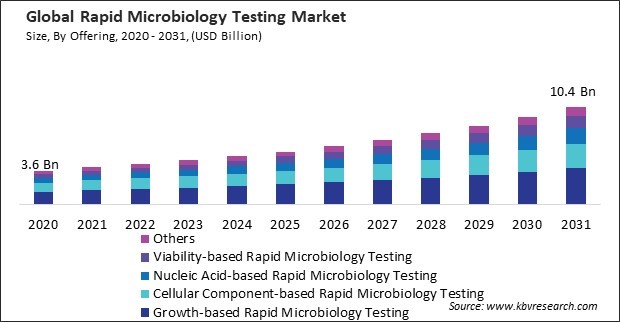

The Global Rapid Microbiology Testing Market size is expected to reach $10.4 billion by 2031, rising at a market growth of 10.5% CAGR during the forecast period.

With foodborne illnesses posing a considerable public health concern globally, there has been a heightened emphasis on implementing stringent quality control measures throughout the food supply chain. This testing plays a pivotal role in this context by enabling food manufacturers to swiftly detect and mitigate microbial contamination, thereby ensuring food products' safety and integrity. Consequently, the food and beverage testing segment would acquire nearly, 40% of the total market share within the industrial testing segment by 2031.

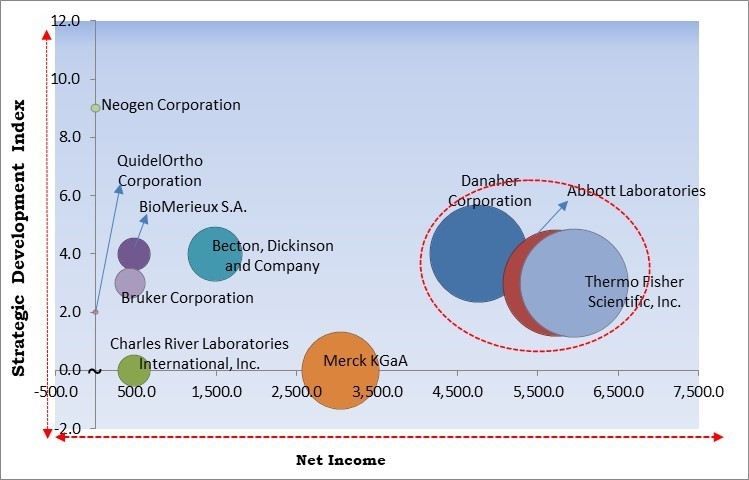

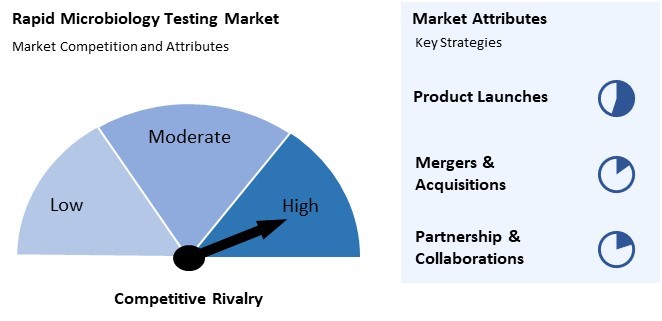

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in May, 2023, Neogen Corporation launched two new assays, Reveal for Histamine and Reveal Q+ for Histamine, designed for the detection of histamine in scombroid species of fish such as tuna and mahi-mahi. Key features of these assays include Easy-to-use Lateral Flow Tests, Water Extraction Method, Qualitative and Quantitative Options etc. Moreover, in January, 2021, Bruker Corporation announced the launch of MBT Sepsityper Kit US IVD, which is designed for the rapid identification of over 425 microorganisms from positive blood cultures. The MBT Sepsityper Kit US IVD leverages the MALDI Biotyper CA System, utilizing proteomic fingerprinting through high-throughput MALDI-TOF mass spectrometry. This technology allows for quick and accurate identification of a wide range of gram-negative and gram-positive bacteria, as well as yeasts like Candida auris.

Based on the Analysis presented in the KBV Cardinal matrix; Thermo Fisher Scientific, Inc., Abbott Laboratories and Danaher Corporation are the forerunners in the Market. In July, 2021, Abbott introduced Panbio COVID-19 Antigen Self-Test, for detection of SARS-CoV-2 virus in children and adults with symptoms or without any symptoms. This product launch aimed to fasten up testing of symptomatic and asymptomatic individuals and contacts of confirmed coronavirus cases. Abbott would provide numerous Panbio COVID-19 Rapid Antigen Tests accessible for self-use. Companies such as Becton, Dickinson and Company, BioMerieux S.A. and Bruker Corporation are some of the key innovators in Market.

The COVID-19 pandemic sparked a surge in demand for diagnostic testing, placing immense pressure on healthcare systems to rapidly identify and isolate infected individuals, trace contacts, and implement effective containment measures. Moreover, in response to the COVID-19 pandemic, governments, healthcare institutions, and industry stakeholders made significant investments in expanding testing infrastructure and scaling up production of testing technologies. Hence, the COVID-19 pandemic positively impacted the market.

The escalating incidence of infectious diseases worldwide has spurred a significant demand for testing solutions. Additionally, rapidly identifying infectious agents through microbiology testing allows for implementing timely intervention strategies to contain and mitigate disease spread. Thus, these factors will pose lucrative growth prospects for the market.

Healthcare-associated infections (HAIs) present substantial hazards to patients, resulting in extended hospitalizations, escalated healthcare expenditures, and potential fatalities. Moreover, the growing healthcare sector worldwide is a significant driver of demand for this testing, with expanding applications across various domains of clinical practice, public health, and healthcare delivery. Therefore, these aspects can boost the growth of the market.

Navigating these regulatory pathways demands a profound understanding of the relevant regulations, documentation requirements, and procedural intricacies, which can be particularly daunting for smaller firms with limited resources and expertise. Additionally, for smaller companies operating in the market, the challenge of regulatory compliance is further exacerbated by resource constraints and financial limitations. Thus, these aspects can hamper the growth of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges On the basis of method, the market is divided into growth-based rapid microbiology testing, cellular component-based rapid microbiology testing, nucleic acid-based rapid microbiology testing, viability-based rapid microbiology testing, and others. In 2023, the cellular component-based rapid microbiology testing segment witnessed a 25% revenue share in the market. Cellular component-based assays leverage advanced technologies, such as nucleic acid amplification techniques and immunoassays, to expedite assay kinetics and reduce turnaround times. Rapid amplification and detection of microbial nucleic acids or proteins within cellular specimens enable faster diagnosis of infectious diseases, facilitating prompt initiation of targeted therapy and infection control measures.

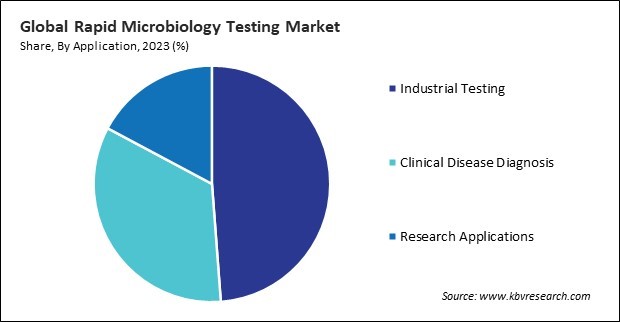

Based on application, the market is divided into clinical disease diagnosis, industrial testing, and research applications. The clinical disease diagnosis segment recorded a 22.5% revenue share in the market in 2023. The escalating burden of infectious diseases globally has fueled the demand for this testing in clinical diagnosis. In order to start the right therapy and avoid complications, diseases like lung infections, urinary tract infections, bloodstream infections, and gastrointestinal infections need to have the causing bacteria quickly identified.

Based on product, the market is segmented into instruments, reagents & kits, and consumables. In 2023, the reagents and kits segment acquired a 35% revenue share in the market. The growing adoption of molecular diagnostic techniques, such as polymerase chain reaction (PCR), nucleic acid amplification tests (NAATs), and next-generation sequencing (NGS), has fueled demand for reagents and kits used in nucleic acid-based assays. Hence, these factors can enhance the demand in the segment.

Free Valuable Insights: Global Rapid Microbiology Testing Market size to reach USD 10.4 Billion by 2031

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured a 38% revenue share in the market in 2023. North America boasts a well-developed healthcare infrastructure comprising state-of-the-art clinical laboratories, research institutions, and healthcare facilities with advanced diagnostic technologies. The region's sophisticated healthcare ecosystem provides a conducive environment for adopting and integrating testing solutions into routine clinical practice. Hence, these factors can assist in the expansion of the segment.

The Market is highly competitive, driven by advancements in technology and the demand for quick and accurate testing solutions. Key players like bioMérieux, Thermo Fisher Scientific, and Merck KGaA vie for market share by innovating rapid diagnostic tools and expanding their global reach through strategic partnerships and acquisitions.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 4.7 Billion |

| Market size forecast in 2031 | USD 10.4 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 10.5% from 2024 to 2031 |

| Number of Pages | 407 |

| Number of Tables | 614 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Method, Product, Application, Region |

| Country scope |

|

| Companies Included | BioMerieux S.A., Becton, Dickinson and Company, Danaher Corporation, Abbott Laboratories, Thermo Fisher Scientific, Inc., Merck KGaA, Bruker Corporation, QuidelOrtho Corporation, Charles River Laboratories International, Inc. and Neogen Corporation |

By Method

By Application

By Product

By Geography

This Market size is expected to reach $10.4 billion by 2031.

Growing awareness and the importance of food safety are driving the Market in coming years, however, Regulatory hurdles and compliance issues restraints the growth of the Market.

BioMerieux S.A., Becton, Dickinson and Company, Danaher Corporation, Abbott Laboratories, Thermo Fisher Scientific, Inc., Merck KGaA, Bruker Corporation, QuidelOrtho Corporation, Charles River Laboratories International, Inc. and Neogen Corporation

The expected CAGR of this Market is 10.5% from 2024 to 2031.

The Industrial Testing segment led the Market by Application in 2023; thereby, achieving a market value of $4.9 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $3.7 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.