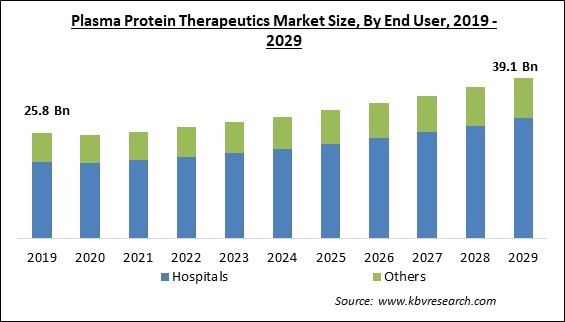

The Global Plasma Protein Therapeutics Market size is expected to reach $39.1 billion by 2029, rising at a market growth of 5.5% CAGR during the forecast period.

Pharmaceuticals known as plasma protein therapeutics are created from proteins extracted from human blood plasma. The biological actions of these proteins include controlling immunological response, blood clotting, and preserving the body's fluid balance. Blood problems, immunological deficiencies, as well as genetic disorders are just a few of the ailments that are treated with plasma protein therapeutics. They are frequently given by injection or infusion, and careful monitoring is necessary to ensure appropriate dosage and reduce any potential side effects.

Plasma is the form of fluid or a part of blood in which cellular components like leucocytes, red blood cells, and platelets are suspended. Plasma makes up 55% of total blood, with 89% of it being water, 2% salt, 3% lipids, and 6% protein. The 2,000–4,000 distinct proteins that make up the plasma proteins (60 g/L) have varying concentrations of hormones as well as about 40 mg/mL (albumin), and their total weight is 60 g/L.

The absence or deficit of a plasma protein could be fatal since each component protein in the human body has a distinct purpose in maintaining homeostasis. Plasma proteins are noted as being absent or dysfunctional in numerous clinical pathological circumstances. In clinical settings, fresh frozen plasma (FFP) or plasma for transfusion both are employed.

Plasma for transfusion is utilized in the treatment of general clotting factor deficiencies as well as in the correction of hyper-fibrinolysis in thrombolysis, replacement of deficient factors during plasmapheresis therapy. The method is also used in isolating deficiencies of clotting factor in lack of purified plasma-derived products. Safety precautions, such as a quarantine time and/or pathogen inactivation, are used in addition to donor exclusion, donor information, and donation screening to avoid the spread of blood-borne illnesses that are transferred during transfusions.

Large opportunities for COVID-19 management drug development were offered by the dearth of these medicines in many developed nations. Due to the increasing demand for COVID-19 vaccines and medications, future growth in the pharmaceutical and biotechnology industries is projected. This is expected to have a substantial influence on the demand for plasma protein. In addition, the market is anticipated to expand as a result of more plasma protein therapies product launches and related research projects. Therefore, it can be stated conclusively that the pandemic had a positive impact on the plasma protein therapeutics market.

The market for plasma protein therapeutics is projected to grow due to technological developments in efficient and affordable methods for fractionating proteins from plasma. More R&D is being conducted because of the rising infectious diseases like hepatitis A&B, rabies, tetanus, and varicella. In addition, over 200 life-threatening diseases affect the immune or neurological systems, including chronic inflammatory demyelinating polyneuropathy (CIDP), idiopathic thrombocytopenic purpura. Hence, all these factors will promote the market's growth throughout the forecast period.

A significant amount of plasma is used in Ig's widespread off-label usage. Examples of the most prevalent off-label IVIG usage include multifocal motor neuropathy (MMN), infant hemolytic illness, acute panautonomic polyneuropathy, autoimmune mucocutaneous blistering disorders, and acute cardiomyopathy. Due to ongoing advancements in diagnosis and higher life expectancy, the clinical demand for these medications has surged over the past several years. It is predicted to continue on its upward trajectory. The demand for Ig is rising due to immunological inadequacies as well as the chronic usage of off-label prescribing in various indications, especially as part of the treatment of certain neurological diseases.

Emerging nations' plasma collection requirements differ from those of fractionators. These areas adhere to stringent laws and norms regarding the caliber of their operations, beginning with the caliber of the raw materials. For plasma, specific fractionators have been created. For instance, the plasma pool used for fractionation must be checked for Parvovirus B, hepatitis A, B, and C, as well as HIV, by the European health authorities. Unfortunately, many facilities' blood collection efforts frequently fail to meet these requirements, wasting some recovered plasma. There is increasing pressure on health finances. Therefore, all these factors may hamper the expansion of the market in the coming years.

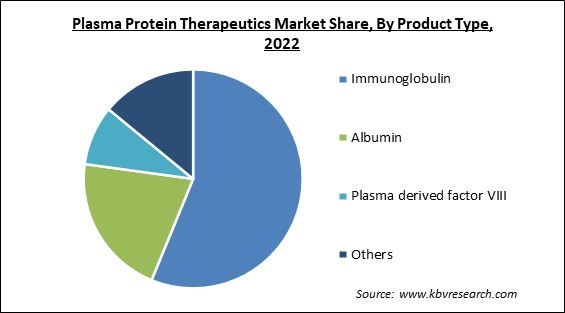

Based on product type, the plasma protein therapeutics market is categorized into immunoglobulin, albumin, plasma derived factor VIII, and others. The immunoglobulin segment garnered the highest revenue share in the plasma protein therapeutics market in 2022. The growth of the segment is owed to the rising use of immunoglobulins in treating various diseases. Immunoglobulins are proteins that control the immune system and eliminate foreign invaders like bacteria and viruses. Additionally, it is employed in treating autoimmune diseases and primary and secondary immunodeficiency.

On the basis of application, the plasma protein therapeutics market is divided into hemophilia, idiopathic thrombocytopenic purpura, primary immunodeficiency disorder, and others. The primary immunodeficiency disorder segment recorded a significant revenue share in the plasma protein therapeutics market in 2022. Primary Immunodeficiency Diseases (PID) are more than 430 uncommon in number, and are long-lasting illnesses brought on by immune system flaws. PID affects over 6.0 million individuals globally. Therefore, the demand for plasma protein therapeutics to treat PID is expected to grow significantly throughout the projection period.

Based on end user, the plasma protein therapeutics market is segmented into hospitals and others. The others segment garnered a considerable growth rate in the plasma protein therapeutics market in 2022. This growth can be attributed to a rise in the number of people visiting hospitals with autoimmune diseases like hemophilia and the accessibility of protein therapies in hospitals. The use of clinics and other patient care infrastructure has expanded as a result of its affordability, ease of booking appointments, and commitment to patient accessibility and convenience.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 27.1 Billion |

| Market size forecast in 2029 | USD 39.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 5.5% from 2023 to 2029 |

| Number of Pages | 231 |

| Number of Table | 365 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Product Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the plasma protein therapeutics market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the plasma protein therapeutics market in 2022. The prevalence of immunological illnesses is rising, uncommon diseases are becoming more common, and research funding for plasma protein therapies is increasing in North America. Additionally, an increase in the number of major companies producing plasma protein therapies contributes to the market expansion in this region. High purchasing power and the availability of well-established healthcare systems are further factors anticipated to fuel market expansion.

Free Valuable Insights: Global Plasma Protein Therapeutics Market size to reach USD 39.1 Billion by 2029

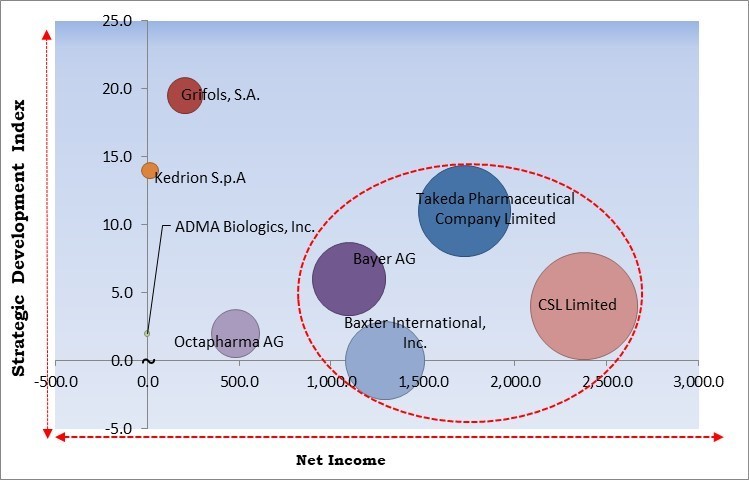

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; CSL Limited (CSL Behring), Baxter International, Inc., Bayer AG, and Takeda Pharmaceutical Company Limited are the forerunners in the Plasma Protein Therapeutics Market. Companies such as Grifols, S.A., Kedrion S.p.A, and ADMA Biologics, Inc. are some of the key innovators in Plasma Protein Therapeutics Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Bayer AG, Abeona Therapeutics, Inc., Takeda Pharmaceutical Company Limited, Grifols, S.A., Baxter International, Inc., Kedrion S.p.A, Octapharma AG, CSL Limited (CSL Behring), Taibang Biological Group Co., Ltd and ADMA Biologics, Inc.

By End User

By Product Type

By Application

By Geography

The Market size is projected to reach USD 39.1 billion by 2029.

Growing funding for technological innovation are driving the Market in coming years, however, Risk of market harm from reimbursement issues and strict regulation restraints the growth of the Market.

Bayer AG, Abeona Therapeutics, Inc., Takeda Pharmaceutical Company Limited, Grifols, S.A., Baxter International, Inc., Kedrion S.p.A, Octapharma AG, CSL Limited (CSL Behring), Taibang Biological Group Co., Ltd and ADMA Biologics, Inc.

The Hospitals segment acquired maximum revenue share in the Global Plasma Protein Therapeutics Market by End User in 2022 thereby, achieving a market value of $29.3 billion by 2029.

The Hemophilia segment is leading the Market by Application in 2022 thereby, achieving a market value of $22 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $16.2 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.