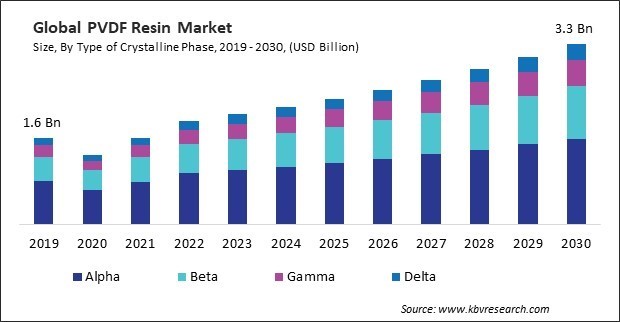

The Global PVDF Resin Market size is expected to reach $3.3 billion by 2030, rising at a market growth of 7.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,06,299.37 Tonnes, experiencing a growth of 6.5% (2019-2022).

The non-stick properties of PVDF coatings make them easy to clean. Therefore, the coatings segment captured $250.68 million revenue in the market in 2022. The surfaces coated with PVDF are less prone to accumulating dirt, making them suitable for applications where cleanliness and hygiene are essential. PVDF coatings are chemically inert, meaning they do not react with various chemicals. This inertness contributes to their stability and effectiveness in protecting surfaces from chemical exposure.

PVDF-coated metal panels and roofing systems are popular in construction projects. The material’s resistance to environmental factors, including sunlight and harsh weather conditions, makes it suitable for roofing applications. PVDF-coated panels and sidings are employed for exterior walls, providing decorative and protective features.

PVDF resin is employed in the production of lightweight components in automobiles. Its low density and high strength contribute to the overall weight reduction of vehicles, enhancing fuel efficiency and performance. This is employed in producing tubing and hoses used in automotive systems. Thus, because of the expansion in automotive manufacturing, the market is anticipated to increase significantly.

However, PVDF resin faces stiff competition from alternative materials, some of which may be lower-cost options. Industries with stringent budget constraints may opt for alternative polymers, potentially affecting the market growth of the market in price sensitive. Due to the high cost of raw ingredients, this may find it difficult to maintain competitive pricing for their products or services. Therefore, high production cost is a significant challenge that hampers the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges By type of crystalline phase, the market is categorized into alpha, beta, gamma, and delta. In 2022, the alpha segment held 49.6% revenue share in the market. Alpha-phase PVDF resin is well-suited for applications in the chemical processing industry. Its excellent chemical resistance makes it ideal for manufacturing pipes, fittings, valves, and other equipment for transporting corrosive chemicals and solvents.

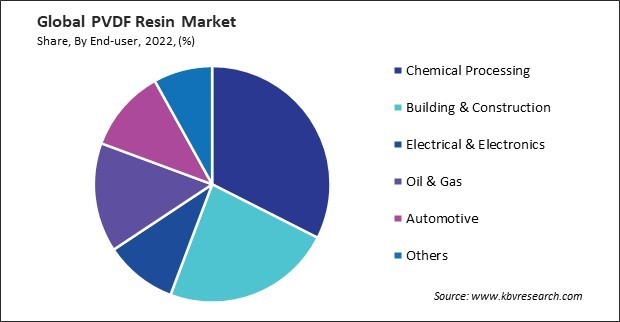

On the basis of end-user, the market is divided into chemical processing, electrical & electronics, building & construction, oil & gas, automotive, and others. The building & construction segment recorded 23.2% revenue share in the market in 2022. PVDF-coated metal panels and roofing systems are popular in the construction industry. The material’s resistance to environmental factors, including sunlight and harsh weather conditions, makes it suitable for roofing applications.

Based on application, the market is classified into pipes & fittings, films & sheets, coatings, membranes, wire & cable, Li-ion batteries, and others. In 2022, the Li-ion batteries segment witnessed 41.0% revenue share in the market. PVDF resin is commonly used as a binder material in the production of Li-ion batteries. It helps hold together the active materials, conductive additives, and other components in the battery electrode, providing mechanical strength and stability.

Free Valuable Insights: Global PVDF Resin Market size to reach USD 3.3 Billion by 2030

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region acquired 24.9% revenue share in the market. PVDF membranes are extensively used in North America for water and wastewater treatment applications. North America’s chemical processing industry relies on PVDF resin to manufacture pipes, fittings, valves, and other equipment. The electronics industry in North America utilizes PVDF resin to produce electrical components, including wires, cables, connectors, and insulation materials.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.9 Billion |

| Market size forecast in 2030 | USD 3.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.3% from 2023 to 2030 |

| Number of Pages | 396 |

| Number of Table | 750 |

| Quantitative Data | Volume in Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type of Crystalline Phase, Application, End-user, Region |

| Country scope |

|

| Companies Included | Arkema S.A., Daikin Industries Ltd., Solvay SA, SABIC (Saudi Arabian Oil Company), Zhejiang Fotech International Co., Ltd, Dongyue Group Limited, RTP Company, Inc., 3M Company, Gujarat Fluorochemicals Limited (INOXGFL Group), Kureha Corporation |

By Type of Crystalline Phase

By End-user (Volume, Tonnes, USD Billion, 2019-2030)

By Application (Volume, Tonnes, USD Billion, 2019-2030)

By Geography (Volume, Tonnes, USD Billion, 2019-2030)

The Market size is projected to reach USD 3.3 billion by 2030.

Increasing demand in construction and architecture are driving the Market in coming years, however, High production cost of PVDF resin restraints the growth of the Market.

Arkema S.A., Daikin Industries Ltd., Solvay SA, SABIC (Saudi Arabian Oil Company), Zhejiang Fotech International Co., Ltd, Dongyue Group Limited, RTP Company, Inc., 3M Company, Gujarat Fluorochemicals Limited (INOXGFL Group), Kureha Corporation

In the year 2022, the market attained a volume of 1,06,299.37 Tonnes, experiencing a growth of 6.5% (2019-2022).

The Chemical Processing segment is generating the highest revenue in the Market by End-user in 2022; there by, achieving a market value of $957.8 million by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $1.5 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.