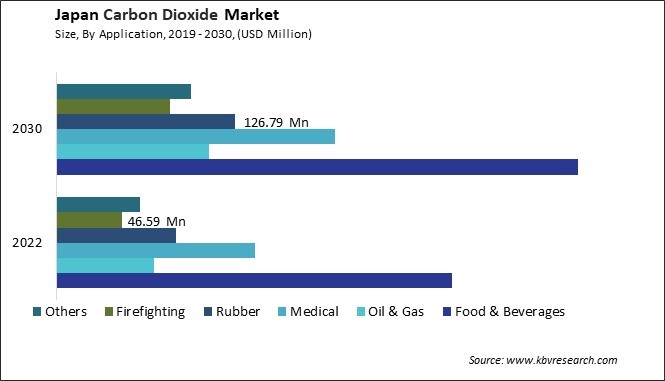

The Japan Carbon Dioxide Market size is expected to reach $978.04 Million by 2030, rising at a market growth of 4.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,675.25 Kilo Tonnes, experiencing a growth of 2.9% (2019-2022).

In Japan, the carbon dioxide market plays a crucial role in various sectors, from manufacturing to food and beverage industries. One significant sector driving the demand for carbon dioxide (CO2) in Japan is the food and beverage industry. Carbon dioxide is widely used in this sector for carbonation purposes, giving beverages like soda and beer their characteristic fizz. Additionally, CO2 is utilized in food packaging to extend the shelf life of perishable products, maintaining their freshness and quality. With Japan being a major consumer of carbonated beverages and processed foods, the demand for CO2 in the food industry remains consistently high.

Another key sector contributing to the carbon dioxide market in Japan is the manufacturing industry. CO2 finds application in various manufacturing processes, including welding and metal fabrication. It is also used as a coolant in industrial applications and as a chemical feedstock for the production of urea and methanol.

According to the International Trade Administration, Japanese manufacturing companies have demonstrated a substantial commitment to advancing their digital infrastructure, with an estimated expenditure of $890 million. This investment is projected to experience a remarkable surge, reaching an anticipated $4.1 billion by 2030. Concurrently, the manufacturing industry has played a pivotal role in Japan's economic landscape, contributing over 20% to the nation's GDP through value-added processes. The manufacturing sector in Japan, known for its innovation and technological prowess, continues to drive the demand for CO2 as the country strives for industrial excellence and efficiency.

However, the carbon dioxide market in Japan has not been immune to the impacts of the COVID-19 pandemic. The pandemic led to disruptions in industrial activities and supply chains, resulting in fluctuations in CO2 demand and supply dynamics. Restrictions on movement and social distancing measures also affected the food and beverage sector. This led to the temporary closure of restaurants, bars, and other establishments that heavily rely on CO2. While the healthcare sector witnessed increased demand for medical-grade CO2 for respiratory support systems, the overall industry experienced uncertainties and challenges amidst the pandemic-induced economic downturn.

The carbon dioxide market in Japan is experiencing a surge in adoption within the food and beverage industry. One of the primary drivers behind this trend is the growing awareness of the environmental impact of traditional carbon dioxide production methods. As concerns over climate change continue to intensify, there is a pressing need for more sustainable alternatives. In response, Japan's food and beverage industry is increasingly turning to carbon dioxide produced through renewable sources such as biomass or captured from industrial processes, thereby reducing their carbon footprint.

According to the U.S. Department of Agriculture, the food processing industry in Japan demonstrated remarkable success in 2020, generating food and beverage products valued at $218.3 billion. The pandemic accelerated a decade-long trend of increased food consumption, with figures rising from $5.56 billion in 2010 to $6.57 billion in 2020. This surge in demand is mirrored by the growing adoption of carbon dioxide in Japan's food and beverage sector.

Moreover, technological advancements have made producing high-quality carbon dioxide suitable for food and beverage applications increasingly feasible and cost-effective. Innovations in carbon capture and purification technologies have enabled manufacturers to produce food-grade carbon dioxide that meets the stringent quality standards of the industry.

Furthermore, shifting consumer preferences towards healthier and more sustainable products has also played a significant role in driving the adoption of carbon dioxide in the food and beverage industry. Consumers in Japan are increasingly seeking out products that are not only delicious but also environmentally friendly. Thus, the surge in the adoption of sustainable carbon dioxide within Japan's food and beverage industry reflects a growing commitment to environmental consciousness and evolving consumer preferences toward healthier choices.

In recent years, Japan has witnessed a significant shift towards enhancing agricultural productivity within the carbon dioxide market. One key strategy to bolster agricultural productivity in Japan's carbon dioxide market is the adoption of innovative technologies. Advanced farming techniques such as precision agriculture, hydroponics, and vertical farming are gaining traction. Additionally, integrating Internet of Things (IoT) devices and artificial intelligence (AI) systems enables real-time monitoring and data-driven decision-making, further enhancing efficiency and reducing environmental impact.

Moreover, there is a growing emphasis on promoting organic farming practices and agroforestry initiatives in Japan. Organic farming eschews synthetic inputs, relying instead on natural fertilizers and biological pest control methods. This approach minimizes carbon footprint and enhances soil health and biodiversity, contributing to long-term sustainability. Similarly, agroforestry, which involves integrating trees into agricultural landscapes, helps sequester carbon dioxide while providing additional revenue streams through timber production and ecosystem services.

Furthermore, Japan increasingly leverages carbon industries and incentives to incentivize carbon-neutral farming practices. Through carbon offset programs, farmers are rewarded for implementing measures that sequester carbon or reduce emissions, such as reforestation, adopting renewable energy sources, or implementing low-carbon transportation methods. Hence, Japan's agricultural sector embraces innovative technologies, organic farming, and agroforestry practices to enhance productivity while mitigating environmental impact and advancing sustainability goals.

In Japan, the carbon dioxide market is a significant sector within the broader context of environmental sustainability and industrial applications. One prominent company in Japan's carbon dioxide market is Mitsubishi Corporation. Mitsubishi has a long history of innovation and diversification across various industries, including energy and environmental solutions. In the carbon dioxide, Mitsubishi focuses on technologies for capturing CO2 emissions from industrial processes and power plants. They also invest in research and development to explore novel carbon capture and utilization methods, aiming to mitigate the environmental impact of greenhouse gas emissions.

Another major player in Japan's carbon dioxide market is JGC Corporation. As a leading engineering company, JGC specializes in providing comprehensive solutions for energy and environmental projects, including those related to carbon capture and storage (CCS). JGC works closely with industrial clients to design and implement CCS systems that help reduce carbon emissions from manufacturing facilities and power plants. Their engineering and project management expertise positions them as a key player in Japan's efforts to combat climate change.

Tokyo Gas Co., Ltd. is also actively involved in the carbon dioxide market in Japan. Primarily known as a natural gas provider, Tokyo Gas has expanded its portfolio to include renewable energy and low-carbon technologies. In the realm of carbon dioxide, Tokyo Gas explores opportunities for CO2 capture and utilization, such as in the production of synthetic fuels or chemicals. By leveraging its infrastructure and expertise in the energy sector, Tokyo Gas aims to contribute to Japan's transition to a more sustainable and carbon-neutral economy.

Furthermore, Japan Petroleum Exploration Co., Ltd. (JAPEX) plays a significant role in the carbon dioxide market, particularly in the context of carbon capture and storage projects. JAPEX is involved in research and development initiatives to advance CCS technologies and enhance their efficiency and scalability. Additionally, JAPEX explores opportunities for utilizing captured CO2 in enhanced oil recovery (EOR) operations, where CO2 is injected into oil reservoirs to enhance oil production while permanently storing the captured carbon underground. Through their carbon capture, utilization, and storage efforts, these entities play a crucial role in Japan's transition to a low-carbon economy and contribute to global efforts to combat climate change.

By Application

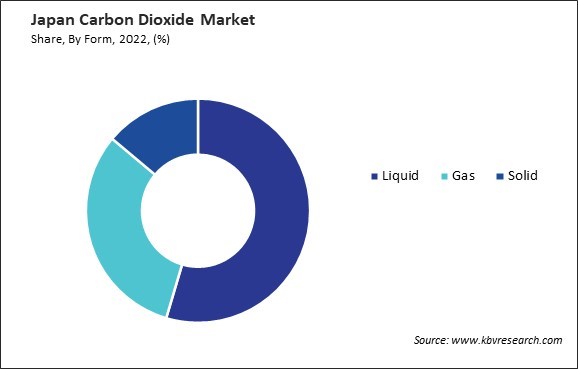

By Form

By Source

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.