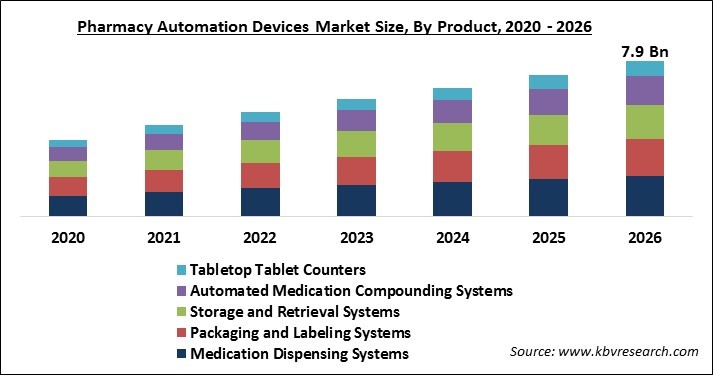

The Global Pharmacy Automation Devices Market size is expected to reach $7.9 billion by 2026, rising at a market growth of 12.5% CAGR during the forecast period. Decreased vulnerability to the storage of medication, low medication cost per dose, reduced medication waste, and improved patient security are some of the advantages provided by pharmacy automation devices. The overall efficiency of these systems can be improved due to the advent of RFID, smart dashboards, barcode scanning technology, and data safety in pharmacies for the smooth workflow. With the help of these devices, medication errors & labor costs can be reduced while accuracy & speed can be improved. Using these products, pharmacists’ time in nonclinical functions can be reduced & these functions include inventory management. Patient experience can be improved as pharmacists spend more time with patients.

The global healthcare industry is facing a lot of burden due to increasing rates of injuries & deaths because of the errors in the medical prescriptions. In order to prevent & reduce these recurrent medical errors, healthcare service vendors & pharmacists are continuously looking for the efficient and advanced technologies. Additionally, as the number of visitors, patients, and their subsequent security requirements is increasing, the medication distribution is becoming more sophisticated on a regular basis. In order to address these critical issues, emerging technologies like pharmacy automation systems are becoming the most effective equipment. Decreasing the errors in medical prescriptions & enhance patient security is the main goal of these tools. Healthcare service vendors and pharmacists can reduce their losses and scale-up effectiveness and productivity by adopting these pharmacy automation systems.

Due to the COVID-19 pandemic, various companies dealing in pharmacy automation devices observed a reduction in sales revenue. On the other hand, the COVID-19 pandemic is anticipated to raise awareness about the significance of automation in the healthcare and pharmaceutical sector, which, as a result, is expected to boost the pharmacy automation market in the next few years.

Based on Product, the market is segmented into Medication Dispensing Systems, Packaging and Labeling Systems, Storage and Retrieval Systems, Automated Medication Compounding Systems, and Tabletop Tablet Counters. The medication dispensing systems segment obtained the highest revenue share in 2019. The healthcare facilities & pharmacists face tremendous pressure to adapt to different medication dispensing systems in order to enhance patient care services owing to the rising number of deaths occurred by medication & dispensing errors, along with severe government policies.

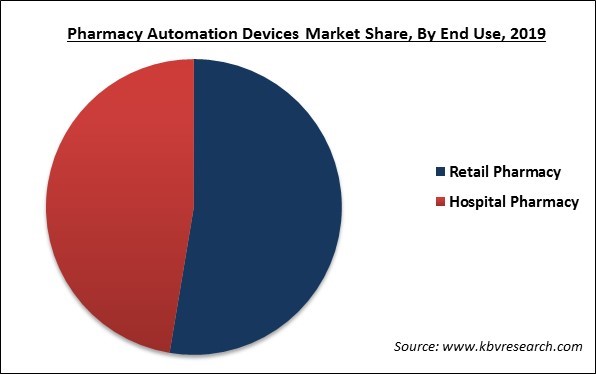

Based on End Use, the market is segmented into Retail Pharmacy and Hospital Pharmacy. The hospital pharmacy segment would showcase the promising growth rate during the forecast period. This growth is owing to the high utilization of automated drug storage & retrieval systems, automated dispensing cabinets, automated sterile compounding systems, barcoded unit dose packaging systems to improve efficiency and productivity.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 4.1 Billion |

| Market size forecast in 2026 | USD 7.9 Billion |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 12.5% from 2020 to 2026 |

| Number of Pages | 176 |

| Number of Tables | 273 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Landscape |

| Segments covered | Product, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global Pharmacy Automation Devices Market to reach a market size of $7.9 billion by 2026

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia-Pacific would exhibit a substantial growth rate during the forecast period. The growth of the regional market is owing to the increasing requirement to reduce medication errors, technological development by key players, decentralization of pharmacies, and the quickly increasing geriatric population. Moreover, the market is anticipated to witness various growth opportunities due to the advancements in healthcare infrastructure in the developing countries.

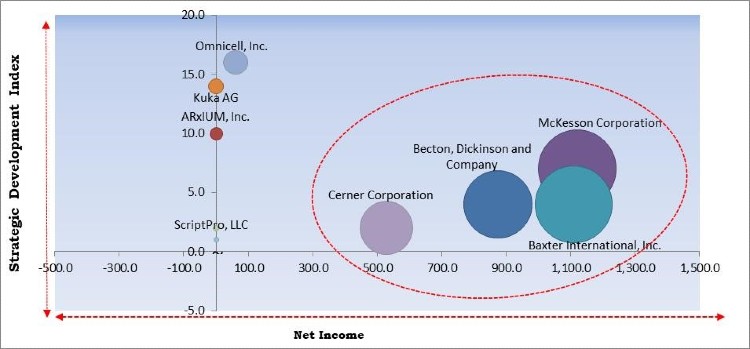

The major strategies followed by the market participants are Partnerships and Product Launches. Based on the Analysis presented in the Cardinal matrix; McKesson Corporation, Becton, Dickinson and Company, Baxter International, Inc., and Cerner Corporation are the forerunners in the Pharmacy Automation Devices Market. Companies such as Omnicell, Inc., Kuka AG, ARxIUM, Inc., and ScriptPro, LLC are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include McKesson Corporation, Baxter International, Inc., Becton, Dickinson and Company, ARxIUM, Inc., Omnicell, Inc., Kuka AG (Swisslog Healthcare), Cerner Corporation, Accu-Chart Plus Healthcare Systems, Inc., Pearson Medical Technologies, LLC, and ScriptPro, LLC.

By Product

By End-Use

By Geography

The global pharmacy automation devices market size is expected to reach $7.9 billion by 2026.

The major factors that are anticipated to drive the pharmacy automation devices industry include healthcare facilities increasingly require a system that can reduce the medication errors.

In 2019, the retail pharmacy segment acquired the maximum revenue share of the global market.

The North America market dominated the Global pharmacy automation devices Market by Region 2019.

McKesson Corporation, Baxter International, Inc., Becton, Dickinson and Company, ARxIUM, Inc., Omnicell, Inc., Kuka AG (Swisslog Healthcare), Cerner Corporation, Accu-Chart Plus Healthcare Systems, Inc., Pearson Medical Technologies, LLC, and ScriptPro, LLC.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.