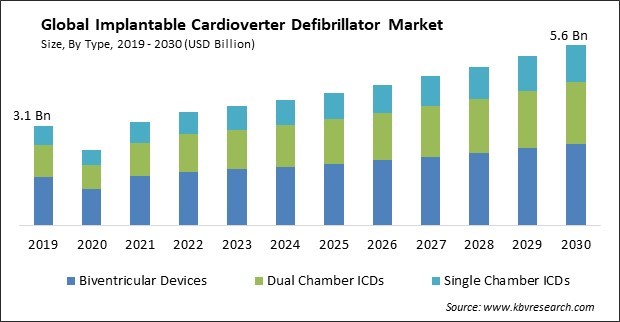

The Global Implantable Cardioverter Defibrillator Market size is expected to reach $5.6 billion by 2030, rising at a market growth of 6.1% CAGR during the forecast period.

The rising incidence of cardiovascular diseases, like heart failure and arrhythmias, contributes to the growing demand for ICDs. Therefore, Dual Chamber ICDs segment would generate $1,164.3 million revenue in the market in 2022. As the global population ages and lifestyle-related risk factors continue to rise, the prevalence of these conditions is expected to increase. CVD, including coronary artery disease and heart failure, is often associated with an increased risk of arrhythmias, including ventricular tachycardia (VT) and ventricular fibrillation (VF). Some of the factors impacting the market are expansion of indications for ICDs, development of MRI-compatible ICDs and high cost and limited accessibility.

Patients with ARVC at risk of ventricular arrhythmias candidates for ICD implantation. ARVC is a rare genetic disorder that affects the heart muscle and can lead to arrhythmias. Patients with inherited LQTS, associated with a higher risk of life-threatening arrhythmias, are considered for ICD therapy if they have experienced syncopal episodes or have a history of cardiac arrest. Brugada syndrome is another inherited arrhythmia disorder that can lead to sudden cardiac arrest. Additionally, the availability of MRI-compatible ICDs has significantly improved patient care by enabling individuals with ICDs to undergo essential MRI scans without needing device removal or the associated risks of potential device interactions during the scan. Additionally, the introduction of MRI-compatible ICDs expanded the ICD potential patient population. Patients often prefer Expanding indications for implantable cardioverter defibrillators (ICDs) have significantly developed the implantable cardioverter defibrillator market and the development of MRI-compatible ICDs represents a significant step forward in patient care, allowing individuals with ICDs to access essential MRI scans without compromising cardiac therapy. Thus, due to the following factors the market will expand.

However, the high cost of ICDs can create financial barriers for some patients, particularly those without adequate health insurance coverage or those living in regions with limited healthcare services. Socioeconomic disparities and disparities in healthcare access can affect who has access to ICD therapy. Some underserved populations face greater challenges in accessing ICDs. Access to specialized healthcare facilities and trained cardiac electrophysiologists who perform ICD implantation procedures are limited in rural or underserved areas. Geographic disparities can affect access to ICD therapy. The cost and accessibility of implantable cardioverter defibrillators are significant challenges in the healthcare landscape.

Furthermore, during the early stages of the pandemic, many hospitals and healthcare facilities postponed elective procedures, including ICD implantations, to prioritize COVID-19 patients and conserve resources. This led to a decline in ICD implantations in some regions. The pandemic accelerated the adoption of remote monitoring technology for ICDs. With in-person visits restricted or discouraged, healthcare providers increasingly relied on remote monitoring to assess device function and patient status. This trend continued even after the pandemic as it offered more flexibility in patient care. While these services are not a replacement for in-person procedures, they played a role in patient monitoring and management. COVID-19 had a moderate effect on the market.

Based on type, the market is classified into single chamber ICDs, dual chamber ICDs, and biventricular devices. The dual chamber ICDs segment acquired a substantial revenue share in the market in 2022. Dual-chamber ICDs have the advantage of monitoring both the atrium and ventricle, which allows for more sophisticated arrhythmia detection algorithms. This improved detection capability can help reduce inappropriate shocks and improve patient outcomes. Many dual-chamber ICDs have pacing capabilities for both the atrium and ventricle. This feature can benefit patients who require physiological pacing to maintain proper heart function, such as those with atrioventricular (AV) block or sick sinus syndrome.

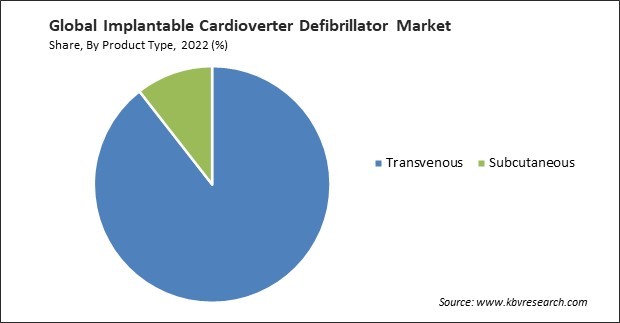

By product type, the market is categorized into transvenous and subcutaneous. In 2022, the transvenous segment held the highest revenue share in the market. Transvenous ICDs suit many patients, including those at risk of sudden cardiac arrest because of various cardiac conditions. This broad patient eligibility expands the potential market for these devices. Ongoing advancements in transvenous ICD technology have led to smaller, more sophisticated devices with improved battery life and advanced arrhythmia detection algorithms. These advancements make transvenous ICDs more appealing to both patients and healthcare providers.

On the basis of NYHA class, the market is divided into NYHA class II and NYHA class III. The NYHA class III segment garnered a significant revenue share in the market in 2022. One of the primary indications for ICD implantation is to reduce the risk of sudden cardiac death in heart failure patients at high risk of ventricular arrhythmias. NYHA Class III patients with specific risk factors, such as a reduced left ventricular ejection fraction (LVEF) or a history of ventricular arrhythmias, are considered for ICD therapy to prevent SCD.

By end-use, the market is fragmented into hospitals, ambulatory surgical centers, and others. In 2022, the hospitals segment registered the maximum revenue share in the market. Hospitals provide a controlled and sterile environment for ICD implantation procedures, ensuring the highest level of care and safety for patients. Hospitals have cardiac electrophysiologists and specialized cardiac teams with extensive training and expertise in ICD implantation, programming, and follow-up care. Leading hospitals have state-of-the-art facilities, including advanced cardiac catheterization labs and operating rooms, essential for ICD implantation procedures.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.5 Billion |

| Market size forecast in 2030 | USD 5.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.1% from 2023 to 2030 |

| Number of Pages | 286 |

| Number of Table | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Product Type, NYHA Class, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. Hospitals, clinics, and other healthcare facilities are well-developed and modernized in North America. Additionally, the region also experiences a high prevalence of cardiovascular diseases (CVD), such as hypertension, necessitating ICDs. The market is further strengthened by significant manufacturers like Medtronic, Abbott, and Boston Scientific Corporation, with Medtronic's launch of extravascular ICDs (EV-ICDs) presenting substantial opportunities. In addition, companies in China, India, and Japan are actively developing and introducing innovative healthcare solutions, driving the development of the regional market.

Free Valuable Insights: Global Implantable Cardioverter Defibrillator Market size to reach USD 5.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Medtronic PLC, Biotronik SE & Co. KG, Boston Scientific Corporation, MicroPort Scientific Corporation, Stryker Corporation, ZOLL Medical Corporation (Asahi Kasei Corporation), LivaNova PLC, Koninklijke Philips N.V. and Getinge AB.

By Type

By Product Type

By NYHA Class

By End-use

By Geography

This Market size is expected to reach $5.6 billion by 2030.

Expansion of indications for ICDs are driving the Market in coming years, however, High cost and limited accessibility restraints the growth of the Market.

Abbott Laboratories, Medtronic PLC, Biotronik SE & Co. KG, Boston Scientific Corporation, MicroPort Scientific Corporation, Stryker Corporation, ZOLL Medical Corporation (Asahi Kasei Corporation), LivaNova PLC, Koninklijke Philips N.V. and Getinge AB

The expected CAGR of this Market is 6.1% from 2023 to 2030.

The Biventricular Devices segment is generating the highest revenue in the Market, By Type in 2022; thereby, achieving a market value of $2.5 billion by 2030.

The North America region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.