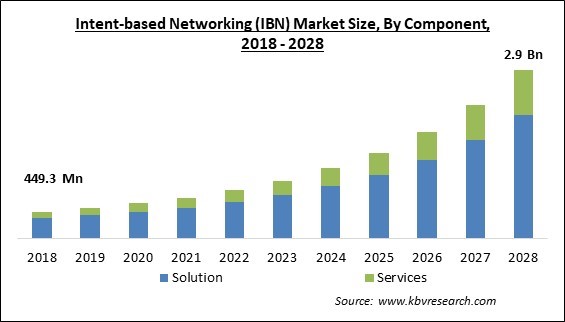

The Global Intent-based Networking (IBN) Market size is expected to reach $2.9 billion by 2028, rising at a market growth of 23.2% CAGR during the forecast period.

The intent-based networking (IBN) refers to a smart system that automates system coordination and corporate networking chores using machine learning (ML) or artificial intelligence (AI). IBN is praised for being an improved form of conventional networking. It is a pragmatic approach to networking where programming and specific APIs help structure, organize and plan crucial changes to the current system while enhancing accessibility and nimbleness.

The growing interest in network infrastructure management and process automation among businesses is driving the growth of the intent-based networking (IBN) market. IBN's agility and availability cut the quantity and length of outages in half, stimulating the market. Opportunities in the industry are anticipated as small- and medium-sized enterprises increase their need for IBN programming. IBN can eliminate human mistakes from business network settings, resulting in market expansion.

With the use of networking technology IBN, the IT infrastructure can be configured in accordance with a network administrator's service request based on corporate intent. It continuously offers crucial network insights and modifies the hardware configuration to ensure the intention is achieved. By doing this, networking shifts from being device-centric to being business-centric. Intent-based networking (IBN) combines IT automation's strength with ML's analytics to increase the IT network's adaptability in every way. IBN is a self-driving networking system.

Nowadays, most networks are managed manually, with administrators writing scripts that specify all the steps needed to complete a given task via a command line interface (CLI). Contrarily, with intent-based networking, different devices automatically comprehend intent without requiring engineers to individually modify each one.

Due to a short halt in the manufacturing process and supply chain, COVID-19's effects on this market were only transitory. As a result, supply chains, production, and demand for IBN steadily rose once the situation improved after the pandemic. Additionally, the COVID-19 lockdown encouraged businesses to consider more sophisticated IBN tools to boost productivity. As a result, intent-based networking solutions became more necessary than ever, which promoted future industry advancement. It also increased demand for SaaS- and cloud-based services. Therefore, despite the short-term negative impact of the pandemic, it had an overall positive impact on the market.

The abundance of cloud services that supplement conventional enterprise data centers has made flow patterns of network traffic more complex. Many businesses are seeking ways to make their networks more cloud-platform compatible. Network automation solutions are becoming more necessary due to the growing network traffic since they improve network management and provide full network visibility throughout all environments. Therefore, as the number of connected devices and cloud-based environments expands, they create a demand for IBN tools, ensuring the market's expansion.

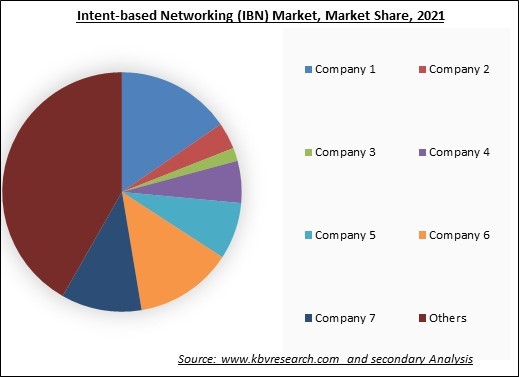

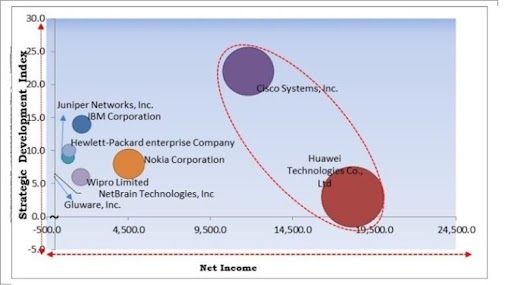

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Networking activities can be safe and secure for organizations. Besides that, network downtime is a major problem for many firms. Any public network may have additional downtime. However, there is less downtime with intent-based networking because of tailored networks. Intent-based networking is more in demand as a result of the requirement to boost productivity and decrease network downtime. As a result of the numerous benefits offered by the IBN tools, more companies are willing to implement IBN in their workflows. Hence, the intent-based networking (IBN) market will grow rapidly in the coming years.

Many businesses, particularly SMEs, lack the necessary experienced personnel to operate the network infrastructure. So, a barrier to expanding the intent-based networking (IBN) market is the lack of knowledge among network administrators regarding how to differentiate between specific network automation solutions. Additionally, market growth is constrained by the high cost of upgrading an enterprise's network from conventional systems to IBN infrastructure. Hence, all these factors are affecting the demand for IBN tools adversely and thus hamper the growth of the market.

Based on component, the intent-based networking (IBN) market is categorized into solution and service. The solution segment garnered the highest revenue share in the intent-based networking (IBN) market in 2021. The market for intent-based networking (IBN) is solution-driven. Because they allow businesses to use the Graphical User Interface (GUI) for improving and automating the network configuration process, IBN solutions are crucial in decreasing the complexity of networks. IBN automation is being pushed for two reasons: the intense desire to develop a novel and highly tailored customer experience and the need to redesign business models by utilizing cutting-edge algorithms, GUIs, and network transparency to increase network efficiency.

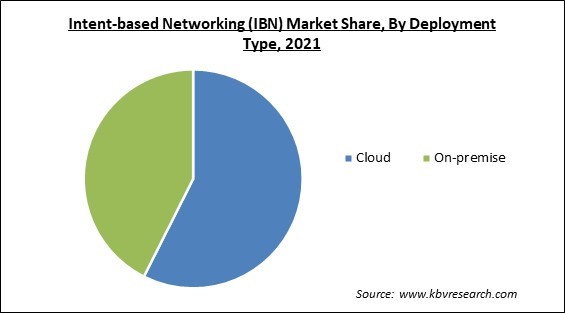

On the basis of deployment type, the intent-based networking (IBN) market is divided into cloud and on-premise. The on-premise segment garnered a remarkable growth rate in the intent-based networking (IBN) market in 2021. On-premises IBN tools are expected to witness rising demand because of their simplicity of deployment. Furthermore, companies that manage networks through old techniques find it difficult to compete with quick-thinking rivals due to digital transformation. As a result, the desire for on-premise deployment of IBN solutions has increased and strengthened the safeguards of networking components in enterprises, which is anticipated to support segment’s growth.

Based on organization size, the intent-based networking (IBN) market is segmented into SMEs and large enterprises. The large enterprises segment procured the highest revenue share in the intent-based networking (IBN) market in 2021. Intent-based networking and related services are being heavily invested in by large businesses, which have the financial money to do so to effectively manage their subscriber base. The proliferation of smart devices in major companies is the main factor controlling the segment's growth. Large enterprises implement IBN solutions and services to manage and integrate these devices.

On the basis of vertical, the intent-based networking (IBN) market is fragmented into IT & telecom, BFSI, healthcare, manufacturing, retail & consumer goods, and others. The BFSI segment witnessed a considerable growth rate in the intent-based networking (IBN) market in 2021. The BFSI segment is anticipated to grow quickly in the coming years as more financial institutions adopt cutting-edge IBN solutions to hasten the rollout of their digital services and customer-centric business models to improve personalized banking experiences. In addition, since it increases its exposure to various consumers and commercial prospects, IBN solutions can help the BFSI sector offer innovative products to all branch locations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 690.5 Million |

| Market size forecast in 2028 | USD 2.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 23.2% from 2022 to 2028 |

| Number of Pages | 273 |

| Number of Table | 444 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Type, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the intent-based networking (IBN) market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region procured the maximum revenue share in the intent-based networking (IBN) market in 2021. Because of its prospective advantages in technological improvements and its status as a developed region, the regional intent-based networking (IBN) market is anticipated to provide manufacturers with the greatest potential for financial success. Much of the growth is owed to the dominance of North American IBN solutions as well as service providers in the market.

Free Valuable Insights: Global Intent-based Networking (IBN) Market size to reach USD 2.9 Billion by 2028

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Huawei Technologies Co., Ltd and Cisco Systems, Inc. are the forerunners in the Intent-based Networking (IBN) Market. Companies such as Nokia Corporation, IBM Corporation, Wipro Limited are some of the key innovators in Intent-based Networking (IBN) Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Juniper Networks, Inc., IBM Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Hewlett-Packard enterprise Company (HP Development Company L.P.), Nokia Corporation, Wipro Limited, Gluware, Inc., Forward Networks, Inc. and NetBrain Technologies, Inc.

By Component

By Deployment Type

By Organization Size

By Vertical

By Geography

The global Intent-based Networking (IBN) Market size is expected to reach $2.9 billion by 2028.

Increasing use of IBN owing to its advantages are driving the market in coming years, however, Network administrators' lack of knowledge restraints the growth of the market.

Cisco Systems, Inc., Juniper Networks, Inc., IBM Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Hewlett-Packard enterprise Company (HP Development Company L.P.), Nokia Corporation, Wipro Limited, Gluware, Inc., Forward Networks, Inc. and NetBrain Technologies, Inc.

The Telecom & IT segment acquired maximum revenue share in the Global Intent-based Networking (IBN) Market by Vertical in 2021 thereby, achieving a market value of $1.2 billion by 2028.

The Cloud segment is leading the Global Intent-based Networking (IBN) Market by Deployment Type in 2021 thereby, achieving a market value of $1.8 billion by 2028.

The North America market dominated the Global Intent-based Networking (IBN) Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.