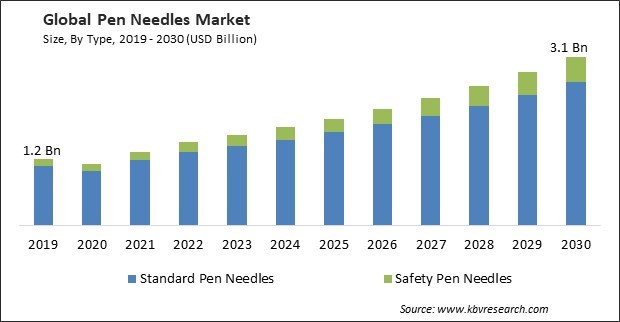

The Global Pen Needles Market size is expected to reach $3.1 billion by 2030, rising at a market growth of 9.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 86,930.9 thousand Units experiencing a growth of 9.1% (2019-2022).

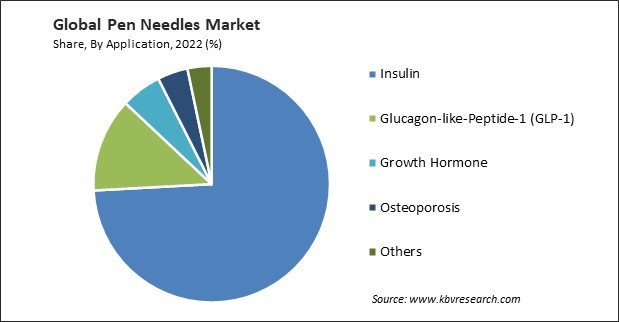

The trend toward self-administration empowers patients to manage their health and treatment independently. This is particularly evident in diabetes management, where self-administration of insulin has become the norm for many patients. Therefore, Insulin segment generated $1,122.2 million revenue in the market in 2022. As a result, self-administration can lead to cost savings for healthcare systems by reducing the need for frequent clinical visits and healthcare professional assistance. This is beneficial, especially in healthcare settings with limited resources.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2023, Embecta Corp. came into partnership with Tidepool, to develop an automated insulin delivery system for the treatment of type 2 diabetes. The two companies would combine their respective offerings to facilitate glucose management within the patients to achieve the aim of their partnership. Moreover, In November, 2021, Terumo Corporation signed a partnership with Diabeloop, to provide Automated Insulin Delivery solutions to European customers. The partnership expands the two company's geographical footprint.

Based on the Analysis presented in the KBV Cardinal matrix; Novo Nordisk A/S is the forerunner in the Market. In September, 2023, Novo Nordisk A/S came into partnership with Aspen Pharmacare Holdings Limited, a global pharmaceutical company. The partnership aimed at providing affordable human insulin to patients within the African continent. Companies such as Terumo Corporation, B. Braun Melsungen AG and Embecta Corp. are some of the key innovators in the Market.

The COVID-19 pandemic had a significant impact on the market. With the pandemic limiting in-person healthcare visits, many people with diabetes and other chronic conditions turned to telemedicine for remote consultations and prescription renewals. As a result, the demand for self-administered medical devices like pen needles increased to facilitate home-based care. The pandemic disrupted global supply chains, leading to delays in the manufacturing and distribution of medical devices, including pen needles. This caused temporary shortages and distribution challenges for these critical healthcare products. This likely led to a surge in the adoption of these needles. Due to such factors, the market will uplift after the pandemic.

Special coatings on pen needles can make the injection process smoother and less painful. These coatings can help the needle glide through the skin more easily. Technological advancements have enabled manufacturers to offer various pen needles with varying specifications to meet individual patient needs. These needles are often compatible with different pen devices, enhancing their versatility. Improved manufacturing processes have increasing precision and quality in pen needle production, ensuring consistent and reliable performance. Some pen devices and pen needles are integrated with digital health technologies, allowing patients to track their injections and monitor their health more effectively. As technology advances, the market will likely see further growth and innovation.

Modern lifestyles characterized by sedentary behavior, unhealthy dietary habits, and increased stress levels have contributed to a rise in obesity and, consequently, type 2 diabetes. As the global population ages, the risk of developing type 2 diabetes increases. Elderly adults are more susceptible to this condition. Obesity is a substantial risk factor for type 2 diabetes. Global obesity has led to a higher incidence of diabetes cases. Increasing urbanization has led to more people leading sedentary lives, which can contribute to insulin resistance and the development of type 2 diabetes. The increasing prevalence of diabetes has a significant impact on the market, driving both the development of advanced pen needles and the expansion of their use in various healthcare settings.

The preference for alternative drug delivery methods, especially for specific medications, can result in competition for market share with pen needles. Manufacturers must adapt to changing preferences and innovate to remain competitive. The market may become saturated, especially in regions with prevalent or preferred alternative delivery methods. Manufacturers need to diversify their product offerings. Some patients struggle with adherence to injection regimens, leading healthcare providers to explore alternative methods that improve patient compliance. This requires patient education and support. The above factors will challenge market growth in the coming years.

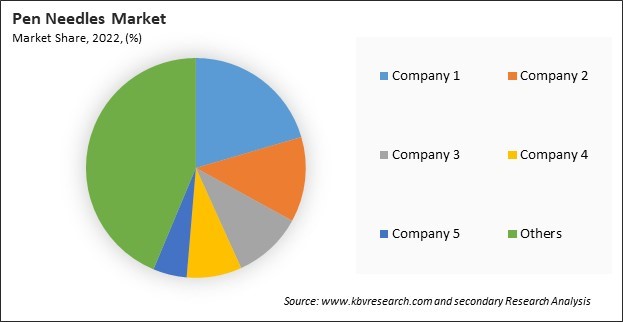

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

On the basis of type, the market is segmented into standard pen needles and safety pen needles. In 2022, the standard pen needles segment dominated the market with the maximum revenue share. Standard pen needles are designed for routine injections and come in various specifications to meet the needs of different patients. Standard pen needles are intended for one-time use. The needle length and gauge choice are based on individual preferences, body type, and healthcare provider recommendations. Some individuals prefer shorter and thinner needles for comfort, while others require longer needles for proper subcutaneous insulin delivery.

Based on setting, the market is divided into homecare, hospitals & clinics, and others. The hospitals & clinics segment garnered a significant revenue share in the market in 2022. Hospitals and clinics use pen needles extensively for diabetes management. This training ensures that patients can safely and effectively self-administer medications. Using pen needles in hospitals and clinics is crucial for providing effective and convenient subcutaneous medication administration to patients with various medical conditions. The patient's needs and the medication administered determine the pen needle type, length, and gauge choice.

By application, the market is classified into insulin, glucagon-like-peptide-1 (GLP-1), growth hormone, osteoporosis, and others. In 2022, the insulin segment registered the highest revenue share in the market. Insulin therapy involves the subcutaneous administration of insulin, which means injecting insulin into the fatty tissue beneath the skin. Using pen needles in insulin therapy allows individuals to personalize their diabetes management based on their lifestyle, insulin regimen, and healthcare provider recommendations. Insulin therapy with pen needles is crucial for individuals with diabetes to maintain proper blood glucose control and prevent complications associated with high or low blood sugar levels.

Based on length, the market is fragmented into 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm. The 12mm segment projected a significant revenue share in the market in 2022. People with diabetes, both type 1 and type 2, often use 12mm pen needles to self-administer insulin. The longer length of these needles ensures that the insulin is delivered into the subcutaneous tissue, even in individuals with thicker skin or more subcutaneous fat. Longer needles can help reduce the risk of medication leakage or being injected too shallowly, ensuring that the medication is effectively delivered to the intended tissue layer.

On the basis of mode of purchase, the market is categorised into prescription-based, over the counter, online purchase, and others. In 2022, the over the counter segment generated the largest revenue share in the market. Over-the-counter (OTC) pen needles are pen needles that can be purchased without the need for a prescription from a healthcare provider. The availability of OTC pen needles provides a suitable and accessible option for individuals who require these devices for their medical treatment, particularly those with diabetes who need insulin administration.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.5 Billion |

| Market size forecast in 2030 | USD 3.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 9.4% from 2023 to 2030 |

| Number of Pages | 529 |

| Number of Table | 1034 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Setting, Length, Mode of Purchase, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region dominated the market with the maximum revenue share. The growth of the North America market is primarily driven by factors such as the high prevalence of diabetes, the increase in the adoption of insulin pens, and the rise in awareness regarding the benefits of pen needles over traditional syringes. Moreover, the availability of a various range of pen needles with different lengths, gauges, and designs and the presence of established market players such as Becton, Dickinson and Company, Novo Nordisk A/S, and Owen Mumford are contributing to the growth of the market in North America.

Free Valuable Insights: Global Pen Needles Market size to reach USD 3.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Embecta Corp., Novo Nordisk A/S, Ypsomed AG, B. Braun Melsungen AG, Terumo Corporation, Nipro Corporation, Owen Mumford Limited, Arkray, Inc., UltiMed, Inc. and Allison Medical, Inc.

By Type (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By Setting (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By Application (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By Length

By Mode of Purchase (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion/Million, 2019-2030)

The Market size is projected to reach USD 3.1 billion by 2030.

Expansion of technological advancements are driving the Market in coming years, however, Preference for alternative drug delivery method restraints the growth of the Market.

Embecta Corp., Novo Nordisk A/S, Ypsomed AG, B. Braun Melsungen AG, Terumo Corporation, Nipro Corporation, Owen Mumford Limited, Arkray, Inc., UltiMed, Inc. and Allison Medical, Inc.

In the year 2022, the market attained a volume of 86,930.9 thousand Units experiencing a growth of 9.1% (2019-2022).

The Homecare segment is generating the highest revenue in the Market by Setting in 2022; thereby, achieving a market value of $1.7 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $977.6 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.