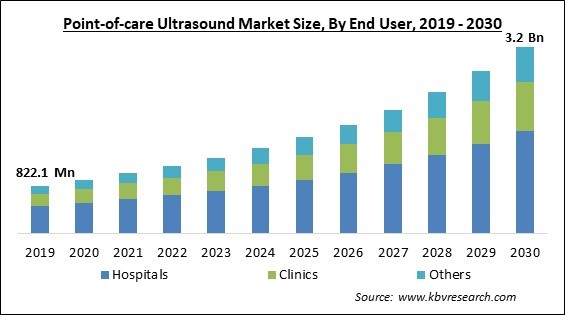

The Global Point-of-care Ultrasound Market size is expected to reach $3.2 billion by 2030, rising at a market growth of 13.8% CAGR during the forecast period.In the year 2022, the market attained a volume of 1,60,085.6 units, experiencing a growth of 14.7% (2019-2022).

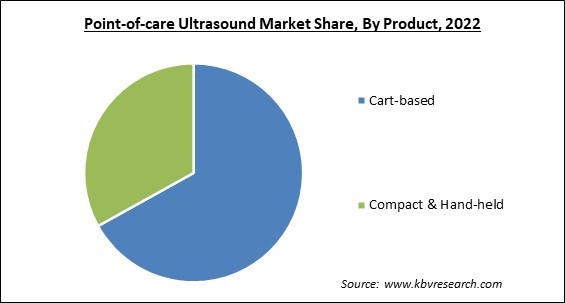

Medical professionals utilize smaller equipment to diagnose respiratory diseases and injuries at the patient's bedside in intensive care units and emergency departments. Thus, the Compact & Hand-held segment will register approximately half of the share of the market by 2030. According to data released by National Health Service (NHS) England, 10.3 million ultrasound procedures were carried out in the U.K. in 2020. Portable, safe, and cost-effective small and hand-held technologies provide rapid outcomes for clinical decision-making. Furthermore, compared to traditional ultrasound machines, expenses for handheld devices are cheaper. The widespread acceptance of these devices was due to their prospective benefits, including non-invasiveness, high sensitivity, and rapid ultrasound interpretation across health centers.

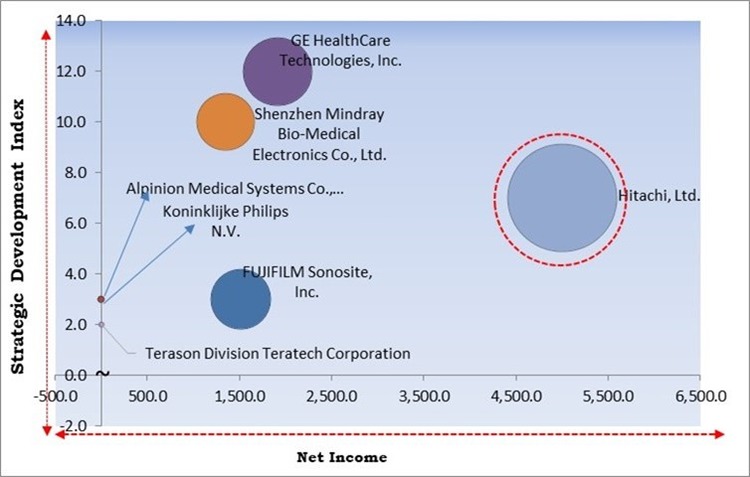

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2023, FUJIFILM Sonosite, Inc. revealed the Sonosite PX ultrasound system. The device offers a novel and adjustable work surface, to increase clinician ergonomics and productivity. Additionally, In November, 2022, Philips released the compact 5000 series. The Compact 5000 series make it easier for more patients to have their ultrasound exams done correctly the first time around because of its portability and versatility without sacrificing image quality or performance.

Based on the Analysis presented in the KBV Cardinal matrix; Hitachi, Ltd. is the forerunner in the Market. In March, 2020, Hitachi, Ltd. revealed ARIETTA 750, the new model from the ARIETTA’s diagnostic ultrasound platform series. This advanced ultrasound platform adapts to the needs of varied therapeutic settings. Companies such as GE HealthCare Technologies, Inc., FUJIFILM Sonosite, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd. are some of the key innovators in the Market.

Due to travel restrictions and national lockdowns, the COVID-19 pandemic hampered access to healthcare for the entire world's population. However, the market saw significant growth after the COVID-19 outbreak due to a rise in diagnostic imaging testing among patients across the globe. a result, bedside diagnostic imaging became an essential component of controlling COVID-19 by reducing the risk of contamination. As a result of the COVID pandemic, there was an increase in the number of lung ultrasound tests performed. These tests were utilized to identify co-occurring respiratory pathologies in COVID-19 patients, assess the severity of lung pathology, and evaluate pathological changes.

Due to advantages such as portability, significantly cheaper cost, and increased clinical efficacy of these devices, the demand for ultrasound equipment for point-of-care applications continues to rise across healthcare specialties. In cohort research conducted in Rwanda hospitals, it was found that point-of-care ultrasound primarily modified the medications delivered (42.4%) and the disposition (30%). Furthermore, market participants focus a lot of attention on the launch and development of ultrasound devices in point-of-care applications in developing countries, which boosts ultrasound device accessibility and adoption, thereby fueling market expansion.

There are numerous opportunities for the market to expand throughout the anticipated period. This is due to technological advancements in procedures like echocardiography, pericardiocentesis, thoracentesis, tomography, vascular access, and arthrocentesis as well as the rising demand for mobile point-of-care devices like venous catheterization and peripheral venous catheterization to improve operational efficiency and patient health. Additionally, market expansion potential is fueled by marketing efforts launched by various organizations to promote the use of point-of-care ultrasound devices and educate professionals from various fields. Furthermore, doctors often employ POCUS to evaluate cardiac arrests. Such advances would guarantee the market's growth in the coming years.

Concerns about adopting these gadgets arise from the restrictions related to using hand-held devices. The ultrasound machines already in the market, such as Lumify and Vscan Air, are made to diagnose certain illnesses, like cardiovascular problems and trauma in individuals. Therefore, these tools cannot support 3D and 4D imaging as well as other components of the patient's physical examination. Furthermore, limitations in the diagnosis and clinical progression of diseases among patients may be caused by factors like low sensitivity and specificity, delayed image quality, and small devices. Additionally, the market is being constrained by the absence of training and certification programs offered by national and international organizations for using these devices.

By product, the market is segmented into cart-based and compact & hand-held. In 2022, the cart-based segment dominated the market with the maximum revenue share. Cart-based systems often come equipped with a range of advanced imaging features, including color Doppler, spectral Doppler, 3D/4D imaging, and elastography, enabling more comprehensive diagnostic evaluations.

Based on end user, the market is trifurcated into hospitals, clinics, and others. The clinics segment garnered a significant revenue share in the market in 2022. The key driver of POCUS's growing use in clinics is the potential to save healthcare costs if complications are detected early. Clinicians can use POCUS to guide various medical procedures, such as central line placements, thoracentesis, paracentesis, and joint aspirations, ensuring precision and reducing the risk of complications.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.2 Billion |

| Market size forecast in 2030 | USD 3.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 13.8% from 2023 to 2030 |

| Number of Pages | 274 |

| Number of Table | 493 |

| Quantitative Data | Volume in Units, Revenue in USD Million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region registered the highest revenue share in the market. Leading companies launching cutting-edge and small ultrasound equipment are responsible for the market's growth. The adoption of ultrasound equipment for point-of-care applications by medical professionals, which continues to rise, also contributed to the market expansion in North America. The combination of technological innovation, clinical benefits, educational opportunities, and regulatory support has fueled the increasing use of POCUS across North America.

Free Valuable Insights: Global Point-of-care Ultrasound Market size to reach USD 3.2 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include GE HealthCare Technologies, Inc., Koninklijke Philips N.V., FUJIFILM Sonosite, Inc. (Fujifilm Holdings Corporation), Alpinion Medical Systems Co., Ltd. (ILJIN Group), Hitachi, Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Terason, Healcerion Co., Ltd., Edan Instruments, Inc. and Chilson Medical Technologies Co., Ltd.

By End User(Volume, Units, USD Million, 2019-2030)

By Product(Volume, Units, USD Million, 2019-2030)

By Geography(Volume, Units, USD Million, 2019-2030)

The Market size is projected to reach USD 3.2 billion by 2030.

Increasing Technological advancements in the field are driving the Market in coming years, however, Limitations of portable devices in point-of-care applications restraints the growth of the Market.

GE HealthCare Technologies, Inc., Koninklijke Philips N.V., FUJIFILM Sonosite, Inc. (Fujifilm Holdings Corporation), Alpinion Medical Systems Co., Ltd. (ILJIN Group), Hitachi, Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Terason, Healcerion Co., Ltd., Edan Instruments, Inc. and Chilson Medical Technologies Co., Ltd.

In the year 2022, the market attained a volume of 1,60,085.6 units, experiencing a growth of 14.7% (2019-2022).

The Hospitals segment is leading the Market by End User in 2022, thereby achieving a market value of $1.8 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.