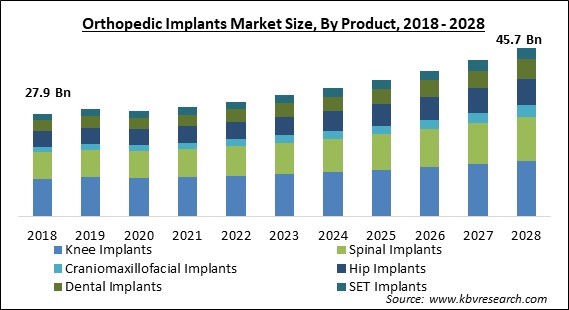

The Global Orthopedic Implants Market size is expected to reach $45.7 billion by 2028, rising at a market growth of 6.6% CAGR during the forecast period.

Orthopedic implants are medical devices used to support a damaged bone to stop more damage from occurring when a bone or a specific joint is missing a portion. This artificial implant uses stainless steel and titanium alloys to achieve maximum strength. It is quoted with the aid of plastic, which mimics the function of cartilage in that specific area of the body to preserve the structure and functioning of the joint.

These kinds of artificial implants, which are often used in treating spinal injuries and other associated conditions including lumbar spine stenosis, are primarily used in operations that call for the least surgical intervention. The variables influencing demand include the increased incidence of musculoskeletal illnesses, weakening bones, lower bone density, and the danger of developing degenerative bone disorders.

Moreover, the availability of cutting-edge orthopedic implants and the fast worldwide growth of healthcare infrastructure would favor the medical sector. Due to these procedures' many advantages, there is a growing awareness of and availability of minimally invasive surgical methods, another essential factor fueling the market's expansion. Also, the rise in athletic and physical activity involvement directly influences the amount of sports injuries needing medical attention, which is anticipated to impact market growth.

The COVID-19 outbreak has hampered workflows in the medical community in different parts of the globe. Several sectors, including details of the healthcare industry, have been temporarily forced to shut down because of the sickness. The introduction of COVID-19 significantly impacted global demand for these devices. The worldwide implant market was directly affected by canceling surgical procedures, particularly bone implantations. Because of the COVID-19 outbreak, participants in the company witnessed a decrease in their revenue from implant sales.

Orthopedic implant manufacturers have developed new technologies in response to the growing demand while expanding their product penetration and market reach. Customized orthopedic implants made possible by 3D printing effectively cut the time and expense of surgery while providing stability over a reasonably extended period. Leading manufacturers of orthopedic implants are using 3D printing technology to enhance the bond between metal and bone in the case of implants with size-controlled micro-pore structures as well as surgical equipment and anatomical models. The market is expected to expand significantly in the years to come due to all of this.

Face fractures are severe wounds that may need surgery and might be permanently incapacitating. Delay in treating face fractures may have disastrous effects, including, in some instances, permanent disability. Based on various demographic and socioeconomic variables, craniofacial fracture cases differ from nation to nation. In addition, facial injuries are a significant burden in underdeveloped countries because quick and efficient treatment is unavailable. So, it is anticipated that these factors will lead to a rise in the demand for craniomaxillofacial implants and the number of individuals choosing to undergo craniomaxillofacial procedures, promoting market development.

Based on statistics from 194 Member States as of 2020, the global health workforce is anticipated to reach 65 million, representing an increase of 29% since the adoption of the Global Strategy on Human Resources for Health: Workforce 2030 in 2016. By 2030, the WHO predicts a 10 million-person shortage in the health workforce, mostly in low- and lower-middle-income nations. To varied degrees, countries at all socioeconomic levels have challenges concerning their workforce's training, employment, deployment, retention, and performance.

Based on product, the orthopedic implants market is segmented into hip implants, knee implants, spinal implants, craniomaxillofacial implants, dental implants, and SET implants. The dental implants segment acquired a substantial revenue share in the orthopedic implants market in 2021. The sector is being driven by growth in its medicinal uses and a rise in the need for prosthetics. Implants are most often made of titanium and titanium alloys. Moreover, factors encouraging the segment's expansion include the increasing frequency of oral injuries brought on by auto accidents and sports-related injuries.

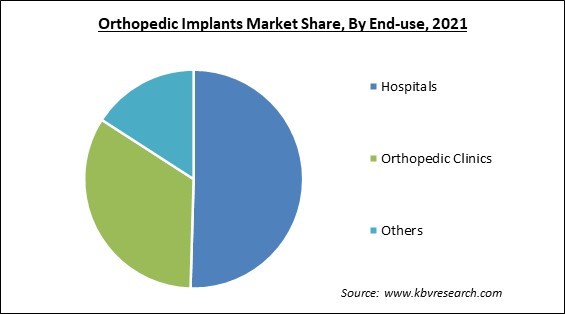

By end-use, the orthopedic implants market is fragmented into hospitals., orthopedic clinics and others. In 2021, the hospital segment dominated the orthopedic implants market by generating the maximum revenue share. This is due to hospitals having the equipment and facilities needed for orthopedic operations, as well as attractive reimbursement schemes. In addition, less expensive healthcare offered by hospitals is resulting in the market growth in this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 29.6 Billion |

| Market size forecast in 2028 | USD 45.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.6% from 2022 to 2028 |

| Number of Pages | 179 |

| Number of Table | 290 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the orthopedic implants market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region held the highest revenue share in the orthopedic implants market in 2021. Due to the increased rates of osteoporosis and osteoarthritis, the aging population, the rise in trauma cases from sports and traffic accidents, and changing lifestyles. Also, factors like a rise in healthcare spending and the use of 3D printing in the healthcare industry contribute to market development in the area.

Free Valuable Insights: Global Orthopedic Implants Market size to reach USD 45.7 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew PLC, ConMed Corporation, B. Braun Melsungen AG (Aesculap, Inc.), Colfax Corporation, NuVasive, Inc., and Arthrex, Inc.

By Product

By End-use

By Geography

The global Orthopedic Implants Market size is expected to reach $45.7 billion by 2028.

Demand for orthopedic implants will increase as more technologically advanced products are used are driving the market in coming years, however, Shortage of qualified professionals restraints the growth of the market.

Medtronic PLC, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew PLC, ConMed Corporation, B. Braun Melsungen AG (Aesculap, Inc.), Colfax Corporation, NuVasive, Inc., and Arthrex, Inc.

The expected CAGR of the Orthopedic Implants Market is 6.6% from 2022 to 2028.

The Knee Implants segment acquired maximum revenue share in the Global Orthopedic Implants Market by Product in 2021 thereby, achieving a market value of $15 billion by 2028.

The North America market dominated the Global Orthopedic Implants Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $19.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.