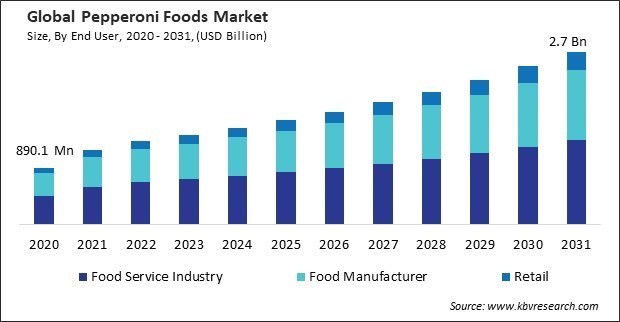

The Global Pepperoni Foods Market size is expected to reach $2.7 billion by 2031, rising at a market growth of 8.6% CAGR during the forecast period.

Beef offers a rich, savory flavor and a satisfying texture that complements the spiciness of pepperoni, making it a popular choice for pepperoni-based dishes such as pizzas, sandwiches, and pasta. Consequently, the Beef-based segment captured $263.3 million revenue in the market in 2023. Beef, especially premium cuts such as Angus or Wagyu, is often perceived as a premium ingredient, and its inclusion in pepperoni foods can elevate the overall quality and appeal of the dish. Hence, the increasing demand for beef will augment the demand for beef-based pepperoni foods, thereby propelling the growth of the market.

Technological advancements in food processing have profoundly transformed the market, ushering in a new era of innovation, efficiency, and quality. These advancements have revolutionized various aspects of food production, preservation, and distribution, significantly improving the supply chain and consumer experience. Technology-driven automation and robotics have optimized production processes, increased efficiency, and lowered costs for food manufacturers, leading to the expansion of the market.

Additionally, as the food service industry expands to cater to growing consumer demand for dining out, takeout, catering, and other food-related services. The expanding food service industry drives the demand for pepperoni foods. According to the U.S. Department of Agriculture, hotels and restaurants in France account for approximately 63 percent of sales ($40.5 billion). Similarly, as per the same source, the food service industry in South Africa recorded sales of $4.3 billion in 2022, an upsurge of almost 20 percent from the $3.5 billion seen in 2021.

However, in recent years, the beef industry has been hindered by concerns regarding the detrimental effects of red meat consumption, particularly beef. Scientific investigations that link excessive red meat intake with an elevated susceptibility to heart disease, certain types of cancer, and additional health complications have stimulated public consciousness and promoted modifications to one's dietary patterns. These health hazards may challenge the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges On the basis of end user, the market is classified into food manufacturer, food service industry, and retail. The food service industry segment garnered the 50.93% revenue share in the market in 2023. The food service industry has witnessed a surge in demand for pepperoni meals as consumers have become more health-aware due to the expansion of awareness campaigns concerning the benefits of a balanced diet.

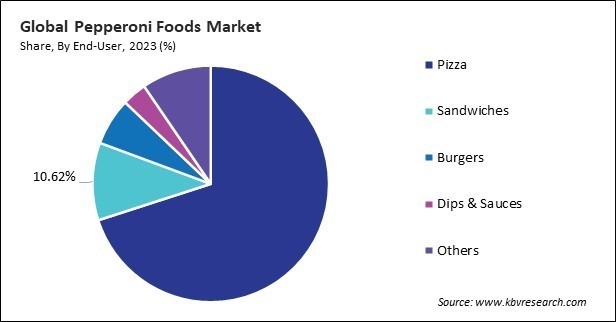

By application, the market is fragmented into pizza, sandwiches, burgers, dips & sauces, and others. In 2023, the burgers segment acquired a 6.46% growth rate in the market. Pepperoni-infused burgers offer a compelling twist on the classic favorite, blending pepperoni's bold, spicy kick with the juicy satisfaction of a well-grilled burger patty.

Based on type, the market is characterized as pork-based, pork & beef based, beef-based, plant-based, and others. The pork-based segment garnered the 40.18% revenue share in the market in 2023. The increased popularity of pork-based fast food and snack foods boosted the meat industry's presence in the fast-food sector.

Free Valuable Insights: Global Pepperoni Foods Market size to reach USD 2.7 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment held a 26.12% revenue share in the market in 2023. Asia-Pacific constituted a significant portion of the worldwide beef industry's revenue. Prominent beef markets in this geographical area include Australia, China, India, and Pakistan.

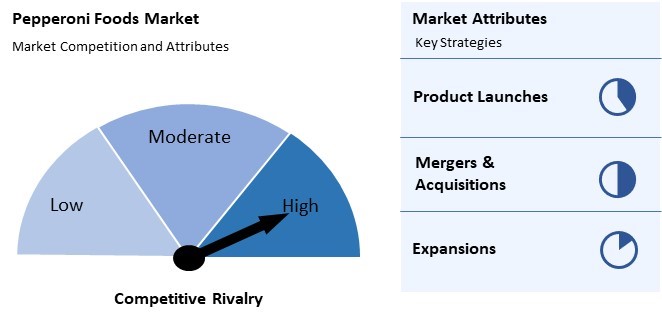

The Market is characterized by intense competition driven by consumer demand for high-quality products and diverse offerings. Established players vie for market share through aggressive marketing strategies, product innovation, and distribution channels. Key competitors continually invest in research and development to enhance product taste, texture, and nutritional profiles, aiming to meet evolving consumer preferences for healthier options while maintaining the classic appeal of traditional pepperoni. Additionally, emerging brands and private labels intensify competition, offering competitive pricing and tapping into niche markets. As consumer awareness grows regarding sustainability and ethical sourcing, companies also compete in adopting environmentally friendly practices throughout the supply chain, further shaping the competitive landscape of the Market.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.4 Billion |

| Market size forecast in 2031 | USD 2.7 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 8.6% from 2024 to 2031 |

| Number of Pages | 248 |

| Number of Tables | 390 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Application, End User, Region |

| Country scope |

|

| Companies Included | Maple Leaf Foods, Inc., Hormel Foods Corporation, Bridgford Foods Corporation, WH Group Limited, Tyson Foods, Inc., Boar's Head Brand, Carl Buddig and Company, Battistoni Italian Specialty Meats, LLC, CTI Foods, LLC, Pocino Foods Company |

By End User

By Application

By Type

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.