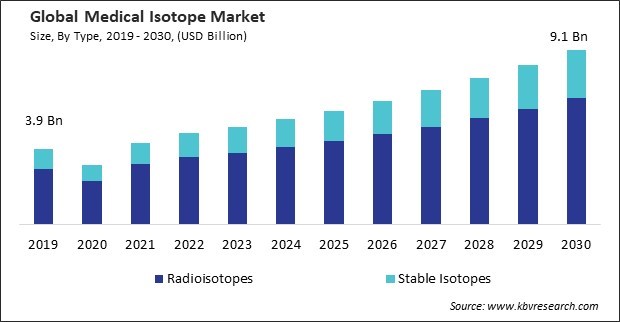

The Global Medical Isotope Market size is expected to reach $9.1 billion by 2030, rising at a market growth of 8.6% CAGR during the forecast period.

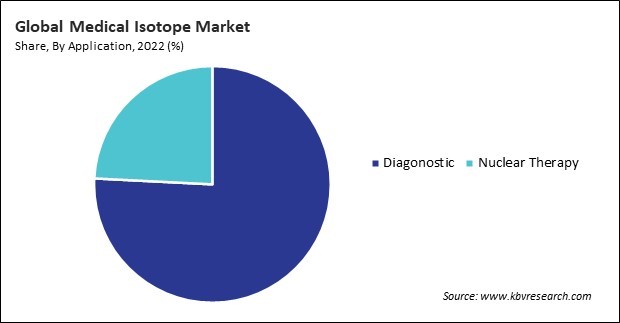

The development of new therapeutic radiopharmaceuticals and expanded clinical indications for existing isotopes has led to a growing number of therapeutic procedures in nuclear medicine. Consequently, the nuclear therapy segment would generate approximately 24.2 % share of the market by 2030. Research and clinical trials continue to explore the efficacy and safety of isotopic therapies for a wide range of medical conditions, including bone metastases, neuroendocrine tumors, thyroid disorders, and hematological malignancies.

Nuclear medicine imaging technology advances have significantly improved image quality, resolution, and sensitivity. High-resolution imaging systems, such as PET/CT and SPECT/CT scanners, provide detailed anatomical and functional information, allowing healthcare professionals to visualize physiological processes at the molecular level with exceptional clarity. Therefore, advancements in nuclear medicine imaging techniques drive the market’s growth.

Additionally, Cancer and cardiovascular diseases often require comprehensive diagnostic evaluation to assess disease extent, stage, and progression. Medical isotopes, such as technetium-99m (Tc-99m) and fluorine-18 (F-18), are widely used in nuclear medicine imaging techniques such as PET and single-photon emission computed tomography (SPECT) to visualize physiological processes and identify disease-related abnormalities. Therefore, the rising cases of cancer and cardiovascular diseases are driving the growth of the market.

However, Many radioisotopes used in nuclear medicine imaging and therapy are produced in nuclear reactors, which require highly specialized infrastructure and regulatory oversight. Radioisotope availability depends on the operational status of nuclear reactors, which may be subject to maintenance shutdowns, regulatory inspections, and safety protocols. Hence, the limited availability of radioisotopes is hampering the market’s growth.

Furthermore, Restrictions on travel, lockdown measures, and reduced staffing at nuclear reactors and isotope production facilities led to delays and shortages in the availability of medical isotopes, impacting patient care and diagnostic procedures. During the peak of the pandemic, many non-essential medical procedures, including diagnostic imaging and nuclear medicine scans, were postponed, or canceled to prioritize resources for COVID-19 patients. Thus, the COVID-19 pandemic had a negative impact on the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges Based on end user, the market is categorized into hospitals, diagnostic centers, and research institutes. The diagnostic centers segment witnessed a 28.92 % revenue share in the market in 2022. Diagnostic centers facilitate multidisciplinary collaboration among healthcare professionals, including radiologists, nuclear medicine physicians, oncologists, surgeons, and medical physicists. Diagnostic centers are hubs for collaboration and communication, fostering teamwork and care coordination across different specialties.

Based on application, the market is bifurcated into diagnostic and nuclear therapy. The diagnostic segment attained the 75.79 % revenue share in the market in 2022. Diagnostic imaging plays a crucial role in the early detection and diagnosis of various medical conditions, including cancer, cardiovascular diseases, neurological disorders, and musculoskeletal injuries. Medical isotopes enable the development of highly sensitive and specific imaging techniques that facilitate the early detection of abnormalities and disease processes at the cellular and molecular levels.

On the basis of type, the market is segmented into stable isotopes and radioisotopes. The radioisotopes segment recorded the 73.57 % revenue share in the market in 2022. Radioisotopes, drugs, or compounds labeled with radioactive isotopes for diagnostic purposes are essential for radiopharmaceuticals. Radioisotopes such as technetium-99m (Tc-99m), gallium-68 (Ga-68), and copper-64 (Cu-64) are commonly incorporated into radiopharmaceutical formulations for clinical use. Hence, higher demand for radiopharmaceuticals is driving the growth of the segment.

Free Valuable Insights: Global Medical Isotope Market size to reach USD 9.1 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region generated a 26.87 % revenue share in the market. The Asia Pacific region is experiencing a rise in the incidence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions. As the burden of disease increases, there is a greater need for early detection, accurate diagnosis, and effective treatment options, driving demand for diagnostic imaging studies and therapeutic interventions using medical isotopes.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.8 Billion |

| Market size forecast in 2030 | USD 9.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 8.6% from 2023 to 2030 |

| Number of Pages | 202 |

| Number of Tables | 330 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Application, End User, Region |

| Country scope |

|

| Companies Included | Mallinckrodt PLC, Bayer AG, GE HealthCare Technologies, Inc. , Canadian Nuclear Laboratories (Atomic Energy Of Canada Limited), ITM Isotope Technologies Munich SE , Siemens Healthineers AG , Eczacibasi-Monrol , NorthStar Medical Radioisotopes, LLC , Nordion Inc. (Sotera Health LLC), Iba SA |

By Type

By End User

By Application

By Geography

This Market size is expected to reach $9.1 billion by 2030.

Advancements In Nuclear Medicine Imaging Techniques are driving the Market in coming years, however, Limited Availability Of Radioisotopes restraints the growth of the Market.

Mallinckrodt PLC, Bayer AG, GE HealthCare Technologies, Inc. , Canadian Nuclear Laboratories (Atomic Energy Of Canada Limited), ITM Isotope Technologies Munich SE , Siemens Healthineers AG , Eczacibasi-Monrol , NorthStar Medical Radioisotopes, LLC , Nordion Inc. (Sotera Health LLC), Iba SA

The expected CAGR of this Market is 8.6% from 2023 to 2030.

The Hospitals segment is leading the Market by End User in 2022 there by, achieving a market value of $4.7 billion by 2030.

The North America region dominated the Market by Region in 2022 there by, achieving a market value of $3.2 billion by 2030, growing at a CAGR of 7.8 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.