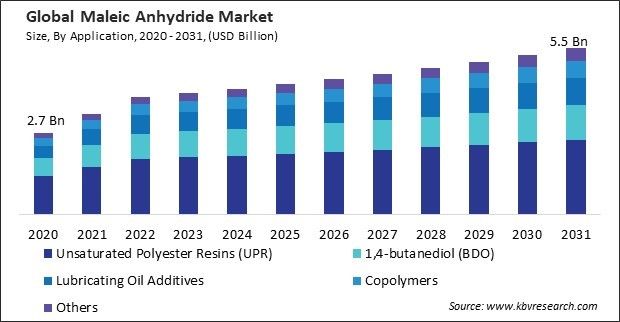

The Global Maleic Anhydride Market size is expected to reach $5.5 billion by 2031, rising at a market growth of 4.1% CAGR during the forecast period. In the year 2023, the market attained a volume of 3240.0 Kilo Tonnes, experiencing a growth of 19.1% (2020-2023).

Maleic anhydride copolymers are widely used in adhesive formulations for bonding substrates such as metals, plastics, wood, and composites. Therefore, the copolymers segment would generate around 10.24% revenue share of the market by 2031. Also, Russia utilized 118.59 Kilo Tonnes of Maleic Anhydride in the market in 2023. They provide excellent adhesion, cohesion, and compatibility with different materials, enhancing the performance and durability of adhesive bonds in the construction, automotive, packaging, and consumer goods industries.

Maleic anhydride is one of the primary raw materials used to synthesize UPR. UPR is a versatile thermosetting polymer widely used in various applications such as fiberglass-reinforced plastics (FRP), composite materials, automotive parts, marine components, construction materials, and consumer goods. Industries such as construction, automotive, marine, aerospace, and electrical industries heavily rely on UPR-based products due to their excellent mechanical properties, corrosion resistance, durability, and cost-effectiveness. Thus, rising demand for unsaturated polyester resins (UPR) drives the market’s growth.

Additionally, Maleic anhydride derivatives, such as maleic anhydride esters, are used as lubricant additives to enhance the lubricating properties of base oils. These additives help reduce friction, wear, and heat generation in mechanical systems, improving equipment efficiency, reliability, and lifespan. Maleic anhydride-based additives act as effective anti-wear and extreme pressure agents in lubricants, protecting metal surfaces under high load and temperature conditions. Therefore, increasing demand for maleic anhydride in lubricant additives propels the market’s growth.

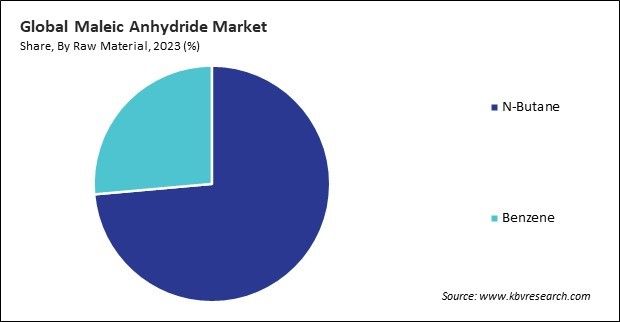

However, the primary feedstocks for maleic anhydride production, such as butane and benzene, are derived from petroleum refining processes. The availability of these feedstocks depends on factors such as crude oil prices, refinery capacity, and geopolitical factors affecting oil production and supply. Any disruption in the supply chain of petrochemical feedstocks can affect the availability and cost of raw materials for maleic anhydride production. In conclusion, the limited availability of raw materials hinders the market’s growth.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges Based on raw material, the market is divided into n-butane and benzene. In 2023, the benzene segment attained a 26.4% revenue share in the market. In terms of Volume, UK market used 37.05 Kilo Tonnes of benzene as raw material in the market in 2023. Benzene exhibits favorable chemical reactivity, making it suitable for synthesizing maleic anhydride through catalytic oxidation. Benzene serves as a precursor in the reaction sequence, undergoing oxidation to form maleic anhydride in the presence of catalysts such as vanadium pentoxide or molybdenum oxide.

On the basis of application, the market is segmented into unsaturated polyester resins (UPR), 1,4-butanediol (BDO), lubricating oil additives, copolymers, and others. The unsaturated polyester resins (UPR) segment recorded a 47.1% revenue share in the market in 2023. In terms of Volume, the UK market utilized 61.55 Kilo Tonnes of maleic anhydride in Unsaturated Polyester Resins (UPR) in 2023. UPRs are versatile materials in various applications, including construction, automotive, marine, aerospace, electrical, and consumer goods industries. They are used to produce fiberglass-reinforced plastic (FRP) composites for various components such as panels, pipes, tanks, boats, automotive parts, and wind turbine blades.

Free Valuable Insights: Global Maleic Anhydride Market size to reach USD 5.5 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated a 19.5% revenue share in the market in 2023. In terms of volume, North America used 611.2 Kilo Tonnes of Maleic anhydride in 2023. North America is home to several key industries that are major consumers of maleic anhydride, including automotive, construction, aerospace, electronics, and chemical manufacturing. These industries require maleic anhydride for various applications, such as unsaturated polyester resins (UPR), lubricant additives, coatings, adhesives, and specialty polymers.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 4 Billion |

| Market size forecast in 2031 | USD 5.5 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 4.1% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 266 |

| Number of Tables | 530 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Raw Material, Application, Region |

| Country scope |

|

| Companies Included | Huntsman Corporation, Mitsubishi Chemical Holdings Corporation, Lanxess AG, Nan Ya Plastics Corp. (NPC), Nippon Shokubai Co., Ltd., IG Petrochemicals Limited (IGPL), China National BlueStar (Group) Co, Ltd. (China National Chemical Corporation), Yongsan Chemical Co., Ltd., Aekyung Chemical Co., Ltd. (AK Holdings Co., Ltd.), Ningbo Jiangning Chemical Co., Ltd. (Zhejiang Jiangshan Chemical Co., Ltd.) |

By Raw Material (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.