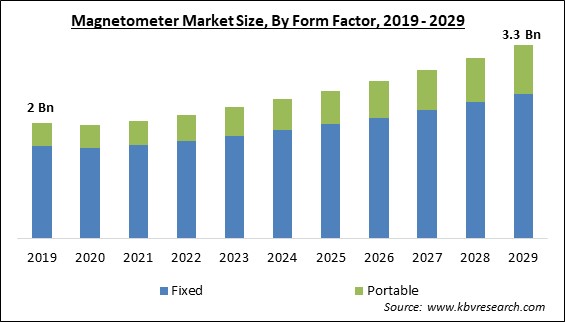

The Global Magnetometer Market size is expected to reach $3.3 billion by 2029, rising at a market growth of 6.8% CAGR during the forecast period.

A magnetometer is a tool utilized in various industries to quantify the intensity, orientation, and direction of a magnetic field. It has diverse applications across industries, including geology, navigation, mineral exploration, archaeology, and aerospace. In addition, magnetometers are utilized in commercial electronics, like smartphones and laptops, to identify device orientation and offer location services.

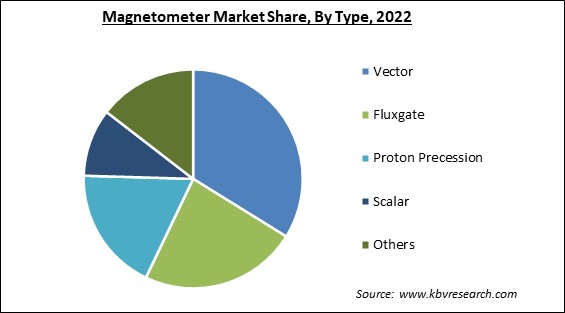

There exists a range of magnetometers with distinct pros. Fluxgate magnetometers and proton precession magnetometers are two types of instruments used to measure changes in magnetic fields. Fluxgate magnetometers utilize a ferromagnetic core, while proton precession magnetometers rely on the frequency of processing protons. Optically pumped magnetometers, magnetoresistive sensors, and SQUID magnetometers are other types of magnetometer options for gaussmeters.

Magnetometers have become increasingly prevalent in the aviation and defense sectors. They are utilized not only for GPS monitoring and tracking but also for their ability to aid in aerial investigation and mapping when integrated into UAVs. In addition, the continuous technological progress in the aerospace and defense industry allows manufacturers to enhance the magnetometers' performance features to meet the specific demands of their uses in these business sectors.

Customers in the aerospace and defense sectors are shifting towards utilizing three-axis magnetometers that possess exceptional variable permeability properties. This is due to their good linearity, superior noise performance, and high sensitivity. As a result, key stakeholders are eager to broaden their attention toward seizing prospects associated with the amalgamation of magnetometers and UAV technology.

The rise of alternative energy sources and electric vehicles has led to a greater demand for magnetometers in EV powertrains and wind turbines. This has aided in reducing the adverse effects of the pandemic. Moreover, the logistics and transportation industry experienced a boost in revenue during the pandemic due to the increased online sales of equipment that utilizes magnetometers. The magnetometer market experienced a decline in revenue due to the impact of COVID-19, but the market quickly rebounded as there was a surge in interest in electric vehicles.

Magnetometers offer precise measurements for various parameters, including proximity, pressure, fluid flow, position, etc. In addition, the sensor boasts various beneficial features, such as superior sensitivity, exceptional linearity, extensive field range, and minimal power usage. As a result, manufacturers are prioritizing the creation of compact 3D magnetometers with low voltage. Hence, such developments are expected to increase their adoption in various areas and propel market growth.

The advancement of adaptable magnetic sensors has captured the interest of diverse stakeholders to pursue novel prospects. The utilization of magnetometers in mobile navigation is a fast-growing application in the business industry. The inclusion of an electronic compass is essential in mobile devices, particularly smartphones and tablets. The magnetometer market is predicted to experience growth in the coming years due to the rising demand for consumer electronics globally, which has led to an increase in the use of magnetometers in the industry.

Although the shipment of magnetic sensors has increased due to their widespread use in healthcare equipment, automated vehicles, and consumer electronics, the growth rate in sales has been significantly slowed due to price erosion. Some of this can be attributed to the high competition between the ever-increasing number of sensor manufacturers. Many companies devote their research and development resources to creating low-cost alternatives to existing magnetic sensing technologies. These alternatives include sensors for position, speed, and angle manufactured using MEMS and 3D sensing technology. Consequently, the new suppliers are hesitant to enter this extremely competitive market, which will restrict market growth.

Based on type, the magnetometer market is segmented into scalar magnetometer, proton precession, fluxgate, vector magnetometer, optical pumping, and others. The scalar segment acquired a garnered a significant revenue share in the magnetometer market in 2022. This is owing to the ability of the scalar magnetometers to measure the scalar value of magnetic fields accurately. Furthermore, the increasing usage of magnetic field measurement in various scientific applications such as volcanology, geophysical exploration, environmental surveys, and weapon detection is driving the demand for this technology and aiding the segment to grow in the projected period.

By product type, the magnetometer market is fragmented into single axis, 3 axis, and 3Dimensional. The 3Dimensonal segment generated a substantial revenue share in the magnetometer market in 2022. This is due to 3D magnetometers' growing utilization in autonomous vehicles and drones. In addition, the 3D magnetometer has its application in virtual and augmented reality applications and 3D mapping and imaging. Hence, these factors associated with the 3D magnetometer segment will surge its growth in the forecasted period.

On the basis of form factor, the magnetometer market is bifurcated into portable and fixed. In 2022, the fixed segment dominated the magnetometer market with the maximum revenue share. The growth of this segment can be attributed to the rising adoption of IoT devices that are capable of mapping and monitoring the Earth's magnetic field. In addition, the increase in prominent companies' efforts to create and implement advanced space exploration and mining solutions globally has resulted in its expansion.

By application, the magnetometer market is categorized into navigation, space exploration, geophysics & mining, industrial automation and medical devices & others. The medical devices & others segment recorded a remarkable revenue share in the magnetometer market in 2022. This is because SQUID magnetometers are sensitive enough to pick up on the body's weak magnetic fields. Furthermore, these provide the possibility of a new kind of functional imaging because they are non-invasive and capable of directly observing the electrophysiological activity. Hence, magnetoencephalography's increasing use is expected to assist the segment's expansion.

Based on vertical, the magnetometer market is classified into aerospace & defense, automotive, consumer electronics, healthcare, industrial, and others. In 2022, the consumer electronics segment held the highest revenue share in the magnetometer market. This is because the magnetometer is a crucial sensor utilized in consumer electronics. The device is designed to quantify the magnitude and orientation of the magnetic field in units of Tesla. In addition, the rising demand for smart home appliances has led to growth in the magnetometer market within this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.1 Billion |

| Market size forecast in 2029 | USD 3.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 6.8% from 2023 to 2029 |

| Number of Pages | 327 |

| Number of Table | 593 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Form Factor, Type, Application, Product Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the magnetometer market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the Asia Pacific region led the magnetometer market by generating the highest revenue share. The APAC region is expected to experience growth due to the flourishing consumer electronics sector, which is in line with the rapid industrialization in emerging economies such as Japan, India, and China. The mobile phone industry is a key driver of demand in the consumer electronics segment. In addition, the healthcare industry's expansion in the area is expected to influence the market notably.

Free Valuable Insights: Global Magnetometer Market size to reach USD 3.3 Billion by 2029

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Honeywell International, Inc. are the forerunners in the Magnetometer Market. Companies such as VectorNav Technologies, LLC, Lake Shore Cryotronics, Inc. and Metrolab Technology SA are some of the key innovators in the Magnetometer Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Honeywell International, Inc., Geometrics, Inc. (OYO Corporation), Metrolab Technology SA, VectorNav Technologies, LLC, Lake Shore Cryotronics, Inc., FOERSTER Holding GmbH, Bartington Instruments Ltd., Cryogenic Limited, Marine Magnetics Corp., and GEM Systems, Inc.

By Form Factor

By Type

By Application

By Product Type

By Vertical

By Geography

The Market size is projected to reach USD 3.3 billion by 2029.

Manufacturers' increasingly focus on producing 3D magnetometers are driving the Market in coming years, however, The high level of market competition restraints the growth of the Market.

Honeywell International, Inc., Geometrics, Inc. (OYO Corporation), Metrolab Technology SA, VectorNav Technologies, LLC, Lake Shore Cryotronics, Inc., FOERSTER Holding GmbH, Bartington Instruments Ltd., Cryogenic Limited, Marine Magnetics Corp., and GEM Systems, Inc.

The Vector segment acquired maximum revenue share in the Global Magnetometer Market by Type in 2022 thereby, achieving a market value of $1 billion by 2029.

The 3 Axis segment is leading the Market by Product Type in 2022 thereby, achieving a market value of $1.7 billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $1.3 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.