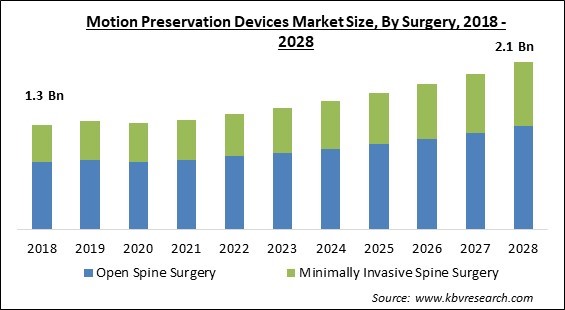

The Global Motion Preservation Devices Market size is expected to reach $2.1 billion by 2028, rising at a market growth of 6.4% CAGR during the forecast period.

The motion preservation devices are utilized to treat problems of the spine. These devices are used to help maintain or restore the spine's normal alignment. Unlike spinal fusion, although, motion preservation devices help to keep the spine's natural motion. Artificial discs and dynamic stabilization devices are two forms of motion preservation devices. Preserving spinal motion, eliminating the requirement for revision recovery, short recovery time, and technological advancement are all features of the motion preservation device.

The stainless steel artificial disc enables normal spine rotation while also offering relief and treatment to the affected area. It aids in the restoration of spine motion, which has led to an increase in the use of such surgical devices. Total disc replacement, inter-spinous process spacers, disc nucleus replacement, posterior dynamic stabilizing devices, and facet replacement devices are four types of technology utilized to cure degenerative lumbar spine posterior motion preservation.

A lot of effort has gone into developing motion preservation and mobility recovery devices for the spine as a substitute for fusion. Over the past years, the first-generation version of these mobility restoration devices (MRDs) has hit numerous markets, and the short-term outcomes have been promising. Compliant mechanisms have several characteristics that make them ideal for motion preservation devices as they produce motion through the deflection of adaptable members rather than conventional articulated elements, they are small, high-accuracy devices capable of complex force-displacement profiles, and they produce little or no wear.

The COVID-19 Impact on the motion preservation devices market is still unfavorable, owing to a decrease in open spine surgical procedures, which has resulted in a decrease in demand for motion preservation devices used in spinal surgeries. As per a study released in the British Journal of Surgery, about 28.4 million elective procedures were canceled or postponed all across the world in May 2020, based on 12 weeks of high interruption to hospital services owing to COVID-19. This pandemic has had a significant impact on the motion preservation device market's comprehensive growth.

The benefit of motion preservation devices over typical spinal fusion treatments is the number of function that the motion preservation device provides in comparison to spinal fusion method. Artificial discs try to restore or retain the natural motion of the human spine, whereas fusion procedures restrict motion nearly entirely. When offered the alternative between a fusion and a motion-preserving device, evaluations have indicated that patients prefer motion-preserving devices over fusions. As a result of the growing patient demand for motion preservation, the number of spinal fusions procedure is predicted to decrease.

Revision surgery is the procedure used to substitute or compensate for a failing implant, such as in the spine, or to remedy unfavorable surgical outcomes. The most common complaint of spinal fusion is that revision surgery is frequently required. For example, according to medical evaluation, fusing a level increases the risk of adjacent levels developing degenerative disc disease (DDD). This isn't a worry with motion preservation techniques. A fusion is not required for every patient with degenerative disc disease.

Despite laser spine surgery being marketed to patients as a less invasive surgical option with a quicker recovery time, it can only be used to treat a limited number of spine disorders. This is because the laser is less exact than a typical instrument; it cannot be used for difficult surgical procedures. The laser, if not used properly, can harm the patient's nerve roots. Laser spine surgery, unlike other surgeries, does not require the assistance of a spine surgeon. There are several reasons due to why difficulties in a complex surgery arises like less education in surgery and the acquisition of surgical skills, adverse events in surgery, poor quality in surgical care, the unethical behavior of surgeons.

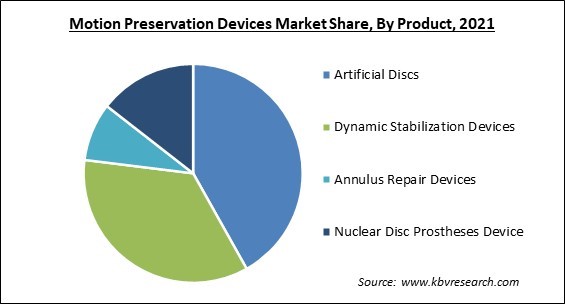

On the basis of the Product, the motion preservation devices market is divided into Artificial Discs, Dynamic Stabilization Devices, Annulus Repair Devices, and Nuclear Disc Prostheses devices. The Dynamic Stabilization Devices segment garnered a significant revenue share in the motion preservation devices market in 2021. These devices are a relatively new addition to the arsenal of the modern spine surgeon. DSDs include pedicle-based dynamic rod devices and posterior interspinous process spacers. The devices are used to treat lumbar (low back) degenerative disc degeneration that is causing symptoms.

Based on the Surgery, the motion preservation devices market is bifurcated into Open Spine Surgery and Minimally Invasive Spine Surgery. The Minimally Invasive Spine Surgery segment garnered a significant revenue share in the motion preservation devices market in 2021. The purpose of the minimally invasive spine (MIS) surgery is to stabilize the vertebral bones and joints, as well as relieve pressure on the spinal nerves, which is typically caused by disorders including spinal instability, bone spurs, and ruptured discs, scoliosis, or malignancies.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.4 Billion |

| Market size forecast in 2028 | USD 2.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.4% from 2022 to 2028 |

| Number of Pages | 168 |

| Number of Tables | 259 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Surgery, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By Region, the motion preservation devices market is analyzed in North America, Europe, Asia Pacific, and LAMEA. North America emerged as the leading segment in the motion preservation devices market with the largest revenue share in 2021. A wide range of mobility preservation devices has been approved in North America for the treatment of various spine injuries. A large increase in the occurrence of spine injuries in the United States as well as the product releases and approvals for motion preservation devices is expected to grow the motion preservation devices market in the forecast period.

Free Valuable Insights: Global Motion Preservation Devices Market size to reach USD 2.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Johnson & Johnson (DePuy Synthes), B. Braun Melsungen AG, Globus Medical, Inc., Zimmer Biomet Holdings, Inc., Orthofix Medical, Inc. (Spinal Kinetics, LLC), Aurora Spine Corporation, HPI Implants, RTI Surgical, Inc., Ulrich GmbH & Co. KG

By Product

By Surgery

By Geography

The global motion preservation devices market size is expected to reach $2.1 billion by 2028.

Maintaining the Spinal Motion are driving the market in coming years, however, Removes the Capacity to Carry Out Difficult Surgical Treatments limited the growth of the market.

Johnson & Johnson (DePuy Synthes), B. Braun Melsungen AG, Globus Medical, Inc., Zimmer Biomet Holdings, Inc., Orthofix Medical, Inc. (Spinal Kinetics, LLC), Aurora Spine Corporation, HPI Implants, RTI Surgical, Inc., Ulrich GmbH & Co. KG.

The expected CAGR of the motion preservation devices market is 6.4% from 2022 to 2028.

North America region acquired maximum revenue share in the Global Motion Preservation Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $748.7 Million by 2028.

The Open Spine Surgery market is leading the Global Motion Preservation Devices Market by Surgery in 2021, thereby, achieving a market value of $1.4 Billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.