The Global Racing Tires Market size is expected to reach $15.8 billion by 2030, rising at a market growth of 5.3% CAGR during the forecast period.

Racing tire manufacturers in the region leverage this environment to drive advancements in tire design, material science, and manufacturing processes. Thus, the Europe region captured 37.5% revenue share in 2022. Italy has a rich tradition and a strong presence in motorsports, with a vibrant car racing scene that includes various championships and events. Monza, located near Milan, hosts one of the most iconic and historic Formula 1 races, the Italian Grand Prix. This sponsorship supports the events and contributes to the visibility and demand for this.

Motorsports, encompassing amateur and professional races, has grown in popularity worldwide. The growing number of racing events, ranging from local competitions to international championships, fuels an increasing demand for high-performance racing tires.

Additionally, as per the data from the International Trade Administration, among Gulf Cooperation Council (GCC) nations, the UAE is the leader in e-commerce, with a record-breaking $3.9 billion in e-commerce sales in 2020, representing 10% of total retail sales and a 53% increase.

However, Racing tire manufacturers need to allocate substantial resources to research and development to stay ahead in a competitive market. This involves continuous testing, experimentation with new materials, and the development of cutting-edge technologies to enhance performance. The financial commitment to R&D contributes significantly to the overall cost structure. Hence, these aspects can hamper the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

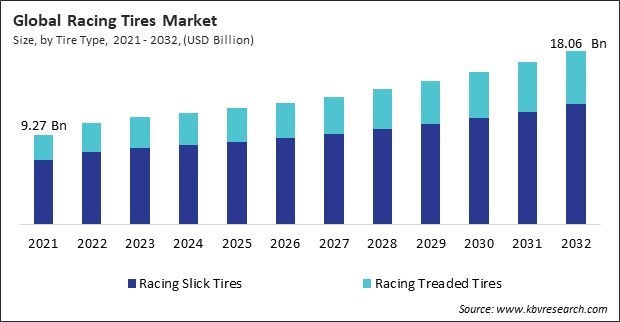

Challenges Based on tire type, the market is divided into racing slick tires and racing treaded tires. The racing slick tires segment recorded 71.8% revenue share in the market in 2022. Slick tires are renowned for superior grip and traction on smooth racing surfaces.

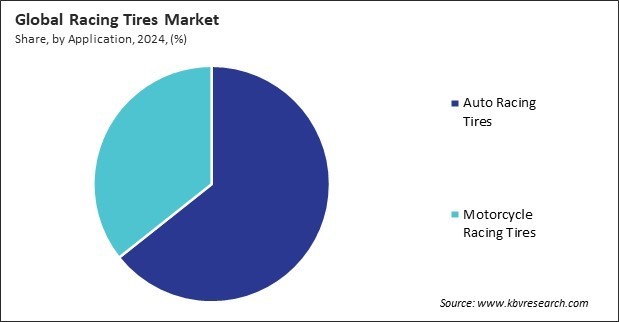

Based on application, the market is segmented into auto and motorcycle racing tires. In 2022, the motorcycle racing tires segment garnered 35.4% revenue share in the market. Advancements in motorcycle technology, particularly in sport and racing motorcycles, have propelled the demand for advanced and specialized tires.

On the basis of distribution channel, the market is divided into replacement tires and OEMs. The replacement tires segment recorded 78.5% revenue share in the market in 2022. Racing enthusiasts and teams often have specific requirements based on the type of motorsports they participate in, whether it be circuit racing, off-road events, or endurance challenges.

Free Valuable Insights: Global Racing Tires Market size to reach USD 15.8 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 30.9% revenue share in the market in 2022. The region has witnessed a notable increase in racing events across various disciplines. From high-profile NASCAR races to grassroots motorsports competitions.

The market is characterized by intense competition driven by factors like performance, durability, and brand reputation. Key attributes include tread design, compound formulation, and construction materials, tailored to specific racing disciplines such as Formula 1, NASCAR, or endurance racing. Innovations in tire technology, including advanced materials and aerodynamic designs, continually reshape the competitive landscape. Brands vie for supremacy through partnerships with racing teams, showcasing their products' performance in high-stakes competitions.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 10.6 Billion |

| Market size forecast in 2030 | USD 15.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.3% from 2023 to 2030 |

| Number of Pages | 212 |

| Number of Tables | 320 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Tire Type, Distribution Channel, Application, Region |

| Country scope |

|

| Companies Included | Bridgestone Corporation, Continental AG, Michelin, Hankook Tire & Technology, Pirelli & C. S.p.A., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Zhongce Rubber Group Co., Limited, Nexen Tire, Maxxis International USA (Cheng Shin Rubber Industry Co.) |

By Tire Type

By Application

By Distribution Channel

By Geography

This Market size is expected to reach $15.8 billion by 2030.

Rising number of motorsports enthusiast participation are driving the Market in coming years, however, High manufacturing costs and price sensitivity restraints the growth of the Market.

Bridgestone Corporation, Continental AG, Michelin, Hankook Tire & Technology, Pirelli & C. S.p.A., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Zhongce Rubber Group Co., Limited, Nexen Tire, Maxxis International USA (Cheng Shin Rubber Industry Co.)

The expected CAGR of this Market is 5.3% from 2023 to 2030.

The Auto Racing Tires segment is leading the Market, By Application in 2022; there by, achieving a market value of $9.9 Billion by 2030.

The Europe region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $5.6 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.