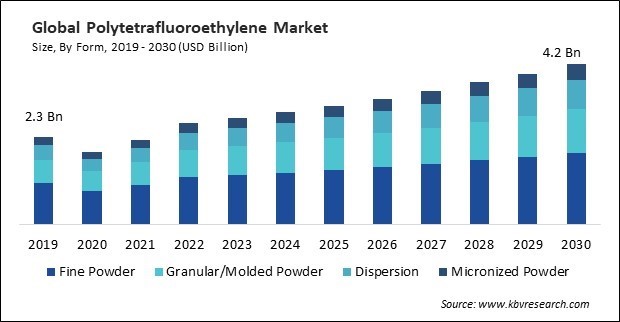

The Global Polytetrafluoroethylene Market size is expected to reach $4.2 billion by 2030, rising at a market growth of 6.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,989.03 hundred tonnes, experiencing a growth of 3.3% (2019-2022).

PTFE-coated architectural membranes are widely used in the construction of tensile membrane structures. Consequently, the building & construction segment captured $206.52 million revenue in the market in 2022. Also, Germany market utilized 7.27 hundred tonnes in the market in 2022. PTFE-coated membranes provide an aesthetically pleasing and functional solution for creating large, open spaces. PTFE coatings, often called Teflon, are applied to structural elements such as bolts and fasteners. For instance, as per Destatis, in 2022, the total number of building permits for construction in Germany was 217,586.

PTFE is used in various applications in the solar PV industry. It is employed in producing back sheets for solar panels, where its chemical resistance and durability contribute to protecting solar modules against environmental factors. PTFE’s chemical resistance is valuable in bioenergy and biomass applications. It can be used in equipment exposed to corrosive byproducts in biomass processing and bioenergy production. Therefore, the market is expanding significantly due to the rise in demand for renewable energy.

PTFE is employed in the production of antennas for wireless communication systems. Antennas for smartphones, modems, and other wireless devices may be constructed from them due to their electrical properties and resistance to environmental factors. For example, according to the International Trade Administration, the online turnover in Hungary’s consumer electronics and computer products increased 37% to HUF 114 billion (USD 370 million) in January- June 2021.

However, Industries and end-users that rely on PTFE may be sensitive to changes in material costs. High production costs may create barriers to entry for new players in the PTFE. The initial investment required for manufacturing facilities and the associated costs may discourage new entrants, limiting competition and potential innovations. Thus, high production costs can slow down the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

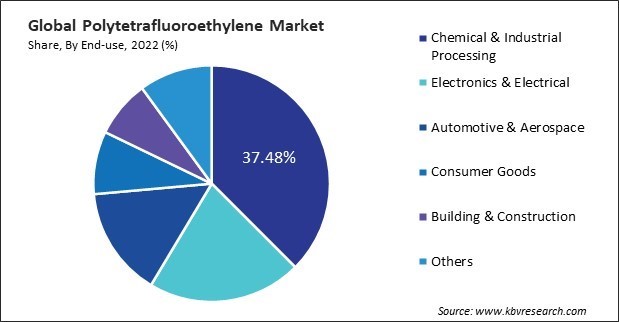

Challenges On the basis of end-use, the market is divided into chemical & industrial processing, electronics & electrical, automotive & aerospace, consumer goods, building & construction, and others. In 2022, the chemical & industrial processing segment dominated the market with 37.48% revenue share. In terms of volume, chemical & industrial processing segment registered 770.17 hundred tonnes in 2022. PTFE’s resistance to corrosion ensures the durability and reliability of critical parts in environments with corrosive substances. PTFE is widely used to produce gaskets and seals for chemical and industrial applications.

By form, the market is categorized into granular/molded powder, fine powder, dispersion, and micronized powder. The granular/molded powder segment covered a 26.65% revenue share in the market in 2022. In terms of volume, granular/molded powder segment registered 546.08 hundred tonnes in 2022. PTFE is often used as joint sealant tapes, providing a versatile and durable solution for sealing joints in pipelines, flanges, and other connections. The material’s ability to conform and create a reliable seal, even on uneven or irregular surfaces, makes it valuable in various industrial settings.

Based on application, the market is classified into sheets, coatings, pipes, films, and others. In 2022, the coatings segment witnessed the 39.0% revenue share in the market. In terms of volume, coatings segment exhibited 803.19 hundred tonnes in 2022. PTFE coatings are extensively used in industrial applications to provide a protective layer on machinery and equipment. These coatings resist corrosion, chemicals, and wear, contributing to the durability and longevity of industrial components. The automotive industry utilizes PTFE coatings for various applications, including coating components such as gaskets, seals, and bearings.

Free Valuable Insights: Global Polytetrafluoroethylene Market size to reach USD 4.2 Billion by 2030

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region acquired a 25.74% revenue share in the market. In terms of volume, North America segment consumed 494.41 hundred tonnes in 2022. North America has a strong presence in chemical and industrial processing industries, where PTFE’s chemical resistance and corrosion-resistant properties are highly valued. The automotive industry in North America utilizes PTFE in various applications, including seals, gaskets, bearings, and components for fuel and brake systems.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.6 Billion |

| Market size forecast in 2030 | USD 4.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.0% from 2023 to 2030 |

| Quantitative Data | Volume in Hundred Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Number of Pages | 407 |

| Number of Tables | 810 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Form, Application, End-use, Region |

| Country scope |

|

| Companies Included | The Chemours Company, Daikin Industries Ltd., 3M Company, Gujarat Fluorochemicals Limited (INOXGFL Group), Dongyue Group Limited, Solvay SA, Arkema S.A., DuPont de Nemours, Inc., Jiangsu Meilan Chemical Co., Ltd., HaloPolymer, OJSC |

By End-use (Volume, Hundred Tonnes, USD Billion, 2019-2030)

By Form (Volume, Hundred Tonnes, USD Billion, 2019-2030)

By Application (Volume, Hundred Tonnes, USD Billion, 2019-2030)

By Geography (Volume, Hundred Tonnes, USD Billion, 2019-2030)

The Market size is projected to reach USD $4.2 billion by 2030.

Growing cleanroom and pharmaceutical applications are driving the Market in coming years, however, Growing Global supply chain challenges restraints the growth of the Market.

The Chemours Company, Daikin Industries Ltd., 3M Company, Gujarat Fluorochemicals Limited (INOXGFL Group), Dongyue Group Limited, Solvay SA, Arkema S.A., DuPont de Nemours, Inc., Jiangsu Meilan Chemical Co., Ltd., HaloPolymer, OJSC

In the year 2022, the market attained a volume of 1,989.03 hundred tonnes, experiencing a growth of 3.3% (2019-2022).

The Fine Powder segment is leading the Market by Form in 2022; thereby, achieving a market value of $1.9 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.97 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.