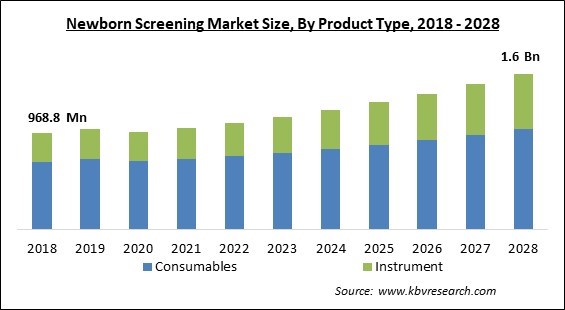

The Global Newborn Screening Market size is expected to reach $1.6 billion by 2028, rising at a market growth of 6.4% CAGR during the forecast period.

Newborn screening reveals conditions that could affect a child's health or survival in the long run. This screening method consists of a set of tests that are necessary for early identification, diagnosis, and health management to avoid total disability and mortality in children. These tests reveal genetic, developmental, and metabolic problems in newborn babies and are conducted shortly after the baby is delivered. During discharge from a hospital or birthing facility, a few droplets of blood from the newborn's heel are tested for specific genetic, endocrine, and metabolic diseases, as well as hearing loss and catastrophic congenital heart abnormalities.

Newborn screening is a public health program in which newborn newborns are examined and diagnosed with rare but dangerous medical disorders such as genetic, hormonal, or metabolic conditions that can disrupt the newborn's normal growth but are treatable. Newborn screening involves a variety of tests performed during the first few hours or days of an infant's life, such as a hearing test, urine test, dry blood test, and others.

These tests can prevent a variety of health issues as well as death. Newborn screening has developed from a simple urine and blood test to a more complete and complex screening method that can detect more than 50 diseases. Newborn screening tests evaluate the presence of certain indicators in an infant's blood that can raise or decrease if the child has certain disorders. Congenital hypothyroidism, phenylketonuria (PKU), cystic fibrosis (CF), and roughly 22 additional metabolic disorders can now be detected by newborn screening tests that alter lipid metabolism or protein.

Newborn screening was founded on the observation that the amino acid condition phenylketonuria (PKU) could've been treated with dietary changes, but that early treatment was necessary for the greatest results. PKU causes irreversible intellectual damage in infants who are unable to metabolize the necessary amino acid phenylalanine.

The COVID-19 pandemic had a detrimental influence on newborn screening, since the majority of screening centers encountered a variety of issues, with the majority of them being more affected in the second wave of the pandemic. Due to mail difficulties and unpredictability, as well as aircraft delays, specimens arriving at screening locations and the accessibility of lab equipment and reagents were postponed. Laboratory personnel availability was occasionally reduced due to an infection, quarantine, or transfer within the healthcare center. The collecting of samples at home, second-tier tests, and follow-up were all affected. Social constraints and public transportation interruptions exacerbated these problems. Only a few institutions were able to maintain the full operation of their NBS (newborn screening) programs.

In recent years, the prevalence of infant illnesses has increased, encouraging health professionals to increase awareness and education they desire for enhanced screening tools. The most common newborn problems are hearing, metabolism, and hormonal issues, as well as serious congenital heart disease, all of which are curable if diagnosed early. According to the US CDC, the prevalence of neonatal diseases in the United States was 34 per 10,000 live births between 2015 and 2017. Each year, approximately 12,900 babies are projected to be diagnosed with a disease.

The Asia Pacific has the world's highest birth rate, which is about half that of the rest of the world, and newborn screening is rapidly gaining traction. As a result, governments in the Asia Pacific area are concentrating their efforts on a variety of initiatives to discuss and find answers to the rising incidence of newborn illnesses. In India, for example, Ayushman Bharat, one of the largest people-centric initiatives, was introduced in 2018. A variety of practices and innovations are being implemented by states, union territories, and organizations in India to address the challenges in maternal and child health as the world strives toward universal health coverage and countries strive towards maternal, reproductive, new-born, child, and adolescent health.

Cortisone medicine administered to the body has the potential to crystallize. The pain and irritation generated by the crystals would be worse than the inflammation and pain caused by the illness being treated. A cortisone flare is a name for this adverse effect. Rest and occasional cold packs can be used to treat a flare that lasts one or two days. Infection is a significant possible adverse effect; however, it is rare. People who are more susceptible to infection, such as those with autoimmune illnesses or those who take immune-suppressing medicines, should consult doctor.

Based on the Product Type, the Newborn Screening market is bifurcated into Instrument and Consumables. The consumable segment acquired the highest revenue share in the Newborn Screening Market in 2021. It is due to the rise in the prevalence of infant illnesses and the rate of newborn screening. The ongoing need for consumables in newborn screening accounts for this market segment's substantial proportion. The rising prevalence of infant diseases and the rising rate of newborn screening around the world are two important factors supporting the expansion of consumables.

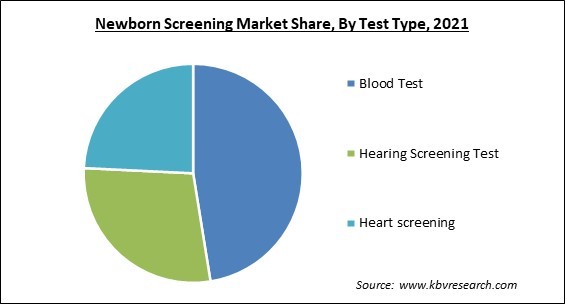

On the basis of Test Type, the Newborn Screening market is divided into Blood test, Hearing screening test, and Heart screening. The heart screening segment registered a substantial revenue share in the Newborn Screening Market in 2021. This test is used to check for a group of heart problems known as critical congenital heart defects in newborns also called critical CHDs or CCHDs. Pulse oximetry is a common medical test. A pulse oximeter machine and sensors placed on baby's skin are used to check the amount of oxygen in the baby blood.

Based on the End user, the Newborn Screening market is classified into Hospitals, and Clinical laboratories. The Hospital segment acquired the largest revenue share in the Newborn Screening Market in 2021. It is because the hospital is a medical facility that treats newborn babies with specialized health science and supplementary healthcare personnel as well as medical equipment. In addition to providing 24*7 monitoring for both infants and mothers, the hospital provides all necessary vaccinations and equipment.

By Technology, the Newborn Screening market is segmented into Tandem Mass Spectrometry, Molecular Assays, Immunoassays and Enzymatic Assays, Hearing Screen Technology, Pulse Oximetry Screening Technology, and others. The pulse oximeter segment witnessed a significant revenue share in the Newborn Screening Market in 2021. By measuring oxygen content in a newborn's blood, pulse oximetry screening aids in the detection of serious congenital heart abnormalities. The test takes just a few minutes to complete, is painless, and does not necessitate the drawing of blood.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1 Billion |

| Market size forecast in 2028 | USD 1.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.4% from 2022 to 2028 |

| Number of Pages | 277 |

| Number of Tables | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Test Type, End User, Technology, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the Newborn Screening market is analyzed across North America, Europe, Asia Pacific, and Europe. The North America region garnered the highest revenue share in the Newborn Screening Market in 2021. Due to the increased prevalence of congenital diseases, the United States leads the North American newborn screening industry. According to the Centers for Disease Control and Prevention (CDC), more than five million babies are examined for various diseases every year.

Free Valuable Insights: Global Newborn Screening Market size to reach USD 1.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include General Electric (GE) Co. (GE Healthcare), F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Natus Medical Incorporated, Masimo Corporation, Waters Corporation, PerkinElmer, Inc., AB Sciex LLC (Danaher Corporation), Medtronic PLC (Covidien plc), Trivitron Healthcare Pvt. Ltd.

By Product Type

By Test Type

By End User

By Technology

By Geography

The newborn screening market size is projected to reach USD 1.6 billion by 2028.

Newborn Disorders are Becoming More Frequent are driving the market in coming years, however, Newborn Screening Can Lead To Inconclusive Outcomes limited the growth of the market.

General Electric (GE) Co. (GE Healthcare), F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Natus Medical Incorporated, Masimo Corporation, Waters Corporation, PerkinElmer, Inc., AB Sciex LLC (Danaher Corporation), Medtronic PLC (Covidien plc), Trivitron Healthcare Pvt. Ltd.

The Blood Test market is leading the Global Newborn Screening Market by Test Type in 2021, achieving a market value of $701 Million by 2028.

The Clinical Laboratories market has high growth rate of 7.9% during (2022 - 2028).

The North America market region shows high market share in the Global Newborn Screening Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $578.8 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.