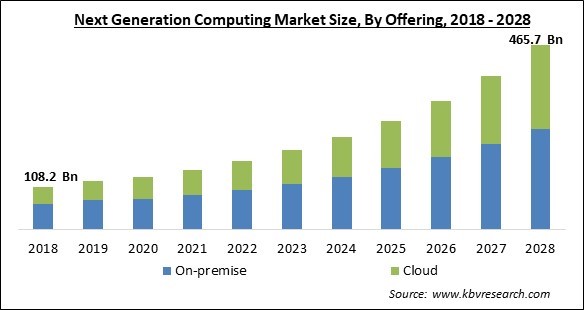

The Global Next Generation Computing Market size is expected to reach $465.7 billion by 2028, rising at a market growth of 18.0% CAGR during the forecast period.

Next-generation computing technology is substantially different from traditional and supercomputer computing technology. It's also known as high-performance computing, and it employs quantum computing technologies. It processes data with quantum bits, rather than traditional computers. Furthermore, when compared to traditional computers, next-generation computing is more capable of doing complex computations, which is a primary driving force behind the market's expansion. It's also used in aerospace and defence, banking and financial services, healthcare and life science, energy and utilities, manufacturing, information technology and telecommunications, and other fields.

The next-generation computing industry is driven by several factors, including increased investments in next-generation computing technology, increased demand for high-performance computing, and increased demand for next-generation computing from scientific science and the capital industry. Over the forecast period, factors such as rising expenditures in artificial intelligence (AI), Industrial Internet of Things (IIoT), and engineering, which involve electronic design automation (EDA), are expected to boost the market.

Without the necessary tools and advanced technologies, meeting the escalating need for quick product development cycles (PLCs) and maintaining consistent quality becomes nearly impossible in real-time. Various sectors, such as automobile and medical robots, are using next-generation computing systems with computer-aided engineering programs for high-fidelity modelling simulation.

Machine learning (ML), Physical modelling, and optimization, in a variety of industrial applications, including financial modelling and life science simulation, are just a few examples of how next-generation computing may help solve complicated issues quickly. In addition, regulatory standards for energy consumption, sustainability, and safety, along with cost pressure, are at an all-time high around the world and are increasing rapidly, leading to increased complexity for development engineers.

The market for next-generation computing has grown in recent years; but, following the outbreak of the COVID-19 pandemic, the sector would see a minor fall in software sales in 2020. This is due to governments in the majority of countries putting the country on lockdown and shutting down cities to avoid the virus from spreading. Following the recuperation from the COVID-19 pandemic, the next-generation computer sector is expected to thrive in the future years. Moreover, several firms around Asia are implementing modern computer technologies to better their business processes and operational efficiency. Furthermore, several countries have implemented quantum computing apps and utilized quantum computing solutions for their health and life sciences operations, all without the virus spreading to the general population.

Advances in genetic, personalized medicine, the mass acceptance of health records (EHRs) and digital photography, as well as the growing multiplication of medical IoT and mobile devices have resulted in a massive growth of structured or unstructured healthcare-related data. The healthcare business has always been at the cutting edge of technology adoption for the past two decades, due to the rising need for data analysis. Furthermore, one of the primary elements that complemented the acceptance of powerful computational solutions in the industry was the necessity to hasten drug development and genomics-related research. The use of AI in the medical field to assist healthcare professionals with diagnoses has been a big enabler for the adoption of these technologies in industrial settings.

The rise of next-generation computing technologies such as high-performance processing and quantum technology, as well as continuous prospective advances noticed by major sectors, are driving market expansion. For example, industry behemoths like NASA, Lockheed Martin, Goldman Sachs Group, and other government agencies are investing in this technology's research and development. Another example, Google LLC teamed up with NASA and Oak Ridge National Laboratory in October 2019 to create the greatest quantum information service in the world. Sandia National Laboratories will also receive million from the US Department of Energy's Innovative Scientific Computing Research Programs.

Many SMEs are unaware of the importance of Next-Generation Computing Market and lack the financial resources to put up such systems. Due to the high investment costs, many SMEs in underdeveloped countries are still hesitant to embrace Next-Generation Computing. Many of them are ignorant of the numerous benefits, such as improved performance and customized delivery. These businesses also lack the skills and know-how required to set up and maintain an Next-Generation Computing system. As a result, lack of awareness amongst SMEs hinders market expansion. Cloud computing, on the other hand, has the potential to increase adoption among SMEs by significantly lower prices.

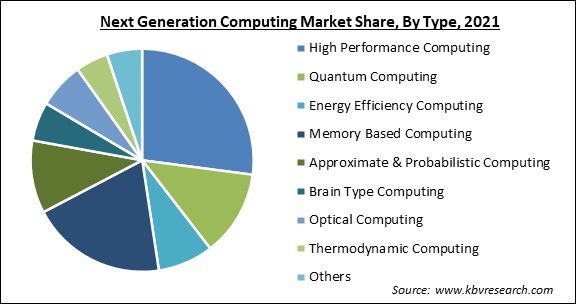

Based on Type, the market is segmented into High Performance Computing, Quantum Computing, Energy Efficiency Computing, Memory Based Computing, Approximate & Probabilistic Computing, Brain Type Computing, Optical Computing, Thermodynamic Computing, and Others. The high performance computing segment acquired the highest revenue share in the Next-Generation Computing Market in 2021. Parallel computational and Supercomputers techniques, processing algorithms, and systems are used in high-performance computing to address complicated computational problems. Next-Generation Computing uses a variety of approaches, such as computer modelling, simulation, and analysis, to solve complex computational problems and conduct research while allowing multiple users to access computing resources at the same time.

Based on Component, the market is segmented into Hardware, Software, and Services. The software segment witnessed a substantial revenue share in the Next-Generation Computing Market in 2021. The implementation of this software improves customer satisfaction in several works for large such as IT & telecommunications, BFSI, and healthcare, maximizing the demand for existing customers while lowering operating costs. This supports the implementation of solutions that are required to properly manage the software.

Based on Offering, the market is segmented into On-premise and Cloud. The On-premise segment acquired the maximum revenue share in the Next-Generation Computing Market in 2021. The aspects that can be credited as governments continue to be interested in obtaining sensitive data defense and security and private details of citizens, businesses are worried about the protection of their administrative data. This is due to a variety of benefits provided by the on-premise implementation, including a strong level of data protection and safety. As a result, on-premise infrastructure is preferred over cloud-based technology. In the coming years, such factors are expected to boost the on-premise segment's growth.

Based on Organization size, the market is segmented into Large Enterprises and Small & Medium Enterprises. The small & medium enterprises segment registered a substantial revenue share in the Next-Generation Computing Market in 2021. This is because SMEs are migrating their organizations to a digital platform and implementing next-generation computing solutions, permitting businesses to become more productive, intelligent, and efficient.

Based on End User, the market is segmented into Government, BFSI & Telecom, Space & Defense, Energy & Power, Chemicals, Healthcare, Academia, and Others. The government segment garnered the highest revenue share in the Next-Generation Computing Market in 2021. The rise of the Next-generation computing is being fueled by governments investing in breakthrough technologies for military and defense, law enforcement, and the Securities and Exchange Commission to detect fraud risk and identify trade infractions. This is due to the government and defense agencies' active adoption of cutting-edge IT systems to improve computing efficiency.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 149.4 Billion |

| Market size forecast in 2028 | USD 465.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 18% from 2022 to 2028 |

| Number of Pages | 386 |

| Number of Tables | 623 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Component, Offering, Organization Size, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America garnered the largest revenue share in the Next-Generation Computing Market in 2021. To increase their regional coverage and reach, regional market sellers have formed new partnerships with other companies. For example, Graph core developed its partner programme to expand its ability to contact new customers and help them scale up using its intelligence processing unit (IPU) products. To increase its presence in the North American market, the company added many new partners to its partner network, including Applied Data Systems and Images ET Technologies, among others.

Free Valuable Insights: Global Next Generation Computing Market size to reach USD 465.7 Billion by 2028

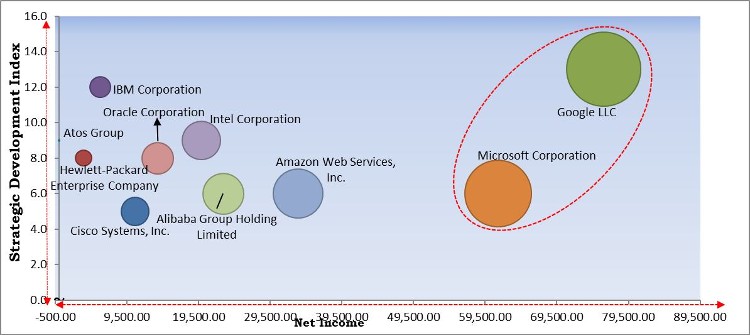

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Google LLC and Microsoft Corporation are the forerunners in the Next-Generation Computing Market. Companies such as IBM Corporation, Oracle Corporation and Intel Corporation are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Atos Group, Cisco Systems, Inc., Hewlett-Packard Enterprise Company, Amazon Web Services, Inc., Microsoft Corporation, Intel Corporation, Oracle Corporation, Google LLC, and Alibaba Group Holding Limited.

By Type

By Component

By Offering

By Organization size

By End User

By Geography

The global next generation computing market size is expected to reach $465.7 billion by 2028.

High demand in science and healthcare sector are driving the market in coming years, however, lack of utilization by SMEs growth of the market.

IBM Corporation, Atos Group, Cisco Systems, Inc., Hewlett-Packard Enterprise Company, Amazon Web Services, Inc., Microsoft Corporation, Intel Corporation, Oracle Corporation, Google LLC, and Alibaba Group Holding Limited.

The expected CAGR of the next generation computing market is 18% from 2022 to 2028.

The Hardware segment is leading the Global Next Generation Computing Market by Component in 2021, thereby, achieving a market value of $242 billion by 2028.

The North America is the fastest growing region in the Global Next Generation Computing Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.