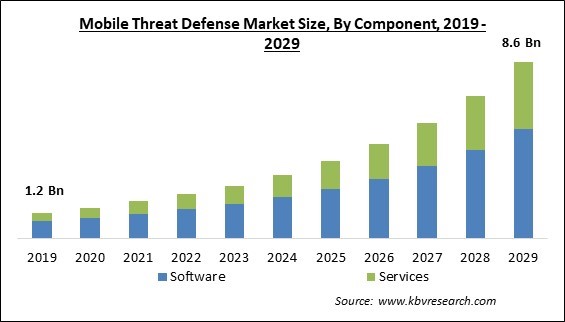

The Global Mobile Threat Defense Market size is expected to reach $8.6 billion by 2029, rising at a market growth of 22.3% CAGR during the forecast period.

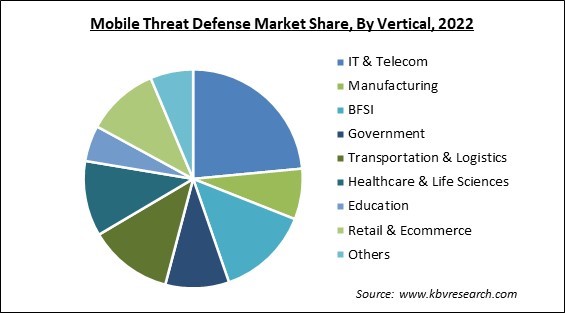

IT & telecom is the largest vertical for Mobile Threat Defense due to the usage of mobile devices, desktop computers, and laptops storing vital information, documents, passwords, and other information. MTD provides many advantages to the IT and telecom sectors, including cost savings, strong security, and quick reaction to cyber attackers. With cutting-edge security features like user alert notifications, threat detection, device encryption, mobile malware protection, etc., MTD solutions are made to combat serious cyberattacks on mobile devices. Hence, IT & Telecom is expected to contribute approximately 1/5th share of the market by 2029.

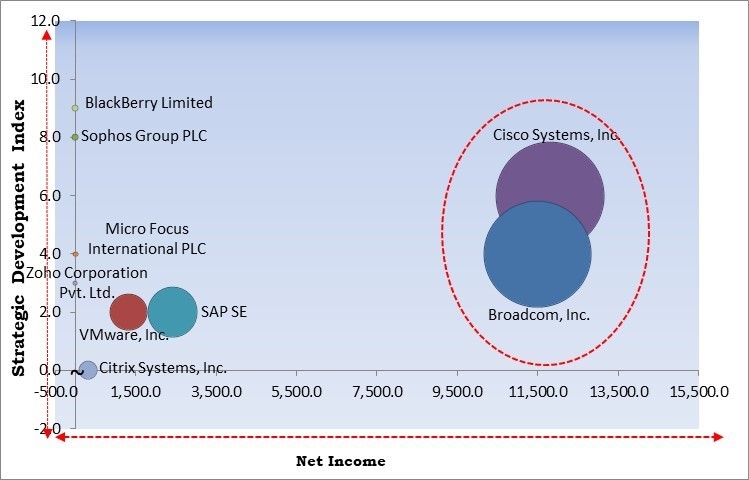

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. and Broadcom, Inc. are the major forerunner in the Market. In April, 2023, Cisco launched the new XDR solution and the advanced features for Duo MFA for helping organizations better protect the integrity of their complete IT ecosystem. Cisco continues to maintain "if it's connected, you're also protected" by enabling security operations teams to respond to attacks and eliminate them before they have a chance to cause major harm. Companies such as BlackBerry Limited, Sophos Group PLC, SAP SE are some of the key innovators in Market.

Both individual mobile devices and operating systems (OS) can incorporate the mobile solution into their workflows. Enterprise Mobility Management (EMM) refers to managing security solutions installed on an operating system. In contrast, Mobile Threat Management (MTM) refers to managing security solutions installed on mobile devices. The deployment of EMM, in conjunction with MTM, provides access to a plethora of extra functions, some of which include device configuration and management, real-time device monitoring, GPS tracking, and so on. In addition, one-third of firms located in various locations are currently utilizing EMM and further planning to install MTM solution technology in the forthcoming years, fueling the market's growth.

Employees utilize the company's network during working hours and while using a device outside of the company's premises. As a direct consequence of this, there is an increased demand to keep the secrecy of corporate and financial data in remote locations while also ensuring its safety. Companies should implement a security system that can differentiate between data belonging to the firm and employees' personal information. When hackers target user payment information, audio, and video files, individual users also experience data loss. Additionally, businesses are focusing on the security and privacy of mobile devices and network infrastructure, which will propel the growth of the market.

Cybercriminals can now more easily attack any town, agency, or department of any country due to the internet. Malware outbreaks and ransomware assaults are easily targeted against countries with advanced IT infrastructure. Because of this, hackers attempt to access unprepared government employees using malware, email phishing schemes, or stolen credentials to steal sensitive data from the government or lock down vital systems required for providing services and operations. The market growth is expected to hinder as many individuals aren't aware of the hazards to mobile devices and the security solutions available to protect them.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on component, the market is segmented into software and services. The software segment dominated the market with maximum revenue share in 2022. This is because mobile-based threat defense software is gaining popularity rapidly as it provides cutting-edge security features like tracking device performance, app updates, alert sharing for potential threats, and improved visibility into users' mobile devices. The characteristics mentioned above and the fact that MTD software is integrated with strong data privacy requirements are anticipated to boost the segment during the projected period.

On the basis of operating system, the market is divided into android, iOS, windows and others. The iOS segment procured a substantial revenue share in the market in 2022. This is owing to the increasing demand for iOS devices, such as iPhones and iPads. Advanced security features, regular updates, threat alerts, configuration control, and data protection are all provided by MTD solutions for iOS devices. These features enable consistent device administration and rapid configuration and update of every device. Thus, the following factors are anticipated to fuel the demand for the market in the iOS segment.

By deployment model, the market is classified into cloud and on-premise. The cloud segment witnessed the largest revenue share in the market in 2022. This is because cloud-based mobile threat defense systems are controlled by servers located in the cloud. Mobile users can access MTD via the internet through a web-based application; it does not need to be installed on users' devices to function; rather, it can be accessed through special user login credentials. The advantages of cloud-based MTD include cost effectiveness, accessibility, scalability, and increased security features because it allows customers to choose the best plan based on their needs. As a result, such characteristics are anticipated to fuel demand for the segment.

Based on the enterprise size, the market is bifurcated into small and medium-sized enterprises (SMEs) and large enterprises. The small and medium-sized enterprises (SMEs) segment recorded a significant revenue share in the market in 2022. This is because as cyberattacks increasingly target customers' systems and software, this results in significant IT spending because it necessitates ongoing monitoring, specialized personnel, and sophisticated equipment that small and medium-sized businesses might be unable to pay.

On the basis of vertical, the market is classified into BFSI, IT & telecom, retail & e-commerce, healthcare & life sciences, education, transportation & logistics, manufacturing, government and others. The retail & e-commerce segment procured a considerable growth rate in the market in 2022. This is because the retail sector's expanding consumer base needs regular communication over mobile phones with clients, customers, and manufacturers. Similarly, the expanding promotional, online-shopping, and advertisement activities collect a lot of information and consumer data on the workforce's mobile devices.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.1 Billion |

| Market size forecast in 2029 | USD 8.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 22.3% from 2023 to 2029 |

| Number of Pages | 342 |

| Number of Table | 573 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Operating System, Deployment Model, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated the highest revenue share in the market in 2022. This is due to the steady rise in smartphone penetration, the Bring Your Own Device (BYOD) trend, the requirement for data security, and hybrid and work-from-home business regulations, which are the main drivers of North America's market. Furthermore, several important players dominate the region. These businesses provide a wide variety of MTD solutions with strong cyber security capabilities like threat intelligence, application management, security management, system monitoring, and system update, aiding the market growth in the region.

Free Valuable Insights: Global Mobile Threat Defense Market size to reach USD 8.6 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., SAP SE, Broadcom, Inc., VMware, Inc., Citrix Systems, Inc. (Cloud Software Group, Inc.), Micro Focus International PLC (Open Text Corporation), Zoho Corporation Pvt. Ltd., SolarWinds Corporation, Sophos Group PLC (Thoma Bravo) and BlackBerry Limited.

By Component

By Operating System

By Deployment Model

By Organization Size

By Vertical

By Geography

The Market size is projected to reach USD 8.6 billion by 2029.

Increased adoption of EMM and MTM in the market are driving the Market in coming years, however, Lack of understanding of cyber security and potential for growth obstruction restraints the growth of the Market.

Cisco Systems, Inc., SAP SE, Broadcom, Inc., VMware, Inc., Citrix Systems, Inc. (Cloud Software Group, Inc.), Micro Focus International PLC (Open Text Corporation), Zoho Corporation Pvt. Ltd., SolarWinds Corporation, Sophos Group PLC (Thoma Bravo) and BlackBerry Limited.

The Android segment acquired maximum revenue share in the Market by Operating System in 2022 thereby, achieving a market value of $4.1 billion by 2029.

The Large Enterprises segment is leading the Market by Organization Size in 2022 thereby, achieving a market value of $5.1 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $2,878.7 million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.