The Medical Tubing Market is Predict to reach USD 19.1 Billion by 2031, at a CAGR of 8.2%

Special Offering :

Industry Insights | Market Trends | Highest number of Tables | 24/7 Analyst Support

Medical Tubing Market Growth, Trends and Report Highlights

According to a new report, published by KBV research, The Global Medical Tubing Market size is expected to reach $19.1 billion by 2031, rising at a market growth of 8.2% CAGR during the forecast period. In the year 2023, the market attained a volume of 3,858.20 kilo tonnes, experiencing a growth of 19.4% (2020-2023).

Medical tubing is crucial in infection prevention and control by providing a barrier between patients and medical devices or fluids. Healthcare-associated infections (HAIs) and cross-contamination in clinical settings are prevented by antimicrobial coatings, sterile packaging, and single-use designs, which also lower healthcare expenditures. The diverse range of materials, sizes, and configurations available in the medical tubing market allows customization to meet specific clinical needs and applications. From pediatric to adult patients, from diagnostic to therapeutic procedures, medical tubing can be tailored to accommodate various anatomical variations, treatment modalities, and medical device requirements.

The Bulk Disposable Tubing segment is leading the Global Medical Tubing Market, by Application in 2023; thereby, achieving a market value of $6.2 billion by 2031. Disposable tubing is available in various configurations, sizes, and materials to accommodate diverse clinical applications and patient needs. Bulk purchasing options allow healthcare facilities to maintain a comprehensive inventory of disposable tubing types, ensuring compatibility with various medical devices, procedures, and specialties. Bulk disposable tubing procurement allows healthcare facilities to scale their inventory according to fluctuating demand, seasonal trends, or unexpected spikes in patient volume.

The Silicone segment is experiencing a CAGR of 7.5% during (2024 - 2031). Silicone tubing has a broad temperature operating range, enabling its use in both high and low-temperature applications without significant degradation in performance. This versatility makes silicone tubing suitable for various medical procedures, including cryogenic storage, autoclaving, and high-temperature sterilization. Silicone is chemically inert and resistant to many common chemicals, solvents, and disinfectants, reducing the risk of material degradation, leaching, or contamination of fluids passing through the tubing. This property ensures the purity and integrity of pharmaceuticals, fluids, and biological samples transported via silicone tubing.

Full Report: https://www.kbvresearch.com/medical-tubing-market/

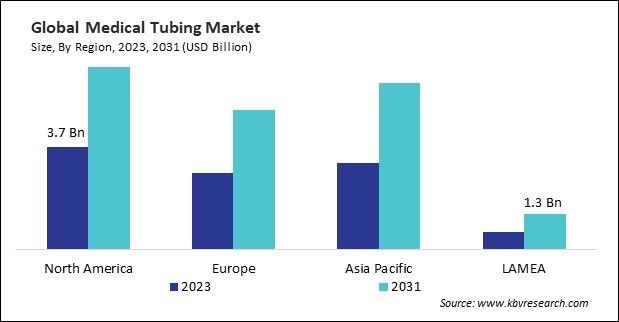

The North America segment dominated the Global Medical Tubing Market, by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $6.6 billion by 2031. The Asia Pacific segment is anticipating a CAGR of 8.7% during (2024 - 2031). Additionally, The Europe segment would exhibit a CAGR of 7.9% during (2024 - 2031).

List of Key Companies Profiled

- Nordson Corporation

- ZARYS International Group sp. Z oo sp.k.

- NewAge Industries, Inc.

- TE Connectivity Ltd.

- Freudenberg SE

- Saint-Gobain Group

- Trelleborg AB

- Lubrizol Corporation (Berkshire Hathaway, Inc.)

- Elkem ASA (Bluestar Elkem International Co., Ltd. S.A.)

- Teleflex Incorporated

Medical Tubing Market Report Segmentation

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Bulk Disposable Tubing

- Drug Delivery Systems

- Catheters

- Biopharmaceutical Laboratory Equipment

- Others

By Product Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Polyvinyl Chloride

- Silicone

- Polyolefins

- Polyimide

- Polycarbonates

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Others

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Related Reports: