The Global Refinancing Market size is expected to reach $28 billion by 2028, rising at a market growth of 7.2% CAGR during the forecast period.

Refinancing is the process of changing the conditions of a preexisting credit agreement, typically one that involves a loan or mortgage. When a person or company chooses to refinance a financial obligation, they are essentially looking to adjust the interest rate, the repayment schedule, and/or other contract terms in a way that benefits them. If accepted, a new contract extension that replaces the initial one is given to the borrower.

In general, consumers want to refinance some debt to get better borrowing terms, frequently in response to changing economic situations. Refinancing is sometimes done with the intention of lowering the fixed interest rate, lengthening the loan's term, or switching from an adjustable-rate mortgage to a fixed-rate mortgage or vice versa.

Additionally, borrowers may refinance if their credit rating has increased, if their long-term financial objectives have changed, or if they want to pay off their current loans by combining them into a single low-cost loan. The environment of interest rates is the most frequent reason for refinancing. Due to the cyclical nature of interest rates, many consumers decide to refinance as rates decline.

The economic cycle, market competition, and monetary policy at the federal level can all play a significant role in determining whether interest rates for consumers and companies rise or fall. All credit product types, including both non-revolving loans and revolving credit cards, might experience interest rate changes as a result of these variables. Borrowers with variable-interest-rate goods wind up paying more in interest in a rising-rate environment; the opposite is true in a falling-rate situation.

The COVID-19 pandemic had a favorable effect on the refinancing market. Due to the global family income crisis, borrowers began choosing financial products with lower interest rates in order to avoid paying excessive interest rates. Due to slow economic growth, the borrowers were able to minimize their monthly mortgage payments by refinancing at a reduced interest rate. Compared to low-income homeowners, high-income borrowers refinance much more often. Refinancing has consequently increased dramatically during the pandemic. To meet the escalating expectations of end customers, market players concentrated on the creation of new products. Simultaneously, some players increased product flexibility to help clients manage their financial responsibilities throughout the pandemic.

The number of venture capital firms and venture capitalists has significantly increased. These companies concentrate on helping the start-ups they finance to develop their product lines. This trend is benefitting the refinancing market's growth. This action supports the development of technological platforms by financial start-ups for improved client experiences, convenience, accessibility, and an expansion in personnel numbers to handle the rising workload and fuel the demand for product developments.

Users will probably need to maintain private mortgage insurance (PMI) when they obtain a traditional home loan and put under 20% of the value to shield the lender from the possibility that they might default on the payments. The monthly mortgage payments may increase by several hundred dollars with PMI. However, if the value of the house has increased and users perhaps also made some loan payments, users may then have at minimum the 20% equity required to avoid PMI. In other words, customers can refinance to a second mortgage, and do away with PMI

While a refinance may allow customers to save money, it's crucial to know that there are refinancing expenses that could potentially reduce or negate this benefit. Additionally, the savings are frequently long-term savings, so users must determine whether the upfront fees are worth the savings they will have to endure for in the future. This is crucial if they anticipate selling or moving well before the breakeven level. It's crucial to weigh the short-term advantages with the long-term effects when refinancing to a long-term loan repayment or choosing a cash-out refinance.

Based on type, the refinancing market is categorized into fixed-rate mortgage refinancing, adjustable-rate mortgage refinancing, cash-out refinancing, and others. The fixed-rate mortgage segment procured the highest revenue share in the refinancing market in 2021. One of the main drivers of the segment's growth is the fixed-rate mortgage refinance's capacity to provide constant interest rates over the course of the loan. Borrowers who anticipate an increase in interest rates in the near future choose to refinance their fixed-rate mortgages in order to lock in their existing interest rates.

On the basis of deployment, the refinancing market is divided into cloud and on-premise. The on-premise segment witnessed the largest revenue share in the refinancing market in 2021. An important reason propelling the segment's growth is the increase in on-premise loan origination options, including refinancing. To streamline the loan origination process, a well-known mortgage software and on-premise loan have been incorporated.

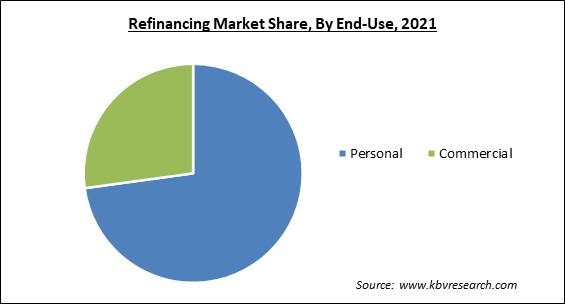

Based on end-use, the refinancing market is bifurcated into personal and commercial. The commercial segment acquired a significant revenue share in the refinancing market in 2021. Refinancing has many advantages for commercial real estate usage, including better financial metrics like return on investment and net operating income (NOI) which are the main drivers of growth. Cash-outs from commercial refinancing can be utilized to pay for property enhancements including home construction and tax-free improvements.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 17.6 Billion |

| Market size forecast in 2028 | USD 28 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.2% from 2022 to 2028 |

| Number of Pages | 192 |

| Number of Tables | 344 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Deployment, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the refinancing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the refinancing market in 2021. The presence of numerous well-known companies in the area can be credited with the expansion. Additionally, this region is home to a large number of government-sponsored mortgage investors, which provide greater refinancing alternatives. In the coming years, this region will have significant growth potential owing to the existence of mortgage investors.

Free Valuable Insights: Global Refinancing Market size to reach USD 28 Billion by 2028

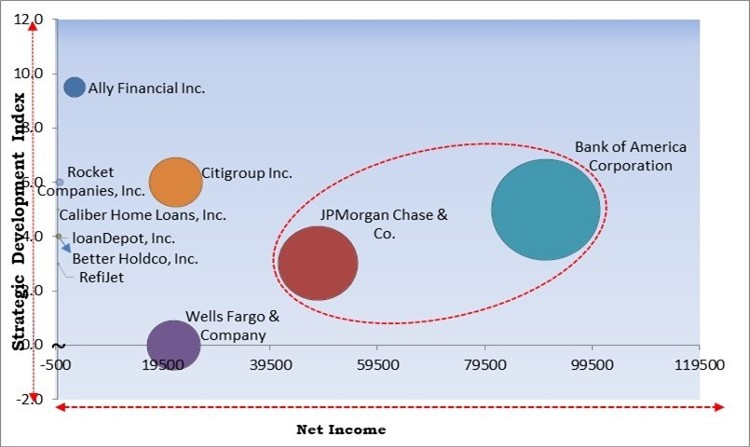

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Bank of America Corporation and JPMorgan Chase & Co. are the forerunners in the Refinancing Market. Companies such as Citigroup Inc., Wells Fargo & Company and Ally Financial Inc. are some of the key innovators in Refinancing Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Wells Fargo & Company, Ally Financial Inc., Rocket Companies, Inc., Citigroup Inc., Berkshire Hathaway, Inc. (Bank of America Corporation), loanDepot, Inc., JPMorgan Chase & Co. (Wepay, Inc.), RefiJet, Better Holdco, Inc., and Caliber Home Loans, Inc. (Newrez LLC).

By Deployment

By End User

By Type

By Geography

The global Refinancing Market size is expected to reach $28 billion by 2028.

Investment Expansion And Shifting Consumer Preferences For Loan Services are driving the market in coming years, however, Less Than Expected Home Equity Or Interest Rate Profit In Refinancing restraints the growth of the market.

Wells Fargo & Company, Ally Financial Inc., Rocket Companies, Inc., Citigroup Inc., Berkshire Hathaway, Inc. (Bank of America Corporation), loanDepot, Inc., JPMorgan Chase & Co. (Wepay, Inc.), RefiJet, Better Holdco, Inc., and Caliber Home Loans, Inc. (Newrez LLC).

The Personal segment is leading the Global Refinancing Market by End-use in 2021 thereby, achieving a market value of $19.6 billion by 2028.

The North America market dominated the Global Refinancing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $9.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.