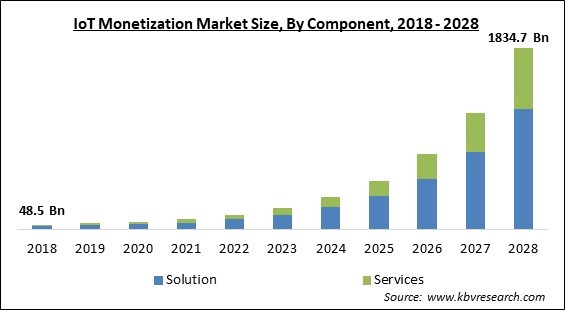

The Global IoT Monetization Market size is expected to reach $1834.7 billion by 2028, rising at a market growth of 52.1% CAGR during the forecast period.

By safeguarding IoT data and collecting data from IoT-connected devices, IoT monetization is a technique that generates money from IoT-enabled products and services. The IoT monetization market is expanding as a result of a variety of advantages offered by IoT monetization solutions, including effectiveness, improved reengineer operations, cost-cutting, expanded reach to new markets, and others. There is a growing need to monetize IoT devices and the data they hold as a result of the growing deployment of IoT devices across a variety of application industries, including retail, automotive, healthcare, transportation, and others.

Since the Internet's introduction, commonplace devices are now connected. Many homes and organizations now function through connected devices because of the advent of the IoT. The demand for IoT monetization is rising as smart device usage, such as that of smartphones and tablets, increases. Many people are turning to it as a legitimate form of business, and it's creating opportunities for expansion in the future.

Many businesses have offered excellent guidelines for integrating IoT into product selection in order to generate income. For instance, customers have the option to buy a single connected doorbell camera, however, they are also given the choice to buy a subscription that allows them to save and watch footage from the doorbell camera. With this business strategy, the producer must only sell one product to start a connection with its customers. Customers of the company can purchase lifetime access to the product's details. Businesses serving businesses (B2Bs) have been hard at work developing new revenue streams, business models, and audiences through the use of IoT in addition to the millions of consumer brands like this example.

The abrupt outbreak of the COVID-19 pandemic has led businesses all over the world to a steep downfall. In addition, various economies all over the world were devastated due to the COVID-19 pandemic. Governments in a number of countries were compelled to impose lockdowns in their own countries. Moreover, a number of companies were also closed temporarily. The IoT Monetization market has been significantly impacted by the COVID-19 pandemic, among other markets. Additionally, consumer demand has now decreased as people have been more intent on cutting down non-essential expenditures from their individual budgets as the general economic condition of the majority of people were negatively impacted by this outbreak.

The use of information and communication technologies, such as IoT, in smart farming, is anticipated to transform the world's agricultural landscape and make it more productive and resource-efficient. In order to increase yields, profitability, and agricultural methods, the agriculture sector and automation vendors are investigating new prospects by utilizing IoT and digital technologies. IoT also has a huge potential in precision farming. Precision farming aims to produce data using sensors that follow vehicles, observe the field, monitor storage facilities, and monitor livestock. Animals that need their health monitored can have the Sensors installed on them.

One of the major factors propelling the growth of the market is an increase in the number of smart city initiatives and projects all over the world. With the expansion of urbanization in a number of developed as well as developing countries, smart city projects are accelerating. The rise in IoT adoption in public transportation as a result of the development of smart cities is one of the factors that fuels the expansion of the global IoT monetization industry. Therefore, in order to more effectively manage traffic, developers are considering how to build a platform that takes a lot of different factors into account.

IoT is a vast, dispersed, and disjointed ecosystem. As a result, interoperability and integrations pose a serious challenge in the entire process. End applications in the IoT eventually provide the required business outcomes by data, fusing devices, and analytics to yield fresh, commercially useful insights. IoT apps must be incorporated into numerous endpoints in order to do this. However, difficulty arises in this process. These endpoints may belong to the IoT and network domains or an IT system (ERP, CRM, or billing, to name a few).

On the basis of component, the IoT Monetization Market is bifurcated into Solution and Services. In 2021, the services segment recorded a significant revenue share of the IoT monetization market. The expansion of the market is owing to the higher reliability that professional services offer to the customer or a business. The deployment of IoT monetization services is growing in B2B sector due to the fact that a very big number of businesses are now understanding the significance of IoT monetization and thus, implementing services. This factor is propelling the growth of this segment of the market.

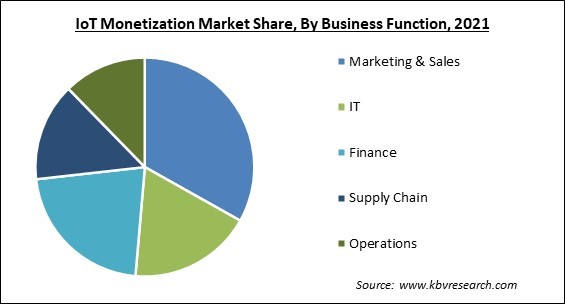

By Business Function, the IoT Monetization Market is segmented into Marketing & Sales, IT, Finance, Supply Chain, Operations. In 2021, the marketing and sales segment procured the biggest revenue share of the IoT monetization market. The surging growth of the segment is mainly owing to the increasing competition within industries all over the world. In order to address this issue, the workloads on marketing and sales service providers have increased significantly. Due to this rapid increase in workflows, businesses are increasingly leveraging the benefits of the IoT monetization technology. Therefore, this factor is driving the growth of the segment.

Based on the Organization Size, the IoT Monetization Market is divided into Large enterprises and Small & Medium Enterprises. In 2021, the small and medium enterprises segment garnered a substantial revenue share of the IoT monetization market. The surge in the growth of this segment is ascribed to a large number of SMEs across the world. Moreover, this type of organization is deploying IoT monetization services on a very big scale owing to fulfill their aim to obtain maximum growth. These factors are bolstering the growth of this segment.

On the basis of Industry Vertical, the IoT Monetization Market is segregated into Retail, IT & Telecom, Manufacturing, Transportation & Logistics, Healthcare, BFSI, Energy & Utilities, and Others. In 2021, the manufacturing segment witnessed the biggest revenue share of the IoT monetization market. The growth of the segment is rising as a result of numerous advantages of IoT monetization solutions in the manufacturing industry, such as streamlined operations, enhanced customer acquisition and retention, reduced cost, and new revenue sources from the insights provided by interferometric products as well as product development processes.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 101.4 Billion |

| Market size forecast in 2028 | USD 1834.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 52.1% from 2022 to 2028 |

| Number of Pages | 298 |

| Number of Tables | 493 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Business Function, Organization Size, Industry Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the IoT Monetization Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the highest revenue share of the IoT monetization market. The rapid use of cloud computing and digitalization, the rise in data volume, the sizeable investments made by leading regional players, and the growing use of AI and IoT for data processing within developed regional countries are the main factors propelling the market's expansion.

Free Valuable Insights: Global IoT Monetization Market size to reach USD 1834.7 Billion by 2028

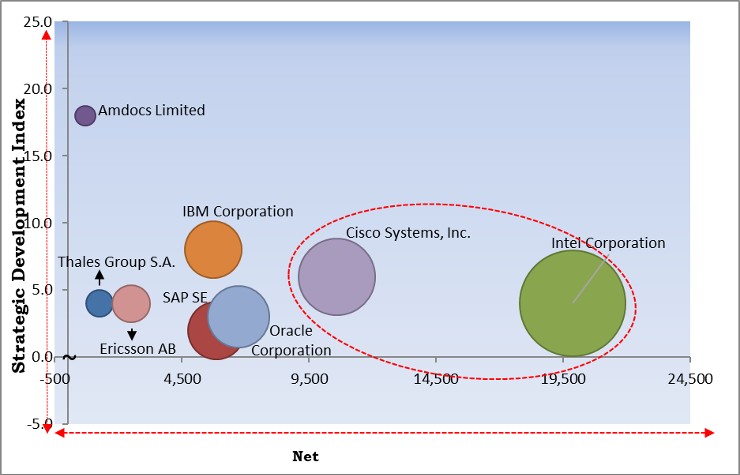

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. and Intel Corporation are the forerunners in the IoT Monetization Market. Companies such as Amdocs Limited, IBM Corporation and Thales Group S.A. are some of the key innovators in IoT Monetization Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amdocs Limited, General Electric (GE) Co., Thales Group S.A. (Gemalto NV), SAP SE, Oracle Corporation, IBM Corporation, Cisco Systems, Inc., Ericsson AB, Intel Corporation and Aria Systems, Inc.

By Component

By Business Function

By Organization Size

By Industry Vertical

By Geography

The IoT Monetization Market size is projected to reach USD 1834.7 billion by 2028.

A Surge in Deployment of IOT Monetization Technology in the Agriculture Sector are driving the market in coming years, however, Challenges in Meeting the Complex Requirements restraints the growth of the market.

Amdocs Limited, General Electric (GE) Co., Thales Group S.A. (Gemalto NV), SAP SE, Oracle Corporation, IBM Corporation, Cisco Systems, Inc., Ericsson AB, Intel Corporation and Aria Systems, Inc.

The Large Enterprises market shows high market share in Global IoT Monetization Market by Organization Size in 2021 in 2021; thereby, achieving a market value of $1,250.4 billion by 2028.

The Solution market is leading the Global IoT Monetization Market by Component in 2021; thereby, achieving a market value of $1,215.0 billion by 2028.

The North America market dominated the Global IoT Monetization Market by Region in 2021; thereby, achieving a market value of $705.0 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.