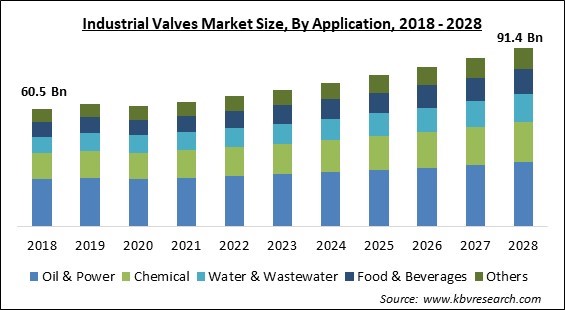

The Global Industrial Valves Market size is expected to reach $91.4 billion by 2028, rising at a market growth of 5.3% CAGR during the forecast period.

Smart valves with smart control systems are also anticipated to get significant importance, further stimulating the growth of the market in the upcoming years. The high automation and control through industrial valves enhance their performance in dangerous applications like nuclear power generation plants, chemical processing, oil & gas, and others. Additionally, the application of automated technology has aided in decreasing the wastage of fluids passing via valves and pipes, leading to the reduction in overall prices.

As a result, several businesses are accepting automation and control technologies by improving their already installed industrial valves that is propelling the growth of the industrial valves market. Furthermore, the growing concern regarding sanitation would further surge the need for stainless steel valves in water and wastewater treatment plants.

This is because the stainless-steel valves can deal with harsh temperatures, chemicals and hard water conditions due to their quality of resisting corrosion. Furthermore, stainless steel is durable compared to other materials like ductile iron, cast iron, copper, and brass under temperature tolerance and pressure rating. Therefore, stainless steel is considered better option than the carbon steel in applications where resistance from corrosion is crucial.

Thus, stainless steel ball valves are majorly being demanded by industry verticals like food & beverages, chemicals, pharmaceuticals, and oil & gas. The on or off valves are one of the most indispensable and fundamental components of the modern technological society. These are one among the oldest products being used from many years. The valve industry is very vast, with several utilization varying from downstream and upstream of oil & gas to nuclear power to water distribution. All of these end-user industry verticals utilize one or another kind of valve.

The energy & power and water & wastewater treatment plants also witnessed a decline in their demand due to COVID-19 pandemic. Also, the manufacturing sector has been significantly impacted by COVID-19 in almost every nation. In addition, there were restrictions on foreign trade because of the non-operational distribution channels, lockdown of international borders, and several other preventive steps taken for public safety and health. Due to these reasons, significant end-user manufacturing businesses in nations like the UK, Germany, the U.S., and others also encountered financial problems because of the halted production. These factors obstructed the growth of the industrial valves market throughout the pandemic period.

Valves can keep materials and components clean in oxygen therapy devices and sterilizers, support analyzers, manage pressure relief, and other essential hematology equipment. The high-purity and high-pressure valves also supply oxygen to remote and pop-up hospitals and triage centers. The increase in the utilization of industrial valves in the pharmaceutical sector to prevent contamination that might occur because of inefficient handling of chemicals is accelerating the market's growth. In addition, the integration of industrial valves in the pharmaceutical industry has become significant with the necessity for high-quality pharmaceutics. These factors will support the growth of industrial valves market during the projection period.

The "Industry 4.0" upgrade has pushed the manufacturing industry more towards automation, which further assists in increasing the quality of the work and process. Technological developments occurred in recent past have allowed the businesses to utilize the latest technologies like IIoT technology and AI (artificial intelligence) to reduce unplanned downtime and several other unfavourable incidents because of the failures of valves. These valve technologies assist the experts in monitoring the condition and health of industrial valves from remote areas. These elements will surge the growth of the industrial valves market throughout the predicted period.

Despite of various benefits, industrial valves also face various issues. These issues involve flashing & cavitation, limited rangeability, erosion & corrosion, and vibrations. Sudden falling of pressure from high to low may lead to flashing & cavitation in globe valves. When these circumstances occur, there will be a decline in the quantity of liquid that flows through the line. This forces the workers to stop the line to solve the problem. These issues with industrial valves will obstruct the growth of the industrial valve market in the upcoming years.

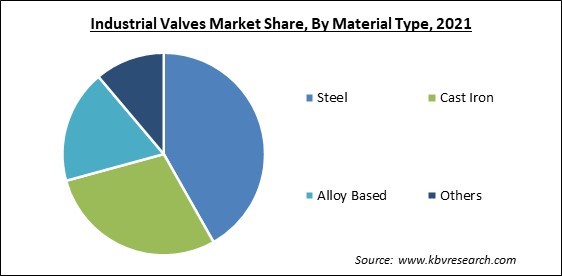

Based on material type, the industrial valves market is segmented into cast iron, steel, alloy based, and others. In 2021, the cast iron segment garnered a substantial revenue share in the industrial valves market. Cast iron or grey iron is a metal that has been utilized for hundreds of years. Its temperature tolerance is impressive and can handle temperatures above 1150C or 2100F. The strength of cast iron relies on the pressure class. The two most common pressure classes are class 250 and class 125. The pressure rating of class 125 is between 150 and 200 psi, whereas the pressure rating of class 250 is between 300 to 500 psi.

On the basis of type, the industrial valves market is fragmented into ball valves, butterfly valves, gate valves, globe valves, plug valves, check valves, and diaphragm valves. In 2021, the gate valves segment acquired a considerable revenue share in the industrial valves market. These valves are capable of completely shutting off the flow of fluid. It could also operate in a fully open position. They could be of the wedge and parallel shape types. Gate valves can also provide a path to the fluid through a barrier lift. These factors will influence the adoption of gate valves and thus supporting the development of the industrial valves market.

By application, the industrial valves market is divided into oil & gas, water & wastewater, chemical, food & beverage, and others. In 2021, the oil & gas segment held the largest revenue share in the industrial valves market. Rising demand for longer pipelines, deeper wells, lower manufacturing costs, and technological advancements of processing, and transportation are responsible for the growth of the industrial valves market. Furthermore, expanding pipeline installations and the necessity for controlling & monitoring from the centralized location have driven the production and demand for smart valves.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 63.9 Billion |

| Market size forecast in 2028 | USD 91.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.3% from 2022 to 2028 |

| Number of Pages | 241 |

| Number of Tables | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Material Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the industrial valves market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region dominated the industrial valves market with the maximum revenue share. In Asia Pacific, the water & wastewater treatment facilities are increasing the utilization of industrial valves significantly. The high per capita income, dense population, rapid urbanization, and large-scale industrialization are the significant factors that are driving the expansion of the industrial valves market in the APAC region.

Free Valuable Insights: Global Industrial Valves Market size to reach USD 91.4 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Emerson Electric Co., Schlumberger N.V., IMI Plc., Crane Co., Flowserve Corporation, Metso Outotec Corporation, The Weir Group PLC, AVK Holding A/S, Avcon Controls Pvt. Ltd., and Forbes Marshall Pvt. Ltd.

By Type

By Material Type

By Application

By Geography

The global Industrial Valves Market size is expected to reach $91.4 billion by 2028.

Technological developments and utilization of IIOT are driving the market in coming years, however, Issues with industrial valves restraints the growth of the market.

Emerson Electric Co., Schlumberger N.V., IMI Plc., Crane Co., Flowserve Corporation, Metso Outotec Corporation, The Weir Group PLC, AVK Holding A/S, Avcon Controls Pvt. Ltd., and Forbes Marshall Pvt. Ltd.

The expected CAGR of the Industrial Valves Market is 5.3% from 2022 to 2028.

The Steel segment acquired maximum revenue share in the Global Industrial Valves Market by Material Type in 2021 thereby, achieving a market value of $36.7 billion by 2028.

The Asia Pacific market dominated the Global Industrial Valves Market by Region in 2021 and would continue to be a dominant market till 2028; thereby, achieving a market value of $33.8 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.