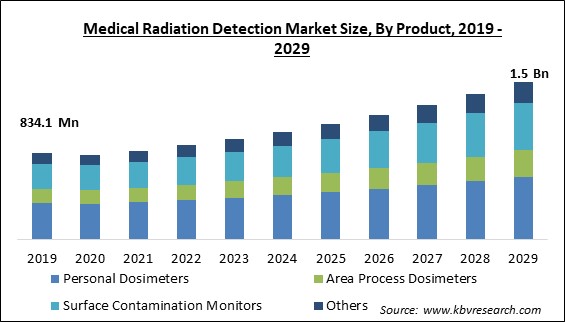

The Global Medical Radiation Detection Market size is expected to reach $1.5 billion by 2029, rising at a market growth of 7.7% CAGR during the forecast period.

A medical device that finds radiation is called a medical radiation detector. An individual is more likely to develop several lethal diseases when exposed to radiation over a long period. The need for technology that can gauge how much radiation is building up inside the body grows. The radiation portal monitor (RPM), handheld survey meter (HSM), personal radiation detector (PRD), and radiation isotope identification device (RIID) are a few of the important detectors for spotting radioactive materials and ionizing radiation.

As technology develops, a variety of radiation-detecting tools might be made accessible for use at home. Gamma rays are the most hazardous external radioactive threat, and dosimeters are medical radiation detectors that can find them. Radiation in various forms is utilized for both medical diagnosis and treatment. However, exposure must be carefully managed to ensure that the benefits to patients outweigh the hazards because all types have the potential to be hazardous.

Radiation monitoring technology is in greater demand as more nuclear power plants are built worldwide. These power plants' byproducts can be applied to the healthcare sector. Hospitals also support the building of diagnostic imaging equipment by using medicinal isotopes supplied to patients.

The majority of the dose a person receives from man-made radiation sources comes from X-ray diagnostics and therapies using radioisotopes in oncology and some other critical disorders. Additionally being used are the future radioactive element-based diagnostic and treatment techniques. Radiation (radioisotope) therapy is still one of the main methods used to treat cancer. Market vendors are supplying personal dosimeters and automated systems for personal dosage control to lessen the harmful effects of radiation on the staff of healthcare facilities. Manufacturers and researchers are incorporating innovative technology into their goods to maintain their position as market leaders.

The pandemic has changed how diagnostic imaging tests are carried out. Numerous healthcare facilities have implemented new policies to lower the danger of COVID-19 transmission, like adopting portable X-ray machines and reducing the number of healthcare staff in the room while imaging is done. These alterations have increased the demand for mobile and handheld medical radiation detection tools that can be applied in various circumstances. In light of these elements, the medical radiation detection market has significantly benefited from the widespread of COVID-19.

The treatment, detection, and prevention of different cancers have made significant strides in recent years. Cancer is treated using surgery, chemotherapy, radiation, and biological and hormonal therapy. Doxorubicin is a frequently prescribed chemotherapy medication that is used to treat several tumor types. Oxidative stress has an impact on the kidney, heart, and brain. Chemotherapy drug resistance in metastatic breast cancer is still a problem for effective treatment. As a result, this element is fueling the medical radiation detection market.

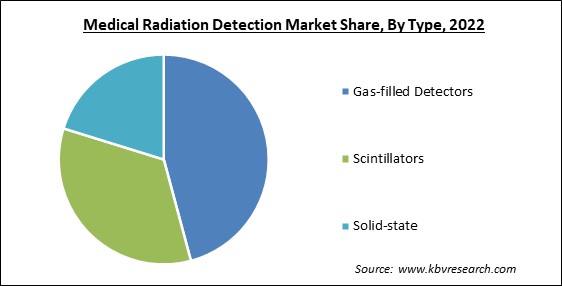

Instrumentation, and IT, nuclear medicine procedures have drastically changed over the past ten years. The need for radiation detection, monitoring, and safety systems has increased due to the growing use of nuclear medicine in diagnosing and treating many diseases, including cancer and cardiovascular ailments. Gas-filled detectors, scintillation detectors, and semiconductor detectors are the different types used in nuclear medicine. In light of these factors, the growing usage of radiation therapy and nuclear medicine is predicted to support the market expansion.

The Nuclear Regulatory Commission (NRC), National Council on Radiation Protection (NCRP), Food and Drug Administration (FDA), International Commission on Radiological Protection (ICRP), and the US Department of Energy (DOE) have established radiation protection standards that are recognized by the national authorities. In addition, these departments have established multiple protocols to approve medical radiation identification, monitoring, and safety products. Nevertheless, these rigorous regulations prolong the duration of the product approval procedure. Hence, with the strict safety regulations which can delay product launches and development are expected to hamper the market expansion.

Based on type, the medical radiation detection market is characterized into gas-filled detectors, scintillators, and solid-state. The solid-state segment covered a considerable revenue share in the medical radiation detection market in 2022. Ionizing radiation can be found using solid-state detectors, which are quite effective since they can turn a significant part of incident radiation into an electrical signal. They can accurately detect radiation at very low levels due to this. For instance, the U.S. Nuclear Regulatory Commission asserts that solid-state detectors are superior to gas-filled detectors at identifying low-energy gamma rays.

On the basis of product, the medical radiation detection market is classified into personal dosimeters, area process dosimeters, surface contamination monitors, and others. In 2022, the personal dosimeters segment witnessed the largest revenue share in the medical radiation detection market. Because of its qualities, including being portable and simple to use, personal dosimeters are growing in popularity. Workers working in areas where radiation exposure poses a concern have their exposure levels monitored by personal dosimeters.

By end-use, the medical radiation detection market is divided into hospitals, ambulatory surgical centers, diagnostic imaging centers, and homecare. In 2022, the hospitals segment dominated the medical radiation detection market with the maximum revenue share. There is a rising need for medical imaging treatments like CT scans, X-rays, and PET scans. This is due to the growing elderly population and the rise in chronic diseases. Medical radiation detectors are crucial in these operations to ensure patients receive the proper dose of radiation and to guard against overexposure.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 915.3 Million |

| Market size forecast in 2029 | USD 1.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.7% from 2023 to 2029 |

| Number of Pages | 214 |

| Number of Table | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the medical radiation detection market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the medical radiation detection market by generating the highest revenue share. This can be due to rising anxiety around the dangers that could be involved with being exposed to ionizing radiation during medical treatments. As a result, radiation safety is receiving increased attention from regulatory agencies and medical establishments. This has increased the need for medical radiation detectors to measure radiation levels correctly and improve patient safety.

Free Valuable Insights: Global Medical Radiation Detection Market size to reach USD 1.5 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBA Dosimetry GmbH, Mirion Technologies, Inc., Thermo Fisher Scientific, Inc., LANDAUER (Fortive Corporation), Polimaster Europe UAB, PTW Freiburg GmbH, ATOMTEX, Radiation Detection Company, MP Biomedicals, LLC (Valiant Co. Ltd), and Amray Group Ltd.

By Product

By Type

By End Use

By Geography

The Market size is projected to reach USD 1.5 billion by 2029.

Rising cases of cancer across the globe are driving the Market in coming years, however, Strict regulatory mandates restraints the growth of the Market.

IBA Dosimetry GmbH, Mirion Technologies, Inc., Thermo Fisher Scientific, Inc., LANDAUER (Fortive Corporation), Polimaster Europe UAB, PTW Freiburg GmbH, ATOMTEX, Radiation Detection Company, MP Biomedicals, LLC (Valiant Co. Ltd), and Amray Group Ltd.

The expected CAGR of this Market is 7.7% from 2023 to 2029.

The Gas-filled Detectors segment is leading the Global Medical Radiation Detection Market by Type in 2022 thereby, achieving a market value of $678.9 million by 2029.

The North America market dominated the Global Medical Radiation Detection Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $554.5 million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.