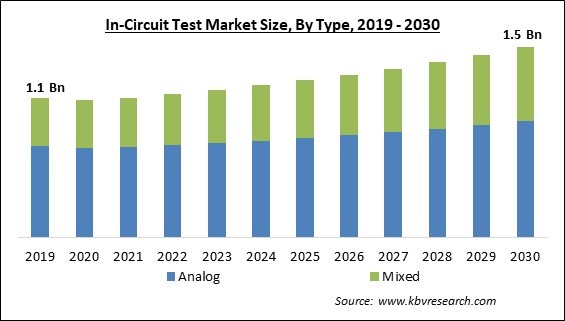

The Global In-Circuit Test Market size is expected to reach $1.5 billion by 2030, rising at a market growth of 3.7% CAGR during the forecast period.

Modern vehicles feature a variety of electronic systems, such as advanced driver-assistance systems (ADAS), engine control units (ECUs), infotainment systems, and electric vehicle components. Integrating these complex electronic systems necessitates exhaustive testing to ensure optimal performance and dependability. Therefore, the Automotive segment registered $74.4 million revenue in the market in 2022. In-circuit testing is utilized at different phases of automobile production, including testing, production, and assembly. In addition, it ensures that the vehicles adhere to the industry's quality standards and safety regulations. The in-circuit test apparatus performs a crucial role in the automotive sector by enabling it to satisfy the ever-changing quality, innovation, performance, and dependability standards. Some of the factors impacting the market are increase in 5G Technology, increasing adoption of Internet of Things and cloud computing, and Insufficient standardization in connectivity protocols and growing PCB design complexity.

Incorporation of complex electronics, such as advanced processors, multiple communication interfaces, and high-frequency components, is required for the implementation of 5G technology. The complexity of these devices, such as 5G handsets, routers, and base stations, presents difficulties regarding functionality, signal integrity, and energy consumption. In-circuit testing is essential for ensuring the correct operation of these complex electronic components, validating signal integrity, and detecting potential manufacturing defects. Additionally, Global adoption of cloud computing and IoT devices has increased significantly in recent years. With increased automation and agility, the requirement to deliver an improved customer experience, increased cost reductions and return on investment, an upsurge in remote work culture acceptance, and the increased popularity of cloud-based business continuity tools and services, cloud computing services are rising. IoT's adoption and growth depend on 5G as a trend. Therefore, the prospects for in-circuit testing to assess the reliability of high-frequency circuits and assure compliance with stringent 5G standards and the rapid adoption of IoT and cloud computing technologies.

However, technological advancements have made PCBs more complex, densely crammed with components, and equipped with advanced functionalities. However, these complexities impose substantial limitations on in-circuit testing techniques. The push for smaller and more compact electronic devices has increased printed circuit boards' miniaturization and component density. Increasing PCB design complexity may necessitate more advanced and sophisticated in-circuit testing equipment to meet testing requirements adequately. The cost of procuring and maintaining these sophisticated instruments may impact the overall earnings of in-circuit test service providers. All of these factors are anticipated to have a negative effect on market growth.

Based on type, the market is categorized into analog and mixed. In 2022, the analog segment held the highest revenue share in the market. This is due to the fact that analog testing is required to ensure the efficacy and performance of different electronic components and circuits. Numerous industries, including automotive, aerospace, and telecommunications, rely heavily on analog signals. Analog testing offers precise measurements and detailed signal analysis. It is, therefore, essential for quality control and product validation in such sectors.

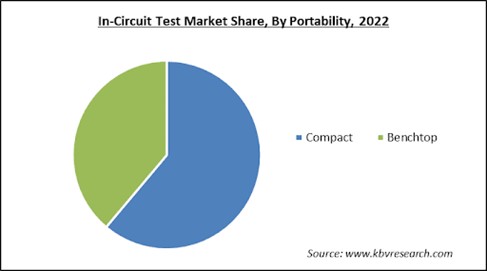

On the basis of portability, the market is segmented into compact and benchtop. In 2022, the benchtop segment acquired a substantial revenue share in the market. Benchtop in-circuit analyzers are utilized for applications including automotive electronics, industrial electronics, consumer electronics, the military, and communication. The expansion of the benchtop market is attributable to the rising demand for advanced consumer electronics.

Based on application, the market is bifurcated into wireless communication, aerospace, defence & government services, consumer electronics & appliances, automotive, medical equipment, and energy. In 2022, the consumer electronics & appliances segment dominated the in-circuit test market by generating the market. Throughout their lifetime, consumer electronics are susceptible to various environmental stresses. In-circuit testing ensures the products fulfil quality standards and are reliable for daily use.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.1 Billion |

| Market size forecast in 2030 | USD 1.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 3.7% from 2023 to 2030 |

| Number of Pages | 233 |

| Number of Table | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Portability, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia Pacific region led the market by generating the highest revenue share in 2022. The expansion of the Asia-Pacific market is primarily fueled by the rising demand for ICT in the region's automotive and consumer electronics sectors. Increasing research and development expenditures in the region are also propelling the market. The growing demand for ICT in North America and Europe's aviation and automotive sectors are also significant markets.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Teradyne, Inc., Test Research, Inc., Keysight Technologies, Inc., Hioki E.E. Corporation, Digitaltest GmbH, Konrad GmbH, Testronics (Catalis Group), SPEA S.p.A., Test Coach Company, LLC. and Okano Electric Co., Ltd.

Free Valuable Insights: Global In-Circuit Test Market size to reach USD 1.5 Billion by 2030

By Type

By Portability

By Application

By Geography

The Market size is projected to reach USD 1.5 billion by 2030.

Increase in 5G Technology are driving the Market in coming years, however, Insufficient standardization in connectivity protocols and growing PCB design complexity restraints the growth of the Market.

Teradyne, Inc., Test Research, Inc., Keysight Technologies, Inc., Hioki E.E. Corporation, Digitaltest GmbH, Konrad GmbH, Testronics (Catalis Group), SPEA S.p.A., Test Coach Company, LLC. and Okano Electric Co., Ltd.

The Compact segment is leading the Market by Portability in 2022; thereby, achieving a market value of $880.8 million by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $560.2 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.