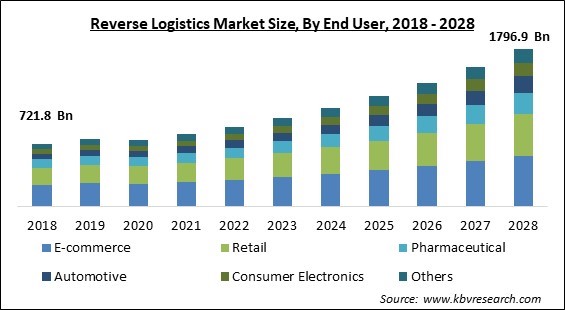

The Global Reverse Logistics Market size is expected to reach $1796.9 billion by 2028, rising at a market growth of 11.9% CAGR during the forecast period.

The process of transferring items from the final destination to receiving returned products/materials for proper disposal is known as reverse logistics. It encompasses a variety of processes such as re-manufacturing, redesigning, and refurbishment. Also, this type of logistics covers the processes of returning merchandise/products due to damage, salvage, restocking, and seasonal and excess inventory. The re-usage of products/merchandise is referred to as reverse logistics. It is the process of planning, executing, and controlling the cost-effective, efficient movement of raw materials, inventory, and finished goods, as well as decreasing transportation-related energy and pollution. This is because of the advent of mobile and internet commerce, reverse logistics strategy is becoming a source of friction in supply chain management.

In the retail and consumer electronics industries, reverse logistics plays a crucial role in allowing shops to deal with returns and process them efficiently. As the process of transferring goods from consumers' locations to return centers faces a number of obstacles, retailers are looking for ways to enable hassle-free multi-channel returns to reduce fraud and abuse. Increased security, reduced fraud, data flow automation to improve efficiency and speed, increased traceability/track ability, and reduced paperwork are just a few of the benefits of blockchain technology. As a result, reverse logistics is becoming more efficient and cost-effective due to blockchain technology.

Consumer demand for goods/products from many industries, such as automotive, consumer electronics goods & products, medical devices, packaging machines, and construction equipment, has grown in importance internationally, resulting in an increase in reverse logistics demand. The reverse logistics is benefited from the growth of manufacturing industries and fast industrialization in developing nations in South America and the Asia Pacific. Moreover, there is a growing awareness that reverse logistics flows do not only move waste but also goods of exceptional value that the company has and will have to retrieve in the near future.

The pandemic of COVID-19 has a negative impact on market growth. This is due to the entire interruption of supply chains around the world during the COVID-19 pandemic, a major drop has been noted in order to maintain the government's regulatory criteria. To prevent the spread of SARS-CoV-2, all countries throughout the world were put on lockdown. The supply chain was halted and interrupted all around the world as a result of this. This is owing to the rising use of e-commerce to obtain the essential demands, the supply chain for the e-commerce business was in operation mode.

Block-chain technology allows for improved tracking and transparency of the product's whole life-cycle, from the makers' sourcing of component materials through the product's final disposal. The logistics industry's top companies have begun exploring and adopting blockchain technology to support the reverse logistics operations. Walmart, for example, uses a blockchain to automate invoice generation, which eliminates time-consuming freight bill audits. For handling product life-cycles such as reclamation, recycling, and disposal, supply chain leaders have used a mix of block-chain and reverse logistics tactics.

The substantial growth in e-commerce industry is owing to the increased availability of connectivity options, and the logistics & e-commerce business has shown huge prospects of growth in the coming years. The need for time-efficient delivery and return services for goods transportation in forward and reverse logistics is growing due to the rise of the e-commerce and logistics industries in each and every region. In some regional fashion e-commerce market, the automation system is expected to simplify high-volume reverse logistics. It is due to the enormous rise of online shopping in recent years that top retail, e-commerce, and third-party logistics organizations have developed and adopted reverse logistics services and solutions.

Manufacturers and retailers are fully reliant on logistics service providers' dependability, competence, and honesty. The manufacturing or retailing organization is dependent on the logistics service provider in this situation, resulting in a lack of direct control. Moreover, the producer being unable to monitor the warehouse's operations, posing a major threat to product quality. With increasing size of warehousing and other associated activities, it is becoming difficult for inexperienced or incompetent manufacturers to handle complete reverse logistics procedure.

Based on End User, the market is segmented into E-commerce, Retail, Pharmaceutical, Automotive, Consumer Electronics, and Others. The e-commerce segment witnessed the maximum revenue share in the reverse logistics market in 2021. This is due to the increasing tendency of people toward online buying, as well as greater usage and acceptance of online shopping sites. In the e-commerce industry, reverse logistics plays a critical role in the product replacement and resale, as well as assisting in transportation activities, all of which contribute to segment growth.

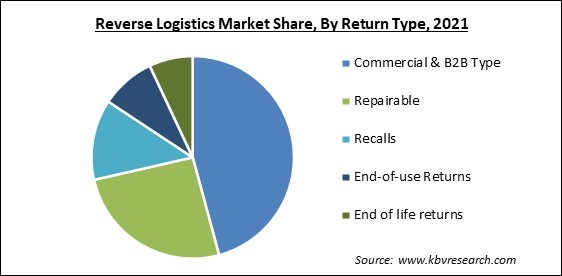

Based on Return Type, the market is segmented into Commercial & B2B Type, Repairable, Recalls, End-of-use Returns, and End of life returns. The Repairable segment garnered a significant revenue share in the reverse logistics market in 2021. This type of return allows the organization to customize workflows by item or brand, ensuring that sensitive customer data is erased from devices and that a designer item is cleaned before being returned to the client.

Based on Service, the market is segmented into Transportation, Refund Management Authorization, Replacement Management, Reselling, and Warehousing. The transportation segment witnessed the maximum revenue share in the reverse logistics market in 2021. Return management is an important aspect of customer service because it requires the firm to strike a balance between the customers' desire for competitive product and service value and the company's desire to make a profit. Businesses are increasingly connecting reverse logistics operations to transportation management as a logical fit in the interests of both.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 828 Billion |

| Market size forecast in 2028 | USD 1796.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 11.9% from 2022 to 2028 |

| Number of Pages | 247 |

| Number of Tables | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Service, Return Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. LAMEA garnered a significant revenue share in the reverse logistics market in 2021. Increasing opportunities in the region, as well as numerous investments in the e-commerce business, are credited with the regional growth. Also a lot of investment in logistics hubs is helping the segment flourish. Such features along with an increase in disposable income make the region easier to access the reverse logistics facilities.

Free Valuable Insights: Global Reverse Logistics Market size to reach USD 1796.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Deutsche Bahn AG, United Parcel Service, Inc., Core Logistic Private Limited, Kintetsu World Express, Inc., FedEx Corporation, Deutsche Post DHL Group, C.H. Robinson Worldwide, Inc., Yusen Logistics Co., Ltd., Safexpress Pvt. Ltd., and Reverse Logistics GmbH.

By End User

By Return Type

By Service

By Geography

The global reverse logistics market size is expected to reach $1796.9 billion by 2028.

Increasing popularity of block chain technology are driving the market in coming years, however, Manufacturers experiencing a lack of control throughout reverse logistics service limited the growth of the market.

Deutsche Bahn AG, United Parcel Service, Inc., Core Logistic Private Limited, Kintetsu World Express, Inc., FedEx Corporation, Deutsche Post DHL Group, C.H. Robinson Worldwide, Inc., Yusen Logistics Co., Ltd., Safexpress Pvt. Ltd., and Reverse Logistics GmbH.

The expected CAGR of the reverse logistics market is 11.9% from 2022 to 2028.

The Commercial & B2B Type segment acquired maximum revenue share in the Global Reverse Logistics Market by Return Type in 2021, thereby, achieving a market value of $792.6 Billion by 2028.

The Asia Pacific market dominated the Global Reverse Logistics Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $673.4 Billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.