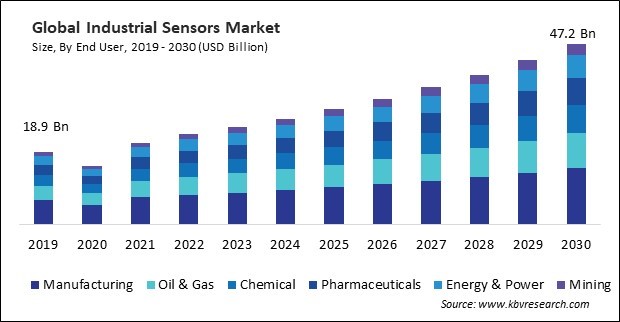

The Global Industrial Sensors Market size is expected to reach $47.2 billion by 2030, rising at a market growth of 9.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,54,445.9 thousand units, experiencing a growth of 11.5% (2019-2022).

Temperature sensors are employed in power plants to monitor temperatures in boilers, turbines, and other components, contributing to efficient and safe energy generation. Consequently, the temperature sensors segment would generate approximately 15.38% share of the market by 2030. Furthermore, research laboratories use temperature sensors to monitor and control temperatures in experiments, ensuring accurate and reproducible results. Thus, the application of temperature sensors in various sectors is propelling the growth of the segment.

The major strategies followed by the market product launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December 2023, Panasonic Life Solutions, a subsidiary of Panasonic Holdings Corporation has unveiled an innovative 6-in-1, 6DoF (Degrees of Freedom) Inertial Sensor. The sensor is made to measure how fast a vehicle speeds up and how it rotates on three different directions, giving important details that improve vehicle safety and stability. In November 2023, Siemens AG launched three new wireless sensors for building management systems (BMS). These sensors offer a measurement accuracy of +/-2%. Additionally, they can measure a temperature range of 0°C – 50°C, humidity range of 0% – 100%, and CO2 concentration range of 0 – 5,000ppm.

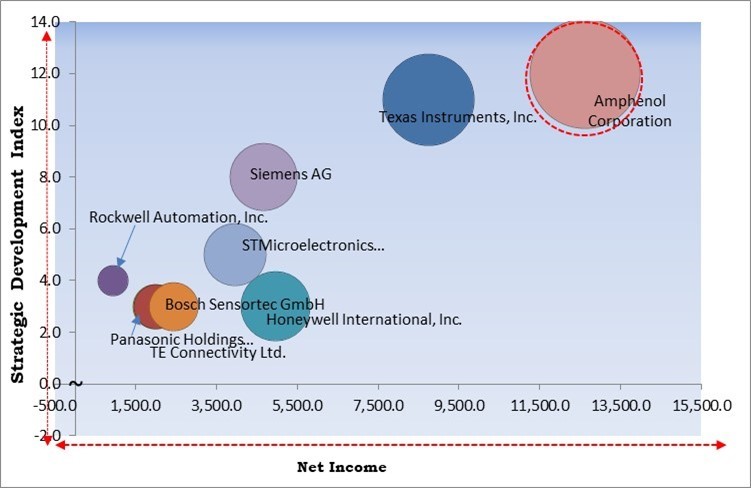

Based on the Analysis presented in the KBV Cardinal matrix; Amphenol Corporation are the forerunners in the Market. And Companies such as Texas Instruments, Inc., Honeywell International, Inc. Siemens AG are some of the key innovators in Market. In August, 2023, Texas Instruments Incorporated launched the TMCS1123 Hall-effect current sensor. With this product, the company aims to assist engineers in making their designs simpler while enhancing accuracy. Furthermore, the new sensor can be used with precision for high voltage systems, boasting the industry's highest reinforced isolation and the highest accuracy over the sensor's lifetime and across various temperatures.

Condition monitoring allows industries to implement preventive maintenance strategies. By continuously monitoring the condition of equipment through sensors, maintenance activities can be scheduled based on actual needs rather than a fixed timetable. This helps in reducing downtime and avoiding costly unscheduled shutdowns. Industrial sensors provide real-time data on temperature, vibration, pressure, and lubrication levels. Monitoring these parameters allows for early detection of abnormalities or wear in machinery components, leading to improved equipment reliability. Therefore, the industry's rising demand for condition monitoring is propelling the market's growth.

Ongoing advancements lead to sensors with improved accuracy and sensitivity. Higher precision in measurements allows industrial processes to achieve greater control and optimization, leading to increased demand for sensors that can provide more accurate data. Advances in sensor miniaturization enable the development of smaller and more compact sensors without compromising performance. In conclusion, the increasing technological advancements in are driving the growth of the market.

The initial investment required to acquire sensors, especially advanced or specialized sensor technologies, can be substantial. These costs include the purchase of sensors and any additional accessories, cabling, or mounting hardware needed for deployment. Integrating industrial sensors into existing infrastructure can be a complex and resource-intensive process. Hence, high investment costs are impeding the growth of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges Based on sensor type, the market is divided into level sensor, temperature sensor, flow sensor, gas sensor, position sensor, pressure sensor, force sensor, humidity sensor, and image sensor. In 2022, the pressure sensor segment held the highest revenue share in the market. Pressure sensors are used in automotive engines to measure manifold absolute pressure (MAP) or barometric pressure. This information is critical for engine management systems, optimizing fuel injection and air-fuel ratio for efficient combustion. Additionally, pressure sensors are used in aircraft for altitude measurement, airspeed monitoring, and cabin pressure control. Therefore, the increasing demand for pressure sensors in the automobile and aircraft industry is driving the growth of the segment.

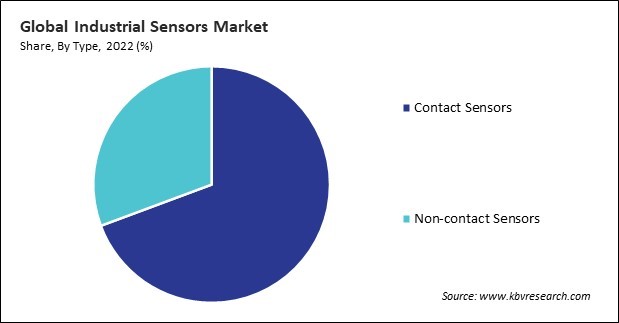

On the basis of type, the market is segmented into contact sensors and non-contact sensors. In 2022, the non-contact sensors segment attained a noteworthy revenue share in the market. In industrial settings, non-contact sensors are widely used for object detection, positioning, and automation. Sensors such as infrared, ultrasonic, and laser sensors are employed to monitor the presence and position of objects on assembly lines, conveyors, and robotic systems. Therefore, the expansion of industries is driving the growth of non-contact sensors.

Based on end user, the market is categorized into manufacturing, oil & gas, chemical, pharmaceuticals, energy & power, and mining. In 2022, the manufacturing segment registered the highest revenue share in the market. Integrating sensors in automated manufacturing processes as part of the fourth industrial revolution (Industry 4.0). Sensors are used in robotic systems, conveyors, and other automated equipment to enable real-time monitoring and control, increasing efficiency and reducing labor costs. Monitoring the condition of machinery and equipment to predict maintenance needs and prevent unexpected downtime.

Free Valuable Insights: Global Industrial Sensors Market size to reach USD 47.2 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated a substantial revenue share in the market. North America has been at the forefront of adopting Industry 4.0 principles and smart manufacturing practices. Integrating sensors in manufacturing processes is a key component of these initiatives, driving the demand for industrial sensors. The region strongly emphasizes automation and robotics across industries such as automotive, aerospace, and electronics. Industrial sensors enable precise control and automation, increasing efficiency and productivity.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 23.6 Billion |

| Market size forecast in 2030 | USD 47.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 9.2% from 2023 to 2030 |

| Number of Pages | 444 |

| Number of Table | 853 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Sensor Type, End User, Region |

| Country scope |

|

| Companies Included | Rockwell Automation, Inc., Honeywell International, Inc., Texas Instruments, Inc., Panasonic Holdings Corporation, STMicroelectronics N.V., TE Connectivity Ltd., Siemens AG, Amphenol Corporation, Bosch Sensortec GmbH, Dwyer Instruments, LLC. |

By Sensor Type (Volume, Thousand Units, USD Billion, 2019-2030)

By Type (Volume, Thousand Units, USD Billion, 2019-2030)

By End User (Volume, Thousand Units, USD Billion, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion, 2019-2030)

This Market size is expected to reach $47.2 billion by 2030.

Rising demand for condition monitoring in industries are driving the Market in coming years, however, High initial investments costs restraints the growth of the Market.

Rockwell Automation, Inc., Honeywell International, Inc., Texas Instruments, Inc., Panasonic Holdings Corporation, STMicroelectronics N.V., TE Connectivity Ltd., Siemens AG, Amphenol Corporation, Bosch Sensortec GmbH, Dwyer Instruments, LLC.

In the year 2022, the market attained a volume of 1,54,445.9 thousand units, experiencing a growth of 11.5% (2019-2022).

The Contact Sensors segment is leading the Market by Type in 2022 there by, achieving a market value of $32.1 Billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $17.1 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.