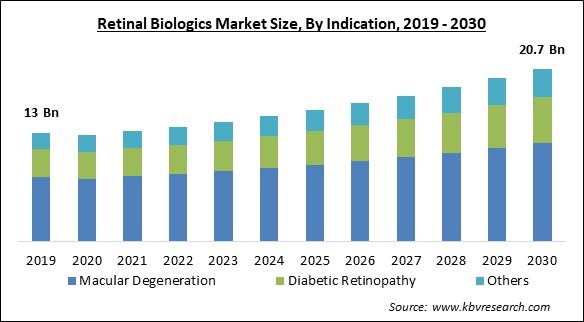

The Global Retinal Biologics Market size is expected to reach $20.7 billion by 2030, rising at a market growth of 5.4% CAGR during the forecast period.

As people age, a variety of diseases and issues can arise. The senior population is more at risk of the age-related progression of AMD disease thus, the macular degeneration segment will register around 60% share in the market by 2030. For example, By 2050, there will be about 1.5 billion people on the planet, a rise of more than three times the current population. Additionally, it is anticipated that by this time, 16.0% of people will be over the age of 60 worldwide. One out of every six people will be 65 or older by the middle of the twenty-first century. The global increase in the number and prevalence of older people is known as the "population aging phenomenon." In 2019, there were 703 million people worldwide who were 65 or older. People 65 and over made up 9% more of the population in 2019 than they did in 2018. Some of the factors impacting the market Technological advances aiding in the development of retinal biologics, Rising prevalence of retinal and eye issues, and longer time periods for drug approval.

Retinal biologic products have undergone technological breakthroughs that have improved their safety and effectiveness profiles, which has led to a rise in patient uptake across the globe. Significant R&D expenditures and business partnerships among market players are advantageous for developing retinal biology. The technical advances place a strong focus on research and development (R&D) pertaining to retinal gene treatments conducted by various institutes, biologics firms, and innovative product launches by key players in the form of implants and biologics. Additionally, Because of the increasing number of initiatives taken by various healthcare organizations, governmental entities, and industry actors, there is a greater awareness among the general public about ocular problems, which is leading to a higher diagnostic and treatment rate in the population. Concern regarding diabetic retinopathy has grown as more adults with type I and type II diabetes are losing their vision as a result of the disease. Thus, technological improvements in retinal biologics products and increasing prevalence of ocular issues will augment the expansion of the market in the coming years.

However, a number of pricey regulatory approvals and research phases are necessary for drug approval. The process of approving a medicine involves several phases of regulatory agency screening, including about four clinical trial steps. The costs of failing studies are high because clinical trial phases need large investments. For instance, according to a Forbes article, a medication producer invests approximately $350 million in each therapy before it is put on the market. Long wait times also cost these producers money, which hinders the expansion of the market. Furthermore, workflows in the healthcare industry were affected globally by the COVID-19 pandemic. Several areas of the healthcare sector, as well as several other industries, temporarily closed their doors due to the sickness. The COVID-19-led worldwide economic slowdown caused a drop in the market for retinal biologics in 2020. The pandemic also caused supply chains in several end-user industries to fall, including the pharmaceutical, healthcare, and industrial sectors. This limited the market and impacted the release of innovative medicines.

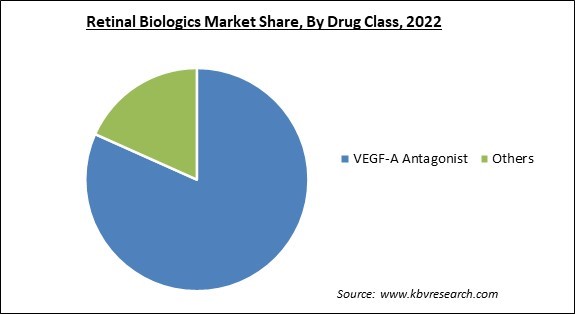

On the basis of drug class, the market is segmented into VEGF-A antagonist and others. The others segment recorded a significant revenue share in the market in 2022. The other segment mostly includes biologics developed from TNF-α. The pro-inflammatory cytokine tumor necrosis factor-alpha (TNF-α) is generated by macrophages and T-cells. It is significant in both inflammation and apoptosis. TNF-α is considered part of developing inflammatory, edematous, neovascular, and neurodegenerative illnesses in the eye.

Based on distribution channel, the market is divided into hospital pharmacy, online pharmacy, and retail pharmacy. The online pharmacy segment procured a considerable growth rate in the market in 2022. One of the key factors influencing the segment's growth is the increasing number of patients visiting ophthalmology clinics for the treatment of various eye conditions. In both established and developing nations, there are more and more people using the internet, and patients are increasingly choosing to buy their drugs online.

Based on indication, the market is categorized into macular degeneration, diabetic retinopathy, and others. The macular degeneration segment procured the highest revenue share in the market in 2022. Retinal biologics can help maintain eyesight and stop additional vision loss in people with macular degeneration by lowering inflammation in the retina and limiting the formation of aberrant blood vessels. Biologics used early and effectively can sometimes stabilize or even improve vision. The frequency of injections or treatments is decreased by some retinal biologics' extended-release formulations.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 13.7 Billion |

| Market size forecast in 2030 | USD 20.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.4% from 2023 to 2030 |

| Number of Pages | 229 |

| Number of Table | 340 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Indication, Drug Class, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region recorded the largest revenue share in the market in 2022. The existence of numerous significant players, including Bayer AG, and Novartis AG, as well as developments in the production of retinal biologics, are driving the market's expansion. Additionally, easier access to retinal biologics medications and greater public awareness of the importance of early detection and treatment are key factors driving market expansion in this region. In addition, a strong network of hospitals, clinics, and research institutions makes up the healthcare infrastructure. This infrastructure aids in the creation, use, and study of retinal biology.

Free Valuable Insights: Global Retinal Biologics Market size to reach USD 20.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Novartis AG, Amgen, Inc., AbbVie, Inc., Bayer AG, Regeneron Pharmaceuticals, Inc., Santen Pharmaceutical Co., Ltd., Bausch Health Companies, Inc., F. Hoffmann-La Roche Ltd., MeiraGTx Holdings plc and Oxurion NV.

By Indication

By Drug Class

By Distribution Channel

By Geography

The Market size is projected to reach USD 20.7 billion by 2030.

Technological advances aiding in the development of retinal biologics are driving the Market in coming years, however, Longer time periods for drug approval restraints the growth of the Market.

Novartis AG, Amgen, Inc., AbbVie, Inc., Bayer AG, Regeneron Pharmaceuticals, Inc., Santen Pharmaceutical Co., Ltd., Bausch Health Companies, Inc., F. Hoffmann-La Roche Ltd., MeiraGTx Holdings plc and Oxurion NV.

The VEGF-A Antagonist is leading the Market by Drug Class in 2022; thereby, achieving a market value of $16.1 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $10.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.