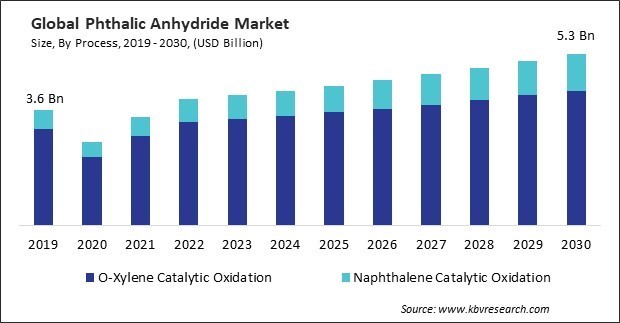

The Global Phthalic Anhydride Market size is expected to reach $5.3 billion by 2030, rising at a market growth of 4.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,907.7 Kilo Tonnes, experiencing a growth of 3.2% (2019-2022).

Phthalic anhydride is widely used in producing polyvinyl chloride (PVC). Therefore, thee building & construction segment captured $1,331.2 million revenue in the market in 2022. Polyvinyl chloride's extensive properties—including low cost, high strength, and dimensional stability—are increasing the demand for PVC in the building and construction industries for applications such as flooring, wiring, and piping. The global building and construction sector is experiencing substantial and profitable growth. A high demand for PVC will result from government-initiated housing initiatives, such as "Housing for All" for impoverished individuals residing in urban and rural regions and the "Smart City Project" to equip smart homes with contemporary amenities. Consequently, expanding the building and construction industry is expected to drive demand for polyvinyl chloride, thereby contributing to the projected growth of the market over the specified time frame.

Improvements in catalyst technology can enhance the selectivity and efficiency of its production. Catalysts play a crucial role in the oxidation of o-xylene to produce phthalic anhydride, and advancements in catalyst design can lead to higher yields and reduced byproduct formation. Technological advancements that enhance the energy efficiency of its production processes can reduce overall production costs and environmental impact. This may involve optimized reaction conditions, heat recovery systems, or advanced process control technologies. Adopting green chemistry principles, such as minimizing hazardous substances, reducing waste generation, and designing more sustainable processes, can make its production more environmentally friendly. Additionally, it is a major component in the production of plasticizers, particularly dioctyl phthalate (DOP) and diethylhexyl phthalate (DEHP). These plasticizers impart flexibility and durability to polyvinyl chloride (PVC), which is widely utilized in the production of consumer goods. Consumer goods such as toys, footwear, upholstery, and clothing often contain flexible PVC materials, and the demand for these products contributes to the need for phthalic anhydride in the manufacturing process. This produces household items such as shower curtains, flooring materials, and furniture upholstery. As consumer goods manufacturing expands, the demand for these items increases, further driving its demand. Due to the above-mentioned aspects, the market is expected to grow significantly.

However, o-xylene is a primary raw material used in the production of phthalic anhydride. Volatility in the prices of o-xylene directly influences the production costs of these. Sudden increases in raw material prices can lead to higher production costs for manufacturers. When raw material prices experience rapid and unpredictable changes, manufacturers may find it challenging to adjust product prices accordingly. This can pressure profit margins, especially if the expanded costs cannot be passed on to customers through higher product prices. Volatility in raw material prices introduces uncertainty into the production planning and budgeting processes for these manufacturers. This delay can make it difficult for companies to plan for future investments and expansions. Volatility in raw material prices can influence investment decisions. Due to unpredictable raw material costs, companies may hesitate to invest in capacity expansions or new projects when the economic feasibility is uncertain. As a result, the above aspects will cause the market growth to decline.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges On the basis of process, the market is segmented into o-xylene catalytic oxidation and naphthalene catalytic oxidation. In 2022, the o-xylene catalytic oxidation segment dominated the market with the maximum revenue share. The primary purpose of o-xylene catalytic oxidation is the production of phthalic anhydride. It is a key intermediate in synthesizing plasticizers, resins, dyes, and other chemical products. The anhydride produced from this process is critical in producing unsaturated polyester resins. These resins are widely used in manufacturing coatings, adhesives, and reinforced plastics. This is a precursor to various phthalocyanine dyes and pigments.

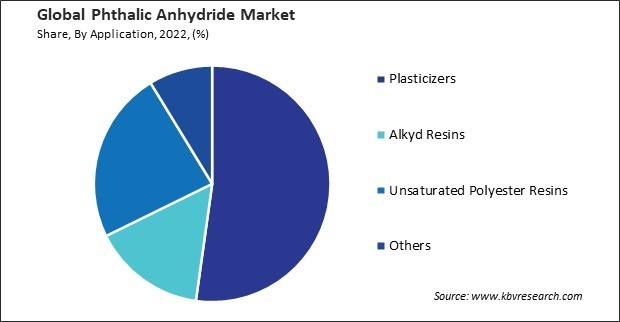

Based on application, the market is fragmented into plasticizers, alkyd resins, unsaturated polyester resins, and others. The alkyd resins segment garnered a significant revenue share in the market in 2022. This reacts with polyols, typically glycerol or pentaerythritol, to form a polyester backbone. The reaction involves the opening of the anhydride ring and the esterification of the resulting carboxylic acid groups with hydroxyl groups from the polyol. Crosslinking unsaturated sites within the alkyd resin enhances its durability, hardness, and chemical resistance. The cured resin forms a tough film on the substrate, providing protective and decorative properties to coatings. This allows for control over the ratio of monomers in the alkyd resin, influencing its solubility and viscosity.

By end-use, the market is classified into paints & coatings, automotive, electrical & electronics, building & construction, agriculture, marine, and others. The agriculture segment covered a considerable revenue share in the market in 2022. Polyester resins derived from these, particularly those reinforced with fiberglass, can be used to construct tanks for storing agricultural chemicals. These materials' corrosion resistance and durability make them suitable for such applications. Plasticizers from these produce flexible PVC films, like dioctyl phthalate (DOP) or diethylhexyl phthalate (DEHP). These films can be employed in agricultural applications such as greenhouse films, mulch films, and tunnel covers.

Free Valuable Insights: Global Phthalic Anhydride Market size to reach USD 5.3 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region witnessed the largest revenue share in the market. As a raw material for the production of end products, this is utilized in numerous end-user industries, including electrical & electronics, building & construction, automotive, paints & coatings, marine, and agriculture. This demand drives the Asia-Pacific market. Furthermore, the expanding construction sector throughout the area is anticipated to generate substantial demand for PVC products, which in turn is anticipated to increase the need for these from manufacturers of PVC products.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.9 Billion |

| Market size forecast in 2030 | USD 5.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 4% from 2023 to 2030 |

| Number of Pages | 346 |

| Number of Table | 690 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Process, Application, End-Use, Region |

| Country scope |

|

| Companies Included | Thirumalai Chemicals Ltd., Mitsubishi Gas Chemical Company, Inc., Asian Paints Limited, POLYNT SPA, BASF SE, Exxon Mobil Corporation, Koppers Holdings Inc., UPC Technology Corporation (MiTAC-SYNNEX GROUP), Nan Ya Plastics Corp. (NPC), Stepan Company |

By Process

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By End-Use (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Billion, 2019-2030)

This Market size is expected to reach $5.3 billion by 2030.

Advancements in plasticizer technologies are driving the Market in coming years, however, Volatility in raw material prices restraints the growth of the Market.

Thirumalai Chemicals Ltd., Mitsubishi Gas Chemical Company, Inc., Asian Paints Limited, POLYNT SPA, BASF SE, Exxon Mobil Corporation, Koppers Holdings Inc., UPC Technology Corporation (MiTAC-SYNNEX GROUP), Nan Ya Plastics Corp. (NPC), Stepan Company

In the year 2022, the market attained a volume of 2,907.7 Kilo Tonnes, experiencing a growth of 3.2% (2019-2022).

The Plasticizers segment is generating highest revenue in the Market by Application in 2022; there by, achieving a market value of $2.6 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $2.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.