The North America Pour Point Depressant Market would witness market growth of 3.8% CAGR during the forecast period (2024-2031). In the year 2020, the North America market's volume surged to 1,328.08 hundred tonnes, showcasing a growth of 18.7% (2020-2023).

Ethylene-co-vinyl acetate (EVA) is a significant by-product in the pour point depressant market, playing a crucial role in enhancing the functionality and performance of various industrial fluids, particularly in cold weather conditions. As a copolymer of ethylene and vinyl acetate, EVA exhibits exceptional compatibility with a wide range of base fluids, including lubricants, hydraulic fluids, and diesel fuels. Its incorporation as a pour point depressant effectively lowers the crystallization temperature of these fluids, preventing wax or paraffin buildup and ensuring fluidity at lower temperatures. Therefore, the USA market consumed 794.72 hundred tonnes of Ethylene-co-vinyl acetate in 2023.

The US market dominated the North America Pour Point Depressant Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $565.5 Million by 2031. The Canada market is experiencing a CAGR of 5.8% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 5.3% during (2024 - 2031).

PPD find widespread applications across various sectors of the petroleum industry due to their ability to improve the flow properties of petroleum fluids in cold weather conditions. For example, these depressants are used in oil production operations to prevent wax deposition and flow restrictions in wellbores, production tubing, and surface facilities. By maintaining the fluidity of crude oil at low temperatures, these depressants enable uninterrupted production and transportation of crude oil from reservoirs to processing facilities.

These depressants are added to gasoline, diesel, and aviation fuel to improve their cold flow properties and prevent wax buildup in fuel lines, filters, and fuel injectors. By ensuring the smooth flow of transportation fuels in cold weather conditions, these depressants enhance engine performance, reduce fuel consumption, and minimize the risk of fuel system failures in automotive, marine, and aerospace applications.

With the expansion of the aerospace industry, there will be a rise in the number of aircraft in Canada's fleet, including commercial airliners, cargo planes, helicopters, and military aircraft. As per the data from the Government of Canada, with a total budget of $250 million over three years (until March 31, 2024), the Aerospace Regional Recovery Initiative (ARRI) was delivered by Canada's regional development agencies (RDAs). It complemented support for the aerospace industry provided through Canada's COVID-19 Economic Response Plan and by Industry, Science and Economic Development (ISED) through the Strategic Innovation Fund. Likewise, with increasing oil production comes a higher demand for oilfield chemicals, including these depressants. As Mexico ramps up its oil production, there is a corresponding increase in the demand for these depressants to ensure the efficient extraction, transportation, and processing of crude oil. According to the International Trade Administration (ITA), Mexico ranked 13th in the world in 2022 for crude oil output, 21st in reserves, 16th in terms of capacity for refined oil, and sixth in logistics infrastructure. Hence, increasing investments in the aerospace sector and high oil production in the region are propelling the market's growth.

Free Valuable Insights: The Pour Point Depressant Market is Predict to reach USD 2.8 Billion by 2031, at a CAGR of 4.3%

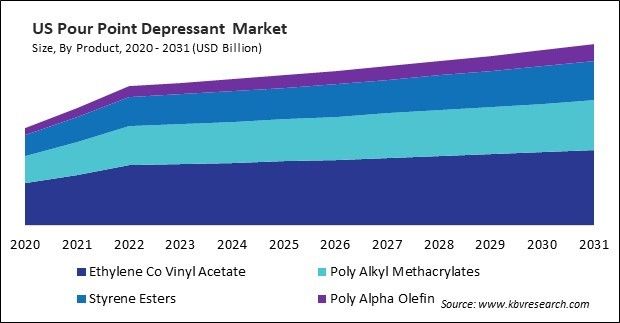

Based on Product, the market is segmented into Ethylene Co Vinyl Acetate, Poly Alkyl Methacrylates, Styrene Esters, and Poly Alpha Olefin. Based on End-use, the market is segmented into Oil & Gas, Automotive, Aerospace, Marine, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

By Product (Volume, Hundred Tonnes, USD Billion, 2020-31)

By End-use (Volume, Hundred Tonnes, USD Billion, 2020-31)

By Country (Volume, Hundred Tonnes, USD Billion, 2020-31)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.