The Global Network Access Control Market size is expected to reach $14 billion by 2030, rising at a market growth of 25.3% CAGR during the forecast period.

Governmental organizations deal with a lot of private and confidential data. Only authorized people can access vital systems and data due to the assistance of NAC solutions in enforcing rigorous access controls. Therefore, Government sector registered $223.7 million revenue in the market in 2022. Networks and resources used by the government, such as databases, infrastructure, and crucial systems, require strong defense against internal and external attacks. To protect government assets, NAC systems establish access controls according to device health, user identity, and contextual data. As a result, only authorized individuals and reliable devices can connect to and access private government data.

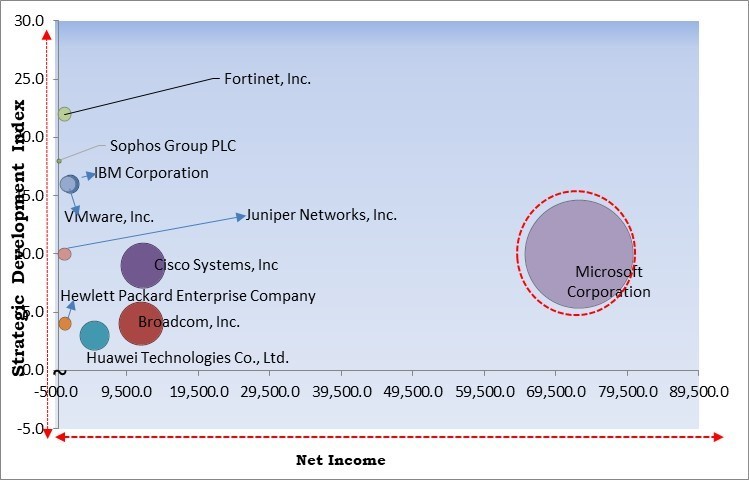

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2023, IBM Corporation acquired Polar Security. The acquisition makes IBM a premier provider of DSPM solutions. In March, 2023, Hewlett Packard Enterprise Company announced the acquisition of OpsRamp, an IT operations management solutions provider. The acquisition would allow Hewlett-Packard to integrate its portfolio with OpsRamp's offerings which would create an effective and manageable edge-to-cloud platform. Furthermore, the acquisition strengthens the reach of the HPE GreenLake platform in IT Operations Management.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the major forerunner in the Market. In July, 2021, Microsoft Corporation announced the acquisition of CloudKnox, a privileged access solutions provider based in the US. The acquisition enhances Microsoft Azure by providing it with automated remediation and granular visibility. Companies such as Cisco Systems, Inc Broadcom, Inc., Huawei Technologies Co., Ltd. are some of the key innovators in the Market.

Enterprises, banks, data centers, and financial institutions continue to lead the market demand for network access control solutions to store & update crucial data. Alarmingly high rates of cybercrime and rising geopolitical unrest have fueled an increase in network security lapses and unauthorized intrusions, necessitating the implementation of effective security solutions, network access control being a key component. Investments in network access control systems will increase steadily during the projection period as numerous enterprise networks compete to reach outside of protected boundaries. Thus, the market is predicted to witness growth in the upcoming years.

Governments have passed stronger laws to protect sensitive & personal data in response to cybersecurity risks & data breaches. Data protection and access control regulations, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), impose strict standards. Through the enforcement of access rules, the preservation of audit trails, and the provision of insight into network activities, NAC solutions assist enterprises in meeting these compliance requirements. In consideration of this, the market is estimated to grow significantly.

A diversified IT ecosystem comprising several systems, applications, and platforms is common in organizations. It might be difficult and time-consuming to integrate NAC systems with these various components. NAC solution deployment and integration might be hampered by compatibility problems, integration difficulties, and a lack of interoperability across various technologies and providers. Due to the lack of a uniform set of standards in the NAC industry, numerous proprietary solutions and methods exist. The adoption of NAC systems from various vendors or in various environments may be hampered by this lack of standardization and its potential to cause interoperability issues. To overcome this restriction, standardized efforts and industry partnerships are required.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

By Offering, the market is segmented into hardware, software, and services. The services segment acquired a substantial revenue share in the market in 2022. Deployment, maintenance, customer support, training, and advisory services are all included in the scope of network access control services. The primary factors anticipated to propel the growth of the segment are the increasing demand for these solutions, devices, and infrastructure and which is expected to sustain the service segments for a longer period due to the ongoing need for license renewal, support & maintenance, and customer support requirements.

Based on deployment, the market is fragmented into on-premise and cloud. In 2022, the cloud segment witnessed the largest revenue share in the market. Subscription models are the main way that cloud-based network access control is defined. It allows companies to use and access cutting-edge network security services cloud infrastructure provides. Based on usage, demand, and purchasing power, it provides enterprises with an affordable and adaptable method of monitoring and guaranteeing network security.

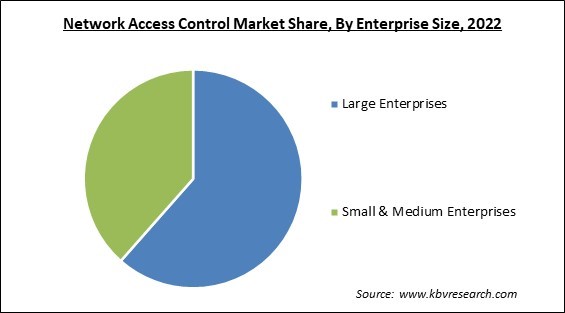

On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. In 2022, the large enterprises segment dominated the market with the maximum revenue share. The main factors drawing cybercriminals to large organizations like banks and financial institutions, IT firms, healthcare institutions, and government agencies are the rising incidences of cyberattacks, data theft, and security breaches caused by the rapid adoption of technologies, remote work cultures, connected devices, and the implementation of unsecured networks to share data. Therefore, protecting the security of corporate networks & connected devices is increasingly crucial for large enterprises.

Based on vertical, the market is classified into BFSI, IT & telecom, retail & e-commerce, healthcare & dental, manufacturing, government, education, manufacturing, and others. The IT & telecom segment garnered a significant revenue share in the market in 2022. Because more consumer data is available, more important data is shared over big networks, more digital technologies are being used, and more connected devices are being used, the IT and telecommunications sectors are seeing a sharp increase in cyberattacks and other security breaches. The need for these solutions in the IT and telecommunications sector is also anticipated to increase due to enterprises' growing knowledge and growing security concerns.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.4 Billion |

| Market size forecast in 2030 | USD 14 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 25.3% from 2023 to 2030 |

| Number of Pages | 304 |

| Number of Table | 483 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Deployment, Offering, Enterprise Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The market in North America is anticipated to expand due to the growing need for network security solutions across several key end-use sectors, including government, healthcare, IT and telecom, education, and BFSI. The following industries are frequently targeted by cybercriminals and data thieves in the region to access vital organizational networks & devices carrying massive amounts of personal & organizational data. These elements are anticipated to fuel the expansion of the regional market.

Free Valuable Insights: Global Network Access Control Market size to reach USD 14 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, Broadcom, Inc., VMware, Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Juniper Networks, Inc., Sophos Group PLC (Thoma Bravo) and Fortinet, Inc.

By Deployment

By Offering

By Enterprise Size

By Vertical

By Geography

This Market size is expected to reach $14 billion by 2030.

Growing risk of cybersecurity threats are driving the Market in coming years, however, Deployment challenges and associated complexity restraints the growth of the Market.

Cisco Systems, Inc, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, Broadcom, Inc., VMware, Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Juniper Networks, Inc., Sophos Group PLC (Thoma Bravo) and Fortinet, Inc.

The expected CAGR of this Market is 25.3% from 2023 to 2030.

The Hardware segment is leading the Global Network Access Control Market by Offering in 2022 thereby, achieving a market value of $6.2 billion by 2030.

The North America market dominated the Global Network Access Control Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $4.5 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.