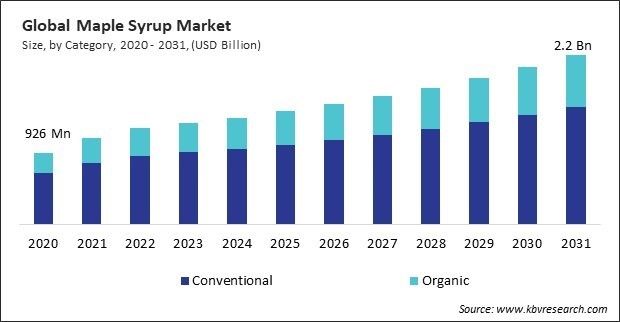

The Global Maple Syrup Market size is expected to reach $2.2 billion by 2031, rising at a market growth of 6.8% CAGR during the forecast period. In the year 2023, the market attained a volume of 89,764.6 Tonnes, experiencing a growth of 13.8% (2020-2023).

The demand for maple syrup in North America is driven by its natural origin and perceived health benefits as people become more health-conscious and look for healthier alternatives to refined sugars and artificial sweeteners. Therefore, the North American region captured $550.4 million revenue in the market in 2023. In North America, consumer demand and adoption are driven by growing awareness of its health benefits, such as its high antioxidant, vitamin, and mineral content. Moreover, total consumption of this syrup in Canada was 8,561.0 Tonnes in 2023.

Maple syrup is perceived as a natural sweetener, free from artificial additives and preservatives. As consumers increasingly seek healthier alternatives to refined sugars and artificial sweeteners, its natural sweetness has gained popularity. According to the glycemic index, this raises blood sugar levels more slowly and steadily than white sugar. Therefore, the market is expanding significantly due to the rising health and nutritional benefits.

Additionally, innovations in processing techniques, such as vacuum evaporation and flash evaporation, have enabled these producers to extend the shelf life of their products without the need for added preservatives. This ensures product freshness and quality over a longer period, reducing waste and increasing consumer satisfaction. Thus, because of the innovations in processing and packaging, the market is anticipated to increase significantly.

However, maple syrup production is highly sensitive to climate conditions, particularly temperature fluctuations and weather patterns during the spring-tapping season. The disruption of sap flow, reduction of syrup yields, and lengthening of the maple sugaring season due to temperature and precipitation patterns caused by climate change can place production volumes and supply availability at risk. Therefore, environmental and sustainability concerns are a significant challenge that hampers the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges By category, the market is bifurcated into organic and conventional. In 2023, the conventional segment witnessed 71.1% revenue share in the market. Conventional products are typically more accessible and affordable than their organic counterparts. This makes them appealing to a larger segment of consumers, including budget-conscious shoppers and those who may not prioritize organic certification but still enjoy this as a sweetener or flavoring. Moreover, in terms of volume, the conventional segment registered 67,958.8 Tonnes in the market in 2023.

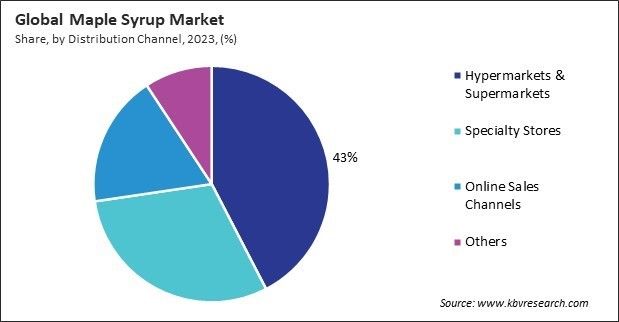

Based on distribution channel, the market is categorized into hypermarkets & supermarkets, specialty stores, online sales channels, and others. The online sales channels segment garnered 18.1% revenue share in the market in 2023. Online sales channels offer ample opportunities for promotional activities, including discounts, coupons, and limited time offers, to attract and incentivize consumers to purchase these products. Moreover, in terms of volume, the online sales channels segment sold 19,290.4 Tonnes of maple syrup in 2023.

On the basis of source, the market is segmented into sugar maple, black maple, and red maple. In 2023, the sugar maple segment held 53.8% revenue share in the market. These producers maintain the long-term health and production of maple forests by managing sugar maple trees sustainably. Moreover, in terms of volume, the sugar maple segment recorded 54,442.2 Tonnes in 2023.

Free Valuable Insights: Global Maple Syrup Market size to reach USD 2.2 billion by 2031

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region acquired 25.2% revenue share in the market. This can be introduced to Asian consumers through culinary exploration and education. The region has seen a growing interest in health and wellness trends, including a preference for natural and organic ingredients. Moreover, in terms of volume, the China consumed 6,924.45 Tonnes Maple Syrup in 2022.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.3 Billion |

| Market size forecast in 2031 | USD 2.2 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 6.8% from 2024 to 2031 |

| Quantitative Data | Volume in Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 318 |

| Number of Tables | 689 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Category, Source, Distribution Channel, Region |

| Country scope |

|

| Companies Included | B&G Foods, Inc., Vermont Pleasant Valley Maples, Ferguson Farm Vermont Maple Syrup, Butternut Mountain Farm, Coombs Family Farms, Maple Joe (Famille Michaud Apiculteurs), Golden Dog Farm LLC, Judd’s Wayeeses Farms, Anderson’s Maple Syrup, Inc. |

By Category (Volume, Tonnes, USD Billion, 2020-2031)

By Distribution Channel (Volume, Tonnes, USD Billion, 2020-2031)

By Source (Volume, Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Tonnes, USD Billion, 2020-2031)

This Market size is expected to reach $2.2 billion by 2031.

Rising health and nutritional benefits are driving the Market in coming years, however, Regulatory compliance and quality standards restraints the growth of the Market.

B&G Foods, Inc., Vermont Pleasant Valley Maples, Ferguson Farm Vermont Maple Syrup, Butternut Mountain Farm, Coombs Family Farms, Maple Joe (Famille Michaud Apiculteurs), Golden Dog Farm LLC, Judd’s Wayeeses Farms, Anderson’s Maple Syrup, Inc.

In the year 2023, the market attained a volume of 89,764.6 Tonnes, experiencing a growth of 13.8% (2020-2023).

The Hypermarkets & Supermarkets segment is generating highest revenue in the Market by Distribution Channel in 2023; thereby, achieving a market value of $904.6 million by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $879.3 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.