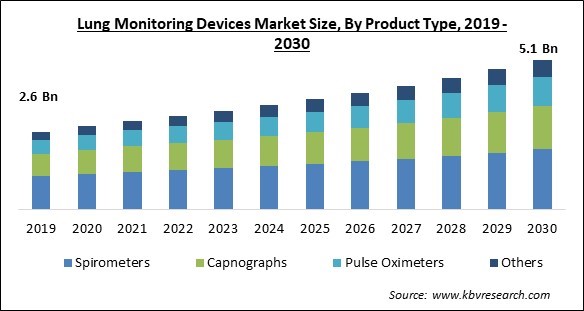

The Global Lung Monitoring Devices Market size is expected to reach $5.1 billion by 2030, rising at a market growth of 6.2% CAGR during the forecast period.

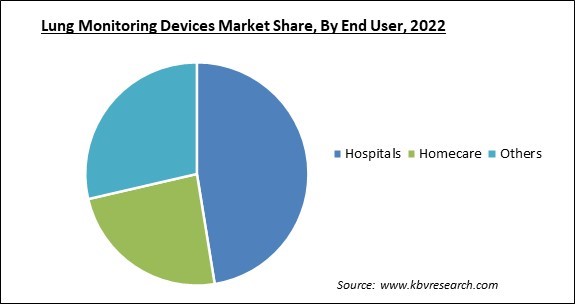

The primary factors influencing the growth of the home healthcare industry are the rapid increase in the world's senior population, the rising prevalence of various lung diseases, and the cost benefits of home care equipment and services over hospital visits. Therefore, the Homecare segment will capture around 30% share in the market by 2030. The WHO reports that people are living longer overall. The majority of people today likely plan to live until their sixties and beyond. In 2030, one in six individuals will be 60 or older. By this period, 1.4 billion people will be over the age of 60, up from 1 billion in 2020. By 2050, there will be 2.1 billion people in the globe who are 60 years of age or older. The high growth potential of developing nations, the decentralization of healthcare, and the development of miniaturized equipment are some of the key drivers that are anticipated to provide companies in the respiratory home health care sector considerable growth prospects.

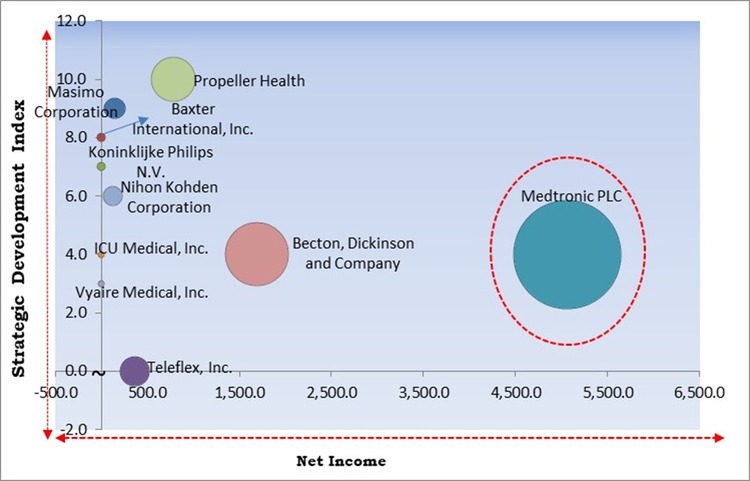

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, Philips signed an agreement with Northwell Health to support emerging technologies as they advance and grow their patient monitoring systems effectively and fast. Additionally, In January, 2023, Philips extended its partnership with Masimo for accelerating patient monitoring capabilities in home telehealth applications with Masimo W1™ advanced health tracking watch.

Based on the Analysis presented in the Cardinal matrix, Medtronic PLC is the major forerunner in the Market. In March, 2022, Medtronic partnered with Rockley Photonics to create the next generation of wearable healthcare monitoring devices. Companies such as Becton, Dickinson and Company, Nihon Kohden Corporation, and Koninklijke Philips N.V. are some of the key innovators in the Market.

The COVID-19 pandemic severely impacted the global economy. Almost all industries have been impacted by the pandemic either positively or negatively. The pandemic outbreak positively affected the market. It can be understood that the COVID-19 virus mostly affects the respiratory system and COVID-19 had weaken the lungs and immunity in patients, making them susceptible to viral infections and lung diseases which led to a significant increase in demand for lung monitoring devices.

Motor vehicles, household combustion, forest fires, and industrial facilities are familiar air pollution sources. Pollutants of primary public health concern contain particulate matter, carbon monoxide, ozone, sulphur dioxide, and nitrogen. Indoor and outdoor air pollution cause respiratory and other diseases and are significant factors for mortality and morbidity. According to World Health Organization, almost all of the world’s population breathes air that exceeds WHO guideline limits and has high levels of pollutants. Out of that, low and middle-income countries are suffering from the highest exposures. Long-term exposure to ambient air pollutants is connected with rising cases of COPD and other lung diseases, which are expected to surge the demand and thereby propel the market’s growth.

Tobacco consumption has increased significantly and has become one of the biggest health threats to the world, responsible for many deaths. The World Health Organization (WHO) has predicted that tobacco kills more than 8 million people annually. Out of these, 7 million die from direct tobacco use, while around 1.2 million are from passive or second-hand smoking. About 80% of the world’s 1.3 billion tobacco users are in low-and middle-income nations. As the cases of lung disease are predicted to increase due to the rising consumption of tobacco globally, the utilization lung monitoring devices for the treatment will also surge and boost the market growth.

A chest X-ray can aid in assisting the diagnosis of many lung diseases and rule out other causes of shortness of breath. Various hospitals in developing nations cannot invest in diagnostic imaging equipment due to high costs and financial restrictions. Although several well-known domestic companies have entered this business and started supplying low-cost refurbished equipment to all medical facilities globally, the cost-benefit ratio of this refurbished medical equipment is on the higher side for many small and medium-sized healthcare facilities. This factor poses a significant challenge to the market.

Based on end user, the market is segmented into hospitals, homecare, and others. In 2022, the hospitals segment dominated the market with the maximum revenue share. This is because the acceptance of lung monitoring devices in hospital for monitoring and diagnosis. These devices used during surgery, such as gas analyzers and capnography, is also growing as hospital surgeries rise in frequency.

By product type, the lung monitoring device market is fragmented into pulse oximeters, capnographs, others, and spirometers. The pulse oximeters segment garnered a significant revenue share in the lung monitoring market in 2022. Pulse oximeters have been used to determine the patient's body's oxygen saturation. The rise in the prevalence of cardiovascular and respiratory disorders, the rise in demand for minimally invasive operations, and the development of novel pulse oximeters by numerous major players all contribute to the growth of this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.15 Billion |

| Market size forecast in 2030 | USD 5.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Number of Pages | 205 |

| Number of Table | 274 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the highest revenue share in the market. The aging population increased respiratory ailments like breathing issues, and new cutting-edge products are all significantly fueling the expansion of the North American market. Additionally, viral and bacterial infections brought due to chronic respiratory conditions, including pneumonia, bronchitis, and asthma fuel market’s expansion.

Free Valuable Insights: Global Lung Monitoring Devices Market size to reach USD 5.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Teleflex, Inc., Medtronic PLC, Masimo Corporation, Baxter International, Inc. (Hill-Rom Holdings, Inc.), Nihon Kohden Corporation, ICU Medical, Inc., Vyaire Medical, Inc. (Apax Partners LLP), Becton, Dickinson and Company, Koninklijke Philips N.V. and Propeller Health (ResMed, Inc.)

By Product Type

By End User

By Geography

The Market size is projected to reach USD 5.1 billion by 2030.

Rising Tobacco Consumption globally are driving the Market in coming years, however, High cost of imaging equipment restraints the growth of the Market.

Teleflex, Inc., Medtronic PLC, Masimo Corporation, Baxter International, Inc. (Hill-Rom Holdings, Inc.), Nihon Kohden Corporation, ICU Medical, Inc., Vyaire Medical, Inc. (Apax Partners LLP), Becton, Dickinson and Company, Koninklijke Philips N.V. and Propeller Health (ResMed, Inc.)

The Spirometers segment is leading the Market by Product Type in 2022; thereby, achieving a market value of $2 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.