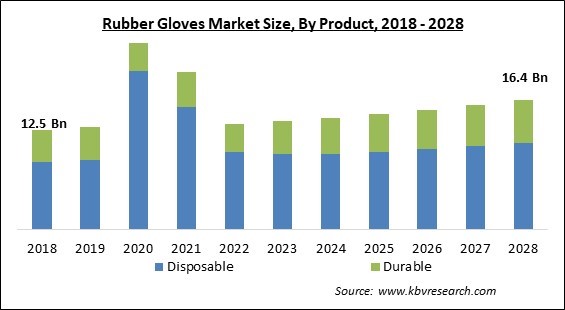

The Global Rubber Gloves Market size is expected to reach $16.4 billion by 2028, rising at a market growth of 3.5% CAGR during the forecast period.

Rubber gloves are created from either natural or synthetic rubber. The term 'rubber' refers to materials derived from natural or synthetic latex that are resilient, waterproof, and elastic. Rubber gloves may or may not be supported (rubber only) (rubber coating of textile glove). Its principal use is hand protection when conducting chemical-related duties.

During dishwashing, rubber gloves can be used to safeguard the hands from detergents and permit the use of hotter water. Occasionally, caregivers will use rubber gloves when changing a child's diaper to prevent contact with feces and urine. Rather than rubber gloves, medical practitioners utilize medical gloves during surgical procedures.

William Stewart Halsted, the first chief of surgery at Johns Hopkins Hospital, designed rubber gloves for his wife Caroline Hampton in 1894 after observing that her hands were affected by the daily surgeries she had performed and to prevent medical personnel from developing dermatitis from surgical chemicals. 1965 saw the invention of the first modern disposable glove by Ansell Rubber Co. Pty. Ltd.

Since the 1960s, rubber gloves have been used for dishwashing and cleaning the house. Traditional gloves are yellow or pink with long cuffs and have been manufactured in a variety of styles and hues. Even if they are still the most popular styles, users can get gloves that range in length from the wrist to the shoulders. There are also protective gloves that are pre-attached to blouses and bodysuits.

The severe consequences of the coronavirus are already obvious and have influenced the market for rubber gloves in 2020. In December 2019, the World Health Organization issued a public health emergency due to the COVID-19 virus pandemic. The pandemic has spread to over 100 countries and has resulted in a worldwide death toll in the millions. Exports and imports, global manufacturing, tourism, and the financial industry have all sustained significant harm. Due to the COVID-19 pandemic, industrial glove sales have decreased. Various industrial manufacturing enterprises throughout the world have ceased production owing to a disruption in the supply of components and equipment caused by the lockdown, which has diminished the need for industrial gloves during the pandemic.

It is because they prevent both patients and healthcare personnel from contracting infections, rubber gloves are mostly used in the healthcare industry. This provides the industry a significant influence on the market. Latex is made from natural rubber, and nitrile is a synthetic rubber that shields hands from bacteria, pathogens, and other environmental contaminants. Nitrile is also used for chemical processing and sanitizing solutions. The majority of physicians and other health care professionals prefer latex or nitrile rubber gloves.

As a result of the global pandemic, there has been a rise in awareness regarding hygiene and body care items such as rubber gloves, masks, and other personal protective equipment (PPE), which has led to an increase in sales of rubber gloves. For instance, The Top Gloves Corporation, an industry leader in the production of rubber gloves, would grow and promised to double the amount of money brought in over the next few years. As a result, new prospects have become available for producers in the market for rubber gloves.

Nitrile Rubber is yet another type of synthetic rubber that ranks among the most popular applications found all over the world. The demand for it during World War II led to its creation as a solution. Applications that require resistance to oil, gas, and chemicals are the most typical places that will find them employed. Because of these characteristics, it is very valuable in the automobile sector, as well as in laboratory and culinary settings. It may be found in a wide range of machines as well as applications that are utilized daily.

By Product, the Rubber Gloves Market is classified into Disposable, and Durable. The disposable segment garnered the highest revenue share in the rubber gloves market in 2021. It is because workers in the medical and food processing sectors are expected to have a high demand for disposable gloves since they must use many pairs of gloves for different operations and disposable gloves are designed for single use and are economical. The COVID-19 pandemic boosted the need for Personal Protective Equipment (PPE) items, such as disposable gloves, dramatically in 2020.

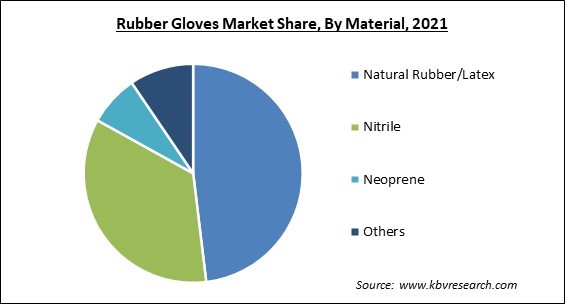

Based on the Material, the Rubber Gloves Market is segmented into Natural Rubber/Latex, Nitrile, Neoprene, and Others. The neoprene segment witnessed a significant revenue share in the rubber gloves market in 2021. It is because neoprene-based gloves offer a stronger resistance to stretch, resulting in a superior fit and grip. These factors are anticipated to increase the demand for these items among food preparation employees, laboratory personnel, and medical personnel. In addition to butyl rubber, isoprene rubber, chloroprene, silicone rubber, and butyl rubber can be used to create rubber gloves.

On the basis of Type, the Rubber Gloves Market is divided into Powdered, and Powder-free. The powdered segment recorded a substantial revenue share in the rubber gloves market in 2021. Increase as the powder makes gloves easier to wear and remove, improves grip, and reduces sweat and moisture. Calcium carbonate and cornstarch are the most often used powders. To avoid any type of skin infection, health authorities have imposed various limits on the use of powders in gloves, which are restricted by a few agencies, including the Food and Drug Administration of the United States.

Based on the Distribution Channel, the Rubber Gloves Market is bifurcated into Online and offline. The online segment witnessed a substantial revenue share in the rubber gloves market in 2021. As a result of the global COVID-19 pandemic, however, the adoption rate of online channels has increased dramatically, as governments in several countries implemented strict lockdowns and customers stayed indoors. During the pandemic, internet firms spent hard in growing their supply networks, maintaining low delivery costs, and achieving economies of scale.

On the basis of End-use, the Rubber Gloves Market is fragmented into Medical & Healthcare, Automotive, Oil & Gas, Food & Beverage, Metal & Machinery, Chemical & Petrochemical, Pharmaceutical, Cleanroom, and Others. The food & beverages segment recorded a significant revenue share in the rubber gloves market in 2021. The usage of gloves is a frequent method for reducing bare-hand contact with food. Gloves are among the most commonly utilized personal protective equipment in the food business. Nearly all food service and food processing facilities have gloves on-site. Many of the gloves will be only one glove designed to prevent hand-to-food or food-to-surface contact.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 19.9 Billion |

| Market size forecast in 2028 | USD 16.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 3.5% from 2022 to 2028 |

| Number of Pages | 299 |

| Number of Tables | 570 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Material, Type, Product, Distribution Channel, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Rubber Gloves Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment garnered the largest revenue share in the rubber gloves market in 2021. Due to the increased need for protective gloves in the food & beverage, metal manufacturing, oil & gas, automotive, and chemical industries, rubber gloves are in high demand in the area. In addition, because of the fast spread of COVID-19 in countries like Germany and Italy, there is an urgent demand for medical gloves. Greater public awareness of the significance of infection and communicable disease prevention can be attributed to the growth in medical and healthcare expenditures in North America.

Free Valuable Insights: Global Rubber Gloves Market size to reach USD 16.4 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ansell Ltd., Kimberly-Clark Corp., Unigloves Ltd., MCR Safety, Top Glove Corporation Bhd, Hartalega Holdings Berhad, The Glove Company, MAPA Professional, Adenna LLC and Atlantic Safety Products, Inc.

By Product

By Material

By Type

By Distribution Channel

By End-use

By Geography

The global Rubber Gloves Market size is expected to reach $16.4 billion by 2028.

Increased Demand from the Healthcare Industry and Other Medical Applications are driving the market in coming years, however, Nitrile gloves have a low tactile sensitivity, which might potentially impede growth restraints the growth of the market.

Ansell Ltd., Kimberly-Clark Corp., Unigloves Ltd., MCR Safety, Top Glove Corporation Bhd, Hartalega Holdings Berhad, The Glove Company, MAPA Professional, Adenna LLC and Atlantic Safety Products, Inc.

The Medical & Healthcare market acquired maximum revenue in the Global Rubber Gloves Market by End-use in 2021; thereby, achieving a market value of $5.3 billion by 2028.

The Natural Rubber/Latex market is leading the Global Rubber Gloves Market by Material in 2021; thereby, achieving a market value of $7.6 billion by 2028.

The Europe market dominated the Global Rubber Gloves Market by Region in 2021; thereby, achieving a market value of $5.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.