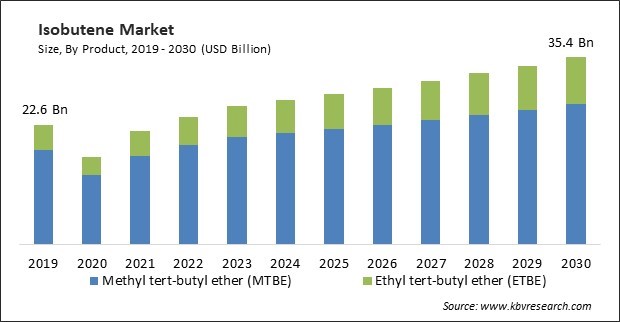

The Global Isobutene Market size is expected to reach $35.4 billion by 2030, rising at a market growth of 4.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 18,952.7 Kilo Tonnes, experiencing a growth of 2.4% (2019-2022).

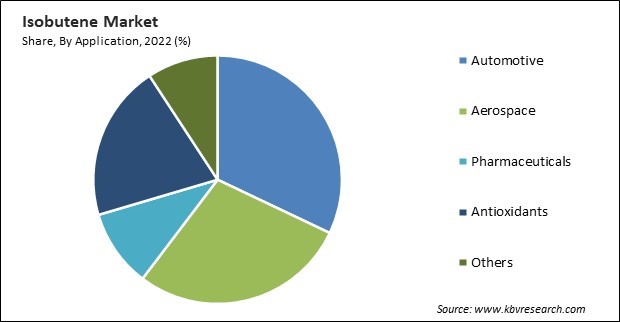

Isobutene is a key raw material in producing certain antioxidants, particularly hindered phenols. Thus, the antioxidants segment would acquire 1/4th share of the market by 2030. Hindered phenols are a class of chemical compounds widely used as antioxidants in plastics, rubber, and other polymer materials. In the polymer industry, isobutene-derived antioxidants are added to plastic and rubber formulations to prevent or slow oxidation. This helps prevent the degradation of the material, including color changes, embrittlement, and loss of physical properties, which can occur when these materials are exposed to oxygen, heat, and UV radiation. Isobutene plays a crucial role in developing antioxidants that help preserve the integrity and longevity of a wide range of materials and products, contributing to their durability and performance. Some of the factors impacting the market are increasing technological advances and techniques, growing adoption of renewable isobutene, and growing health and safety regulations.

Technological innovations have led to more efficient methods of isobutene production. These innovations can reduce energy consumption, waste generation, and production costs, making isobutene more economically viable and increasing its availability in the market. Advancements in technology have enabled the use of alternative feedstocks for isobutene production. These feedstocks can include biomass, agricultural residues, and other sustainable sources, reducing the reliance on traditional fossil fuels and contributing to an additional sustainable industry. Developing new catalysts and catalyst systems has improved the selectivity and yield of isobutene in production processes. This results in higher product quality and increased production efficiency. Innovative methods, such as metathesis, have been developing to produce isobutene efficiently. Additionally, Renewable isobutene is typically produced from biomass sources, such as agricultural residues, forestry waste, or dedicated energy crops. This renewable feedstock reduces the environmental impact of traditional isobutene production, which relies on fossil fuels. As sustainability becomes a more prominent concern, the demand for eco-friendly chemicals like renewable isobutene grows. The production of renewable isobutene can result in lower greenhouse gas emissions compared to traditional petrochemical-based isobutene production. The availability of renewable isobutene can open up new markets and applications, especially in industries where sustainable materials are highly valued. It addresses environmental concerns, supports renewable energy sources, and offers a more responsible alternative to traditional petrochemical-based isobutene, contributing to the market's growth and long-term viability.

However, Isobutene production and handling can pose risks to workers, such as exposure to toxic chemicals, fire hazards, and explosion risks. Complying with safety standards and ensuring the well-being of employees is a top priority. This often requires significant investments in safety measures, training, and equipment. Meeting health and safety regulations can vary by jurisdiction and be complex and costly. Companies in the isobutene market must navigate and adhere to many chemical handling, transportation, and emergency response planning rules. In case of accidents or chemical releases, isobutene producers must have robust emergency response plans. Preparing for various contingencies and ensuring effective communication with local authorities is essential. Preparing for these assessments and addressing any identified non-compliance issues can be challenging. Due to several health and safety concerns, the market growth will decline in the coming years.

Based on application, the market is fragmented into automotive, aerospace, antioxidants, pharmaceuticals, and others. In 2022, the automotive segment held the highest revenue share in the market. Isobutylene-based elastomers have properties exclusive to automotive applications. These characteristics include minimal gas and liquid permeability, chemical resistance, and superior damping. When these elastomers are halogenated, their thermal efficacy also improves. Similar to isobutylene-co-para-methylstyrene, brominated isobutylene-co-para-methylstyrene has inherent ozone resistance. These characteristics give the material an advantage in automotive applications, including dynamic components, cables, and tire inner liners. In addition, its chemical properties have contributed significantly to its widespread use as an anti-knock agent in automotive fuel.

On the basis of the product, the market is segmented into methyl tert-butyl ether (MTBE) and ethyl tert-butyl ether (ETBE). The ethyl tert-butyl ether (ETBE) segment acquired a substantial revenue share in the market in 2022. ETBE is a biofuel derived mainly from isobutylene and ethanol. Due to its high-octane content, low pressure of vapor, and low boiling point, it is an ideal component for gasoline combining. This allows refiners to meet bio-component and octane requirements. Its use also enables companies to meet environmental standards and adapt to alterations in the gasoline market. Using compounds, naphtha is upgraded to gasoline, or lower octane grades are improved to higher grades. Over the forecast period, the demand for ETBE is anticipated to be driven by an increasing worldwide need for higher-quality gasoline due to various factors, such as a greater awareness of the importance of vehicle performance enhancement and stricter regulatory mandates requiring consumers to use eco-friendly fuel.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 24.1 Billion |

| Market size forecast in 2030 | USD 35.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 4.4% from 2023 to 2030 |

| Number of Pages | 289 |

| Number of Table | 530 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region registered the highest revenue share in the market. Isobutene is a key raw material in the production of butyl rubber, which is used in various applications, including tire manufacturing. The growing automotive industry in North America and the demand for high-quality tires drove the need for butyl rubber and, consequently, isobutene. The vital contribution of North America to this industry is owing to higher spending on passenger cars and light vehicles, increasing per capita disposable income, and strong and sustained manufacturing sector growth in the region in recent years.

Free Valuable Insights: Global Isobutene Market size to reach USD 35.4 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BASF SE, Evonik Industries AG (RAG-Stiftung), Exxon Mobil Corporation, Sumitomo Chemical Co., Ltd., Global Bioenergies, Weifang Binhai Petro-Chem Co., Ltd (Tiande Chemical Holdings Co., LTD), Honeywell International, Inc., LyondellBasell Industries Holdings B.V., Linde PLC, and China Petrochemical Corporation (Sinopec Group).

By Product (Volume, Kilo Tonnes, USD Million, 2019-2030)

By Application (Volume, Kilo Tonnes, USD Million, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

This Market size is expected to reach $35.4 billion by 2030.

Increasing technological advances and techniques are driving the Market in coming years, however, Growing health and safety regulations restraints the growth of the Market.

BASF SE, Evonik Industries AG (RAG-Stiftung), Exxon Mobil Corporation, Sumitomo Chemical Co., Ltd., Global Bioenergies, Weifang Binhai Petro-Chem Co., Ltd (Tiande Chemical Holdings Co., LTD), Honeywell International, Inc., LyondellBasell Industries Holdings B.V., Linde PLC, and China Petrochemical Corporation (Sinopec Group).

In the year 2022, the market attained a volume of 18,952.7 Kilo Tonnes, experiencing a growth of 2.4% (2019-2022).

The Methyl tert-butyl ether (MTBE) segment is leading the Market, By Product in 2022 thereby achieving a market value of $26.4 Billion by 2030.

The North America region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $14.1 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.