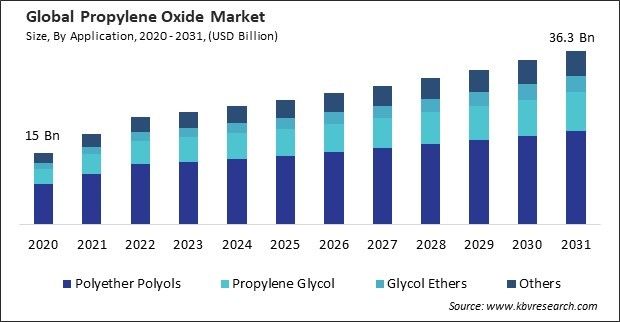

The Global Propylene Oxide Market size is expected to reach $36.3 billion by 2031, rising at a market growth of 5.7% CAGR during the forecast period. In the year 2023, the market attained a volume of 13,671.4 kilo tonnes, experiencing a growth of 20.8% (2020-2023).

Styrene monomer is a crucial feedstock for producing polystyrene (PS) and expandable polystyrene (EPS), which have extensive applications in packaging, construction, electronics, and automotive industries. Thus, the styrene monomer process segment captured 19.5% revenue share in the market 2023. In the terms of volume styrene monomer process segment would attain a volume of 4,162.1 kilo tonnes in the market 2030. The growing demand for lightweight, durable, and versatile materials in these sectors drives the consumption of PS and EPS, fueling the demand for styrene monomers. Hence, these aspects will help in the expansion of the segment.

Bio-based propylene oxide is produced from renewable feedstocks such as biomass, bioethanol, or glycerol, which have a lower carbon footprint than fossil fuel-derived feedstocks. By utilizing biomass as a raw material, bio-PO production emits fewer greenhouse gases, thereby reducing overall carbon emissions.

Additionally, governments and private investors worldwide are undertaking large-scale infrastructure development projects to modernize and expand transportation networks, utilities, and public facilities. These projects include the construction of roads, bridges, railways, airports, ports, and energy infrastructure.

However, Epichlorohydrin and other chemicals are substitutes for it in various applications, such as epoxy resins, glycols, and polyurethanes. These substitute products may offer comparable performance characteristics or cost advantages, making them attractive alternatives for consumers and industries. Therefore, these factors can pose challenges for the propylene oxide market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

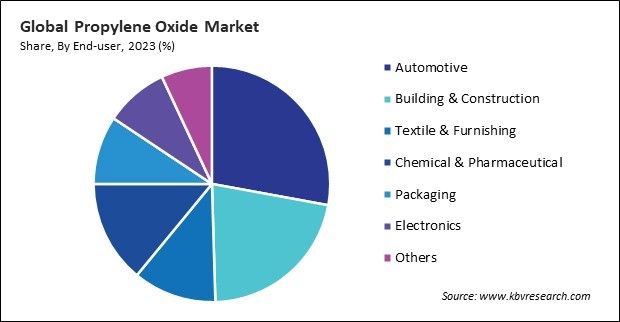

Challenges Based on end-user, the market is segmented into automotive, building & construction, textile & furnishing, chemical & pharmaceutical, packaging, electronics, and others. The automotive segment held 27.8% revenue share in the market in 2023. In the terms of volume, the automotive segment would attain a volume of 5,036.2 kilo tonnes in the market 2031.

Based on production process, the market is divided into chlorohydrin process, styrene monomer process, TBA co-product process, cumene-based process, and hydrogen peroxide process. The chlorohydrin process segment recorded 31.9% revenue share in the market in 2023. In the terms of volume, the TBA segment would attain a volume of 5,940.4 in the market 2029.

On the basis of application, the market is divided into polyether polyols, propylene glycol, glycol ethers, and others. In 2023, the propylene glycol segment witnessed 21.4% revenue share in the market. In terms of volume the propylene glycol segment would attain a volume of 4,427.4 kilo tonnes in the market 2028.

Free Valuable Insights: Global Propylene Oxide Market size to reach USD 36.3 Billion by 2031

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2023, the Europe segment acquired 21.7% revenue share in the market. In terms of volume the Europe region would attain a volume of 3,733.8 kilo tonnes in the market 2028.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 23.5 Billion |

| Market size forecast in 2031 | USD 36.3 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 5.7% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 437 |

| Number of Tables | 830 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Production Process, Application, End-user, Region |

| Country scope |

|

| Companies Included | The Dow Chemical Company, BASF SE, LyondellBasell Industries Holdings B.V., Shell plc, INEOS Group Holdings S.A, Merck KGaA, Huntsman Corporation, Sumitomo Chemical Co., Ltd., Tokuyama Corporation, Repsol Group |

By Production Process (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By End User (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.