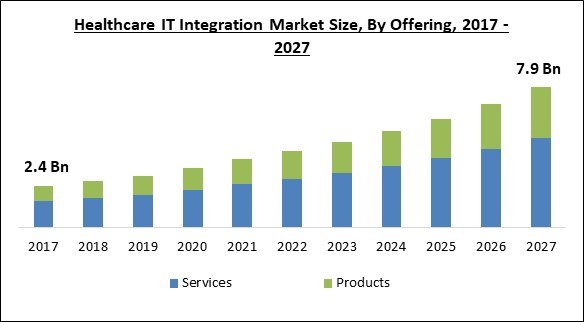

The Global Healthcare IT Integration Market size is expected to reach $7.9 billion by 2027, rising at a market growth of 12.8% CAGR during the forecast period.

Integrating information technology (IT) with healthcare operations is referred to as healthcare IT integration. Information technology (IT) integration in healthcare encompasses a wide range of automated ways for managing information about people's health and healthcare, for both individual and group patients.

Healthcare IT integration is a category of medical gadgets that allows physicians and clinicians to constantly monitor and care for infants and children. These devices can also be used to give the infant drugs, fluids, or even blood, check blood pressure, treat a variety of ailments, and keep track of the baby's status and health.

Healthcare IT integration allows healthcare equipment to collect and share data with the cloud as well as with one another, allowing for the rapid accumulation of data that can be precisely analyzed. IoT integrates sensor output and communications to perform services that were previously considered notional, from tracking and diagnostics to delivery methods. Wearable sensors, cloud-based sensors, and device integrated sensors are all options.

The healthcare business today has a continuous accumulation of patient data to stimulate diagnoses and preventative care, as well as to estimate the likely outcome of preventive therapy, thanks to developments in sensors and ICT. Integration of healthcare IT, such as automatic drug dispensers in hospitals, helps to improve efficiency. These types of integrated devices are also utilized to monitor medicinal cold storage in warehouses and well-funded drug stores with storage areas.

IoT-enabled sensors incorporated in healthcare equipment that monitor the patient's condition during and after surgery or therapy are examples of patient monitoring applications of healthcare IT integration. Patients can also be monitored remotely using these devices. As a result, the market for healthcare IT integration solutions is primarily driven by rising demand for healthcare IT integration.

All healthcare facilities are under tremendous strain as a result of the COVID-19 outbreak, and healthcare facilities around the world have been overloaded as a result of the daily visits of countless patients. In various nations around the world, the increased prevalence of coronavirus disease has fueled demand for accurate detection and treatment equipment.

Connected care technologies have shown to be quite beneficial in this area, since they enable healthcare professionals to track patients using digitally connected noninvasive equipment like home blood pressure monitors and pulse oximeters. Furthermore, the disease's rapid global spread has resulted in a shortage of hospital beds and healthcare staff. As a result, connected medical devices have become more popular for monitoring vital signs, and this trend is expected to continue in the future years. As a result, in the coming years, healthcare IT integration solutions are projected to be widely utilised.

Patient data is generally unstructured, complex, and private. Integrating this data into the healthcare delivery process is a hurdle that must be overcome in order to gain enhanced patient care potential. Despite the fact that EHRs have been in use for over a decade, the market has recently gained up steam as a result of government measures in several nations to increase patient data protection. In the United States, for example, the Health Information Technology for Economic and Clinical Health (HITECH) Act, which was enacted as part of the American Recovery and Reinvestment Act (ARRA), set aside funds to reward hospitals and physicians who demonstrate meaningful use of electronic health records.

Telehealth services are currently in high demand for monitoring and consulting. Delivering instructional content and ensuring uninterrupted contact between patients and healthcare providers has become possible thanks to advancements in healthcare systems. The efficient integration of medical devices and ICT, which helps offer healthcare services over great distances, is critical to the smooth operation of remote patient monitoring solutions. It's tough for doctors and nurses to carry patient records on the fly because they spend so much of their time away from computers in hospitals. As a result, numerous industry participants began to offer mobile platforms for healthcare IT solutions, such as mobile applications.

Patient information is created in all departments and at all points of treatment within the healthcare organization, making it a highly information-intensive industry. However, in order to create comprehensive and reliable patient records, it is critical to provide reliable information by integrating large amounts of data. Because numerous medical devices and diagnostic tools are employed in healthcare systems, there is an increasing need to integrate all of these systems to help healthcare practitioners respond quickly at multiple care delivery points.

Based on Offering, the market is segmented into Services and Products. During the projected period, the products segment is expected to grow at the fastest rate. The increasing deployment of healthcare IT integration solutions to streamline healthcare organizations' workflows, the growing need for data standardisation, and the growing need to build, design, and implement standardised, interoperable networking platforms are expected to propel the healthcare IT integration services market forward during the forecast period.

Based on Services Type, the market is segmented into Support & Maintenance Services and Implementation & Integration Services. In 2020, the support and maintenance services segment acquired the largest revenue share of the Healthcare IT Integration Market. Interoperability and software complexity problems are handled through support and maintenance services. These services ensure that clients (healthcare providers) have access to the vendor's technical knowledge base, receive assistance from its product support team, and learn how to administer applications.

Based on Products Type, the market is segmented into Interface/Integration Engines, Medical Device Integration Software, Media Integration Software, and others. The Medical Device Integration Software segment obtained a significant revenue share of the Healthcare IT Integration Market in 2020. The medical device integration software market is growing due to factors such as increased adoption of EHR systems and other interoperability solutions in healthcare organizations, an increase in regulatory requirements and healthcare reforms, a rising preference for home care settings, and a growing need for integrated healthcare systems to improve healthcare quality and outcomes.

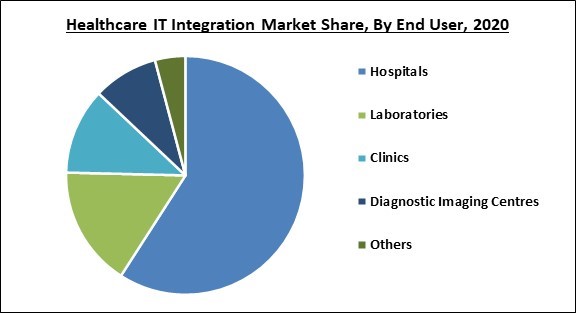

Based on End User, the market is segmented into Hospitals, Laboratories, Clinics, Diagnostic Imaging Centres, and others. In 2020, the Hospitals segment held the maximum revenue share of the Healthcare IT Integration Market. The expanding use of healthcare IT integration solutions in hospitals to maximize value-based payments and the increasing acceptance of medical device integration solutions to minimize medical errors and enhance treatment quality and patient safety are principally responsible for this segment's high share.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.4 Billion |

| Market size forecast in 2027 | USD 7.9 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 12.8% from 2021 to 2027 |

| Number of Pages | 257 |

| Number of Tables | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, North America emerged as the leading region in the overall Healthcare IT Integration Market. Factors such as the widespread adoption of clinical device connectivity and interoperability solutions to reduce rising healthcare costs, the rising number of coronavirus (COVID-19) patients in the United States, and strict rules and guidelines implemented by government and non-government authorities such as the Federal Communications Commission (FCC) and the Centers for Medicare and Medicaid Services (CMS) are driving the growth of the healthcare IT integration market in the region.

Free Valuable Insights: Global Healthcare IT Integration Market size to reach USD 7.9 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens Healthineers AG (Siemens AG), AllScripts Healthcare Solutions, Inc., General Electric (GE) Co. (GE Healthcare), NextGen Healthcare, Inc., Epic Systems Corporation, IBM Corporation, Oracle Corporation, Infor, Inc. (Koch Industries), Koninklijke Philips N.V., and Wipro Limited.

By Offering

By End User

By Geography

The healthcare IT integration market size is projected to reach USD 7.9 billion by 2027.

Telehealth services and remote patient monitoring solutions are in high demand are driving the market in coming years, however, challenges related to data integration limited the growth of the market.

Siemens Healthineers AG (Siemens AG), AllScripts Healthcare Solutions, Inc., General Electric (GE) Co. (GE Healthcare), NextGen Healthcare, Inc., Epic Systems Corporation, IBM Corporation, Oracle Corporation, Infor, Inc. (Koch Industries), Koninklijke Philips N.V., and Wipro Limited.

The Services segment acquired maximum revenue share in the Global Healthcare IT Integration Market by Offering 2020, and would continue to be a dominant market till 2027.

The North America is the fastest growing region in the Global Healthcare IT Integration Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.