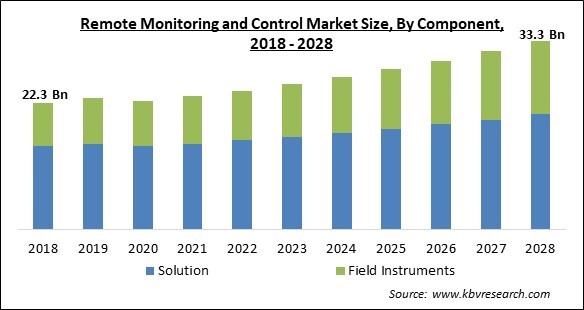

The Global Remote Monitoring and Control Market size is expected to reach $33.3 billion by 2028, rising at a market growth of 5.2% CAGR during the forecast period.

Remote monitoring is the facility that helps to see the performance, status, and behavior of the machine from a distance. IoT (Internet of Things) technology and cloud computing are employed to track the working of devices. This permits an asset to be seen by people in charge of stopping downtime or, in the event of unintended downtime, increase in proper service, whether it is in a hospital, on-site at a factory, out in the field, or on the road.

Remote monitoring and control systems are used to create and automate big & complicated activities. They often consist of compound digital and mechanical components that work together to process, record, and act on a greater volume of data quicker than a person could do so safely or successfully. Smart locker is an example of a remote monitoring and control system.

These systems are significant for fulfilling various industry standards, like ISO 9001. They are utilized in many industries for multiple tasks, such as physical asset management & distribution, patient monitoring in hospitals, public transportation controls, network securities in IT companies, and industrial automation.

Restrictions implied by the government in consideration to COVID-19 outbreak has raised the concerns regarding productivity, efficiency and safety of industrial processes. But, the factories are steadily recommencing their manufacturing activities and other services. This is predicted to lead to restart of remote monitoring and control systems use at their upmost capacity. Also, the pandemic period has enforced businesses to use advanced solutions to tackle the obstacles occurred due to COVID-19. This has resulted in rising the adoption of remote monitoring and control systems across the various industries. Thus, the market steadily recovered from the effects of pandemic period within few months after the loosening of restrictions.

Industry 4.0 is transforming the way businesses operate. Most of the businesses from different industry verticals as widely accepting the concept of Industry 4.0 in order to stay competent in the market. Emerging of smart plants provides an incredible chance for the manufacturing business to get into the fourth industrial revolution. As the adoption of Industry 4.0 has been surged the usage of SCADA systems would also accelerate, thereby supporting the market growth.

Not only is data administered more proficiently in monitoring and control systems, but one can also get a higher capacity of valuable data. This enable users able to make quicker and more efficient decisions. Sensors are constructed adequately into the infrastructure, that serve with the capability to gather information correctly from the source. Information gathering can occur continuously and simultaneously in real time. As the use of remote monitoring and control systems enables the collection of more accurate and detailed data, the adoption of these systems would increase significantly.

SCADA system combines software and hardware containing sensors, PLCs, RTUs, and HMIs. Systems in a plant are maintained and controlled from remote areas by the assistance of the data collected by the SCADA system. Collecting data is one of the significant responsibilities in operational business to attain the best use of resources and high quality of the finished product. The initial capital and maintenance to be spent on these systems is generally high. This could be a major concern of SMEs who can’t afford high expenses. Owing to this, the market growth may impede in the upcoming years.

Based on component, the remote monitoring & control market is segmented into solutions and field instruments. In 2021, the solutions segment dominated the remote monitoring & control market with maximum revenue share. Previously available solutions were wired solutions which were linked to the computers. The development of technology increased the popularity of browser-based solutions and allowed monitoring remotely. The rise in high-speed mobile data technologies has permitted the application of solutions that can be used on tablets or smartphones on applications or browsers.

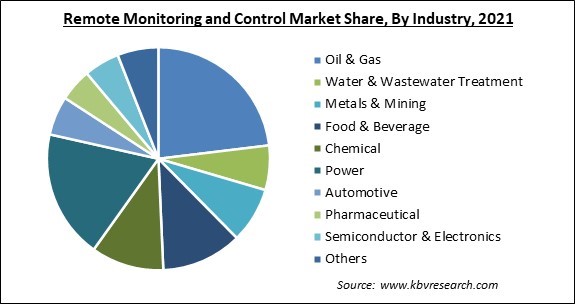

On the basis of industry, the remote monitoring and control market is categorized into oil & gas, chemical, water & wastewater treatment, metals & mining, food & beverage, power, automotive, pharmaceutical, semiconductor & electronics and others. In 2021, the food & beverages segment registered a considerable growth rate in the remote monitoring and control market. The food service business is an evolving and highly dynamic industry. IoT helps businesses in this industry to attain high levels of food safety, cut down wastage, enhance traceability, and reduce costs & risks in the various phases of food processing and packaging.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 23.5 Billion |

| Market size forecast in 2028 | USD 33.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.2% from 2022 to 2028 |

| Number of Pages | 333 |

| Number of Tables | 524 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the remote monitoring and control market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region dominated the remote monitoring and control market with maximum revenue share. The increasing demand for the SCADA system for industrial automation has significantly contributed to the region’s market growth. Further, the growth is being supported by the presence of major market players in the North American nations.

Free Valuable Insights: Global Remote Monitoring and Control Market size to reach USD 33.3 Billion by 2028

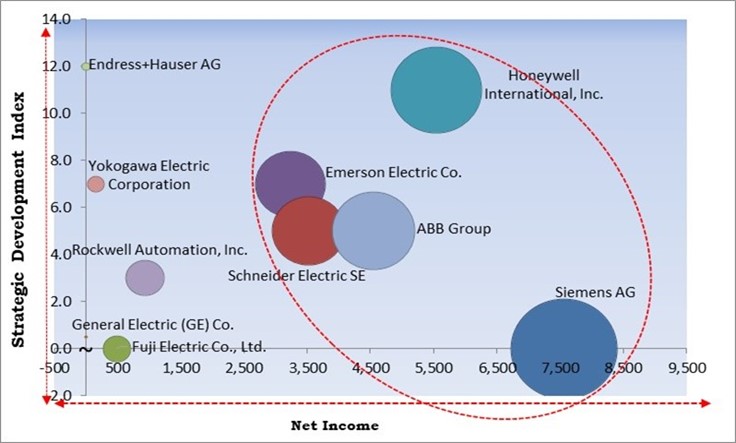

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Honeywell International, Inc. and Siemens AG are the forerunners in the Remote Monitoring and Control Market. Companies such as Rockwell Automation, Inc., Yokogawa Electric Corporation, and Fuji Electric Co., Ltd. are some of the key innovators in the Remote Monitoring and Control Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Emerson Electric Co., Honeywell International, Inc., Siemens AG, Schneider Electric SE, ABB Group, General Electric (GE) Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, Fuji Electric Co., Ltd., and Endress+Hauser AG.

By Industry

By Component

By Geography

The global Remote Monitoring and Control Market size is expected to reach $33.3 billion by 2028.

Surging Implementation Of Industry 4.0 are driving the market in coming years, however, High Cost Required For Installing Scada Systems restraints the growth of the market.

Emerson Electric Co., Honeywell International, Inc., Siemens AG, Schneider Electric SE, ABB Group, General Electric (GE) Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, Fuji Electric Co., Ltd., and Endress+Hauser AG.

The expected CAGR of the Remote Monitoring and Control Market is 5.2% from 2022 to 2028.

The Oil & Gas segment acquired maximum revenue share in the Global Remote Monitoring and Control Market by Industry in 2021 thereby, achieving a market value of $6.6 billion by 2028.

The North America market dominated the Global Remote Monitoring and Control Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $11.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.