services, and training, support, & maintenance. In 2022, the integration & implementation segment garnered the highest revenue share in the market. Service providers offer implementation services to help organizations set up and deploy SIAM frameworks tailored to their needs. This involves designing, configuring, and deploying the necessary processes and tools. Integrating multiple services, systems, and vendors within the SIAM ecosystem requires specialized integration services. Service providers assist in integrating diverse IT services seamlessly.

On the basis of enterprise size, the market is fragmented into large enterprises and small & medium sized enterprises. The small and medium sized enterprises segment registered a remarkable growth rate in the market in 2022. SMEs often have limited resources and need to maximize the efficiency of their IT operations. SIAM solutions can help SMEs streamline their IT service delivery processes, automate repetitive tasks, and improve overall productivity. As SMEs grow, their IT needs become more complex. SIAM solutions provide a scalable framework that can grow with the business, allowing SMEs to add new services and capabilities without significant disruption.

Based on vertical, the market is categorized into BFSI, government & defense, IT & telecom, retail & consumer goods, manufacturing, energy & utilities, healthcare & life sciences, transportation & logistics, and others. The IT & telecom segment witnessed a considerable growth rate in the market in 2022. IT landscapes are becoming increasingly intricate, comprising various applications, platforms, services, and technologies. SIAM provides a structured framework to manage and integrate these complexities efficiently. The increasing complexity of IT environments is creating a demand for the market.

Based on offering, the market is bifurcated into solution and services. In 2022, the solution segment attained the highest revenue share in the market. The increasing demand for service integration and management solutions is primarily driven by the need for organizations to efficiently manage complex IT ecosystems, enhance operational efficiency, improve service quality, and adapt to the evolving technological landscape while ensuring alignment with business goals and customer expectations.

On the basis of solution type, the market is divided into business solutions and technology solutions. The technology solutions segment procured the highest revenue share in the market in 2022. The demand for technology solutions in the service integration and management market continues to grow as businesses increasingly recognize the need for comprehensive tools and platforms to effectively manage the complexities of modern IT environments. These solutions offer integration, automation, security, and efficiency features crucial for organizations seeking to optimize their service integration and management processes.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.7 Billion |

| Market size forecast in 2030 | USD 6.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5% from 2023 to 2030 |

| Number of Pages | 579 |

| Number of Tables | 933 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter's 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Organization Size, Vertical, Region |

| Country scope |

|

| Companies Included | IBM Corporation, HCL Technologies Ltd. (HCL Enterprises), Wipro Limited, Fujitsu Limited, Atos Group, TATA Consultancy Services Ltd., DXC Technology Company, Infosys Limited, CGI, Inc., and Accenture PLC |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated the highest revenue share in the market in 2022. The demand for market in North America is driven by the need for organizations to manage complex IT environments efficiently, embrace digital transformations, ensure compliance and security, and remain competitive in a rapidly evolving market. The framework's ability to streamline IT operations, integrate diverse services, and enhance overall efficiency contributes significantly to its high demand in the region.

Free Valuable Insights: Global Service Integration and Management Market size to reach USD 6.9 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, HCL Technologies Ltd. (HCL Enterprises), Wipro Limited, Fujitsu Limited, Atos Group, TATA Consultancy Services Ltd., DXC Technology Company, Infosys Limited, CGI, Inc., and Accenture PLC.

By Component

By Organization Size

By Vertical

By Geography

The Market size is projected to reach USD $6.9 billion by 2030.

Rapid globalization leading to the expansion of MNCs are driving the Market in coming years, however, Lack of skillful workforce restraints the growth of the Market.

IBM Corporation, HCL Technologies Ltd. (HCL Enterprises), Wipro Limited, Fujitsu Limited, Atos Group, TATA Consultancy Services Ltd., DXC Technology Company, Infosys Limited, CGI, Inc., and Accenture PLC.

The expected CAGR of this Market is 5.0% from 2023 to 2030.

The North America region dominated the Global Service Integration and Management Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2.4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.