The Germany Flavor Drops Market size is expected to reach $9.5 Million by 2030, rising at a market growth of 6.8% CAGR during the forecast period.

The flavor drops market in Germany has witnessed notable growth in recent years. One of the key drivers behind the rising popularity of flavor drops is the increasing awareness of health and wellness among German consumers. With growing concerns about the negative health effects of sugar-laden beverages and snacks, many German consumers are actively seeking out healthier options. Flavor drops provide an attractive solution by allowing individuals to customize the flavor of their beverages or food items without adding excessive amounts of sugar or calories.

Furthermore, the growing trend of customization and personalization in food and beverage consumption has also contributed to the popularity of flavor drops. German consumers today seek products that allow them to tailor their experiences to their individual preferences, and flavor drops provide a convenient and versatile way. With various flavor options available, German consumers mix and match different flavors to create unique combinations.

The distribution landscape for flavor drops in Germany is also evolving, with traditional brick-and-mortar retailers facing increasing competition from online channels. According to the International Trade Administration, in 2022, the e-commerce industry in Germany experienced robust growth, with total sales estimated at USD 141.2 billion. The online population in Germany is expected to climb from 62.4 million in 2020 to an estimated 68.4 million by 2025. In 2022, the industry's online presence in Germany soared to 80%. E-commerce platforms offer German consumers a convenient way to purchase flavor drops from the comfort of their homes, driving further growth in the flavor drops market.

Moreover, COVID-19 has had a mixed impact on the flavor drops market in Germany. The pandemic has heightened consumer health awareness, leading to increased demand for products that promote wellness and immune support. This has driven sales of certain types of flavor drops, particularly those fortified with vitamins and antioxidants. However, the economic uncertainty and restrictions imposed during the pandemic have led to changes in consumer behavior and spending patterns, impacting overall consumption levels in the industry.

Germany's food and beverage industry has experienced significant expansion in the flavor drops market. One key driver of this expansion is the growing trend towards healthier lifestyles and the increasing awareness of the impact of sugar consumption on health. As German consumers seek to reduce their sugar intake, they turn to alternatives such as flavor drops to add taste to their food and beverages without the added calories or sugars.

In addition, the food service industry has also embraced flavor drops as a versatile ingredient for creating unique culinary experiences. According to the U.S. Department of Agriculture, there was a notable uptick in German food service sales in 2021, registering a 0.6% increase to $76 billion. Hotel sales experienced a modest rise from $22.7 billion in 2020 to $24.2 billion in 2021. Restaurants, cafes, and bars incorporate flavor drops into their menus to craft signature dishes, cocktails, and beverages, catering to German consumers' desire for novel and Instagram-worthy experiences.

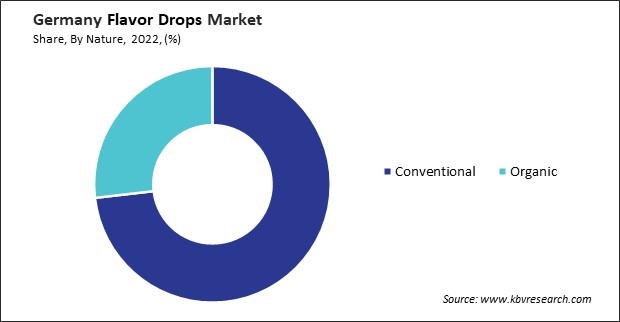

Furthermore, manufacturers in the food and beverage industry in Germany have responded to the demand for flavor drops by introducing innovative products tailored to specific dietary preferences and lifestyle choices. This includes organic, vegan, and gluten-free flavor drops, appealing to diverse consumers with varying dietary needs and preferences. Hence, the flourishing flavor drops market in Germany reflects a shift towards healthier choices, culinary innovation, and diverse consumer preferences in the food and beverage industry.

In recent years, Germany has witnessed a significant surge in home cooking and mixology popularity, catalyzing a notable increase in the flavor drops market. One of the primary drivers behind the rise of home cooking in Germany is the growing emphasis on health and wellness. With an increasing awareness of the ingredients used in processed foods and a desire to adopt healthier lifestyles, many Germans are turning to home-cooked meals as a way to exercise greater control over their diets.

Moreover, the proliferation of culinary content on social media platforms has fueled interest in cooking and mixology among Germans. Platforms like Instagram and YouTube are awash with aesthetically pleasing food and beverage tutorials, inspiring individuals to experiment with new flavors and techniques in their kitchens. Flavor drops, with their versatility and wide range of options, enable amateur chefs and aspiring mixologists to replicate popular recipes or concoct innovative creations easily, further driving the demand for these products.

Furthermore, the rise of mixology as a popular pastime has contributed to the growth of the flavor drops market in Germany. As German consumers increasingly seek to craft artisanal cocktails and mocktails in the comfort of their homes, they rely on flavor drops to add depth and complexity to their beverages, transforming ordinary drinks into extraordinary libations. Therefore, the surge in home cooking and mixology in Germany, fueled by a desire for health, wellness, and creative culinary expression, has propelled the flavor drops market to new heights.

The flavor drops market in Germany reflects a diverse landscape with various companies vying for consumer attention in this segment. One of the prominent players in the German flavor drops market is Monin. Monin has established a strong presence in Germany with its high-quality syrups and flavorings. The company offers an extensive selection of flavor drops in a liquid form, ranging from classic fruit flavors like strawberry and raspberry to more exotic options such as lavender and gingerbread. Monin's products are widely used by consumers and professionals in the food service industry, including cafes, bars, and restaurants, making it a popular choice among German consumers seeking to enhance the flavor of their beverages and culinary creations.

Another key player in the German flavor drops market is Dr. Oetker. Known for its wide range of baking and dessert products, Dr. Oetker also offers flavor drops specifically designed for baking and cooking. These flavor drops come in concentrated form, allowing consumers to easily add flavor to their recipes without altering the texture or consistency of the final product. Dr. Oetker's flavor drops are available in various flavors, including vanilla, almond, and lemon, making them versatile ingredients for sweet and savory dishes.

In addition to these established brands, smaller and niche players are also making waves in the German flavor drops market. For example, Flavor Drops GmbH specializes in natural and organic flavor extracts from high-quality ingredients. The company's products are free from artificial additives and preservatives, appealing to German consumers who prioritize clean-label and sustainable products. Flavor Drops GmbH offers a range of flavors, including citrus, berry, and herbal varieties, catering to diverse culinary preferences.

Furthermore, the German flavor drops market has witnessed the rise of private label brands offered by retailers such as Aldi, Lidl, and Edeka. These private label products provide consumers with affordable options while delivering on taste and quality. With their extensive distribution networks and competitive pricing strategies, private label brands have gained popularity among German consumers seeking value-for-money flavor drops.

Moreover, international players such as The Hershey Company and McCormick & Company have also entered the German flavor drops market, leveraging their global presence and brand recognition to capture industry share. These companies offer various flavor drops under their respective brands, catering to different consumer preferences and usage occasions. With the growing demand for convenient and customizable flavor solutions, the German flavor drops market is expected to expand.

By Content Type

By Nature

By Flavor Type

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.