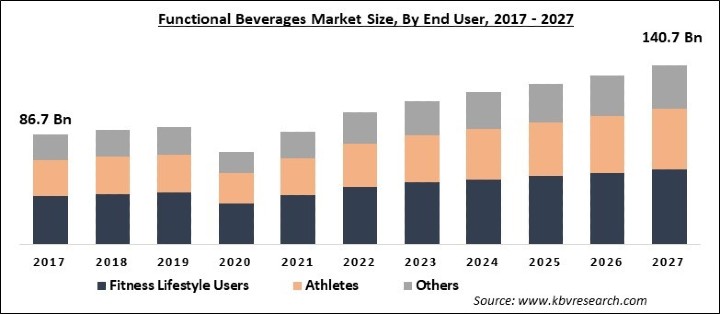

The Global Functional Beverages Market size is expected to reach $140.7 billion by 2027, rising at a market growth of 8% CAGR during the forecast period. The presence of nontraditional ingredients such as minerals, probiotics, various artificial ingredients, and raw fruit are present in functional beverages makes them highly popular among the masses. These beverages offer nutritional value as well as health benefits and have positive effects on the mind & body.

The functional beverages market is witnessing considerable growth due to the shifting preferences of customers towards a healthy lifestyle and the growing number of fitness enthusiasts. In addition, people are participating in sports at international and national levels, leading to a rise in the number of athletes, thereby boosting the demand & growth of functional beverages in the global market. These beverages are excessively utilized to increase stamina and improve the mental alertness of the human body. In addition, customers are largely shifting from carbonated beverages to healthy beverages, which is expected to surge the demand for functional beverages and would create new growth opportunities for the players operating in the global market.

Moreover, processing companies in this market are introducing beavers that contain low fat and calorie and adding vegetable & fruit flavoring additives to offer a unique taste to the rising number of casual users for sports and energy drinks. Casual users signify those customers who consume functional beverages just for fun and taste. Distribution channels have a significant role in the growth of the market. Distributional channels like hypermarkets, supermarkets, and specialty stores have high availability of functional beverages, thereby boosting the growth of the global market.

The outbreak of the COVID-19 has created a panic situation across the world and had a negative impact on several industries. During this pandemic, people started focusing on their health and have started consuming healthy beverages as well as foods. This led to fuel the demand for functional products as they help in boosting the immunity. Moreover, the effects of the coronavirus were mainly witnessed on the people having weak immune system. This is the major reason behind choosing functional foods and beverages as the integral part of the diet.

However, the functional beverages market witnessed a slow down during the COVID-19 as WHO announced it a public health emergency across the world. Several nations also witnessed lockdowns, which banned traveling and movements. Due to this, supply chains of functional drinks witnessed disruptions across the globe for a longer period, which has hampered the growth of the functional beverages market. Whereas, it is estimated that in the post-COVID period, the market will exhibit rapid growth, owing to increased demand from customers, innovation in the existing products, and increased awareness about these products.

The customer’s purchasing attitude is influenced by the growing number of organic, non-GMO, and clean-label products. This has resulted in changing the customer preferences from fruit juices and carbonated drinks to functional drinks, which is anticipated to surge the demand for such drinks over the forthcoming years. To fulfill the growing demand and offer an emotional appeal to the customer, the manufacturers are using natural, non-GMO, and clean label ingredients during the preparation time of functional beverages.

The objective of these beverages is to improve the body functionalities such as digestive health, weight management, immune system, and management of heart rate. In addition, these drinks contain amino acids, herbs, vitamins, and minerals. The presence of these nutritional components helps in reducing health issues due to which, customers are changing their preferences and inclining towards these functional drinks.

The functional drinks are made from naturally sourced ingredients due to which, they are expensive in comparison to other drinks. For instance, dry beverage mixes offer high nutrients replacing the requirement of functional drinks, have low transportation costs, and are cost-effective. The manufacturing and commerce factors of functional drinks are very complicated, uncertain, and expensive.

Based on End User, the market is segmented into Fitness Lifestyle Users, Athletes and Others. The fitness lifestyle users are a changing category of the health & fitness conscious category as customers have integrated fitness & sports activities into their daily life activities. In addition, the number of fitness lifestyle users is growing due to the rising awareness and health concerns about the benefits offered by yoga and daily exercise.

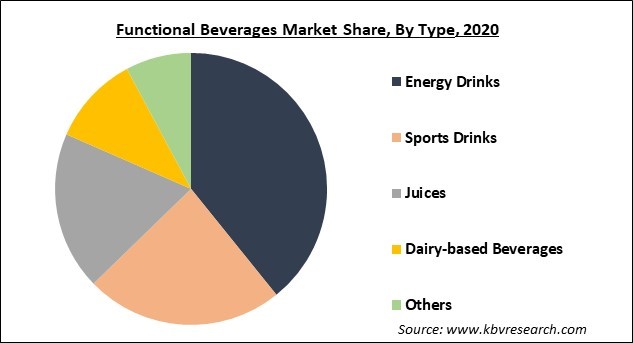

Based on Type, the market is segmented into Energy Drinks, Sports Drinks, Juices, Dairy-based Beverages and Others. In 2020, the energy drinks segment dominated the functional beverages market and would exhibit similar kind of trend even during forecasting years. Energy drinks offer physical & mental stimulation and instant energy. These drinks contain caffeine as a key ingredient, which offers stimuli to the body. In addition to this, they also contain taurine as one of the key ingredients that are important for the function and development of cardiovascular and skeletal muscle respectively.

Based on Distribution Channel, the market is segmented into Supermarket/Hypermarket, Specialty Stores, E-commerce and Others. Supermarkets & hypermarkets are focusing on increasing their product sales to improve their revenue share. Such stores also showcase a wide range of functional beverages products of varied brands. Further, the customers in regions like Europe and North America prefer supermarkets & hypermarkets for buying consumer goods. In the well-established and emerging region, the supermarkets & hypermarkets are gaining traction due to the growing working-class population and competitive prices, and rising urbanization.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 73 Billion |

| Market size forecast in 2027 | USD 140.7 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 8% from 2021 to 2027 |

| Number of Pages | 234 |

| Number of Tables | 384 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | End User, Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America holds the major revenue share of the market in 2020. The demand for dairy-based beverages and sports drinks is increasing in the market as these drinks help in improving stamina and performance of fitness lifestyle users & athletes. Moreover, the presence of key sports & energy functional beverages players such as Red Bull GmbH, Dr. Pepper Snapple Group Inc., and Monster Beverage Corp in this region would further drive the market growth in the region. Thus, the aforementioned factors are accountable to accelerate the regional functional beverages market.

Free Valuable Insights: Global Functional Beverages Market size to reach USD 140.7 Billion by 2027

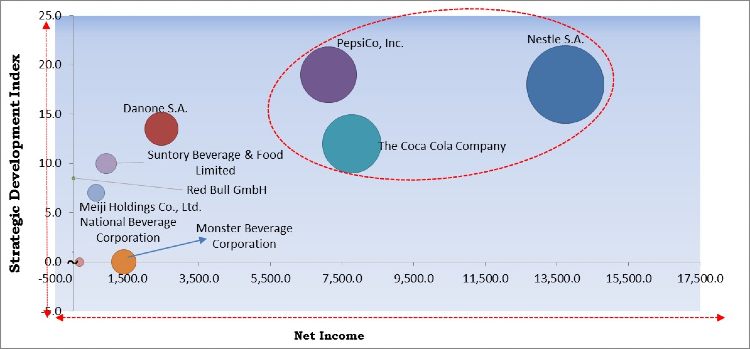

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; PepsiCo, Inc., The Coca Cola Company and Nestle S.A. are the forerunners in the Functional Beverages Market. Companies such as Monster Beverage Corporation, Suntory Beverage & Food Limited, National Beverage Corporation are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include PepsiCo, Inc., The Coca Cola Company, Nestle S.A., Danone S.A., Meiji Holdings Co., Ltd., Monster Beverage Corporation, Suntory Beverage & Food Limited, National Beverage Corporation, Red Bull GmbH, and Clif Bar & Company.

By End User

By Type

By Distribution Channel

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.