“Global Freight Forwarding Market to reach a market value of USD 310.11 Billion by 2032 growing at a CAGR of 5.0%”

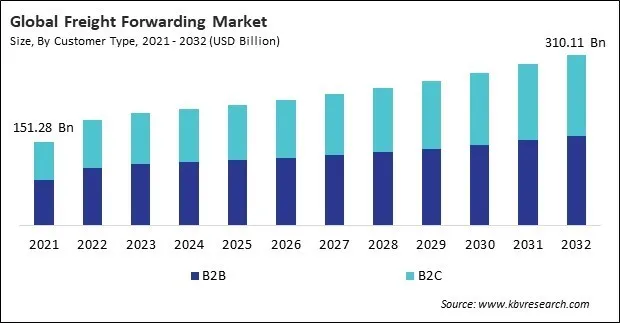

The Global Freight Forwarding Market size is expected to reach $310.11 billion by 2032, rising at a market growth of 5.0% CAGR during the forecast period.

Business-to-Business (B2B) customers form the backbone of the freight forwarding market, comprising enterprises that require large-scale, consistent, and highly coordinated logistics solutions. This customer segment typically includes manufacturers, exporters, wholesalers, distributors, and multinational corporations. Their primary logistics needs revolve around the movement of high-volume goods—often across international borders—requiring multimodal transport solutions, warehousing, customs clearance, inventory control, and regulatory compliance.

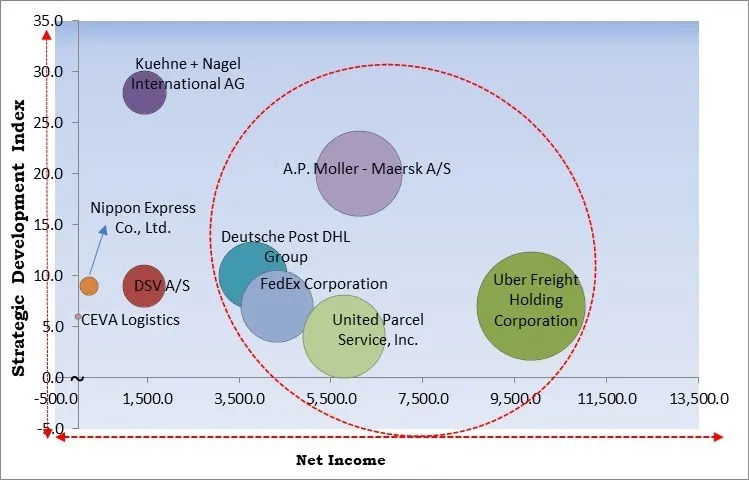

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2025, Kuehne + Nagel International AG unveiled an air freight carrier engagement program focused on sustainability. This initiative encourages airline partners to improve carbon efficiency and transparency in air cargo operations. It aligns with growing industry demands for greener logistics, further positioning Kuehne+Nagel as a sustainability-driven freight forwarding leader. Moreover, In May, 2025, DSV A/S unveiled a dedicated air freight charter service between Chicago and Shanghai to enhance supply chain efficiency and reduce transit times. This new route aims to meet the growing demand for reliable, time-sensitive logistics, reinforcing DSV’s global freight forwarding capabilities between North America and Asia.

Based on the Analysis presented in the KBV Cardinal matrix; Deutsche Post DHL Group, FedEx Corporation, A.P. Moller - Maersk A/S, Uber Freight Holding Corporation, and United Parcel Service, Inc. are the forerunners in the Freight Forwarding Market. In June, 2025, Deutsche Post DHL Group unveiled Xcelerate, a premium airport-to-airport cargo service designed to offer faster transit times and higher reliability. This new solution enhances DHL’s air freight capabilities, supporting global supply chains with speed-focused logistics, especially for time-sensitive goods, thereby strengthening its position in the competitive freight forwarding market. Companies such as Kuehne + Nagel International AG, DSV A/S, and Nippon Express Co., Ltd. are some of the key innovators in Freight Forwarding Market.

The COVID-19 pandemic severely disrupted global supply chains, leading to widespread delays and cancellations in freight forwarding operations. As countries enforced lockdowns and travel restrictions, international shipping routes were curtailed, and port operations were scaled down or halted entirely. This sudden contraction in logistics capacity made it increasingly difficult for freight forwarders to manage shipments efficiently, resulting in bottlenecks across critical transport corridors. During the height of the pandemic, demand volatility created an unpredictable market environment. Many manufacturers paused production due to health concerns and labor shortages, leading to inconsistent cargo volumes and idle capacity for freight forwarders. This mismatch between supply and demand not only decreased profitability but also forced logistics providers to re-evaluate existing contracts and operational strategies, further straining the market.Thus, the COVID-19 pandemic had a negative impact on the market.

The most significant driver of the freight forwarding market is the sustained growth in global trade volumes, complemented by the explosive rise in cross-border e-commerce. As globalization has intensified, the interdependence of nations for goods, components, and raw materials has become a norm, compelling the seamless movement of freight across continents. Emerging economies are increasingly integrating into global value chains, pushing the demand for freight forwarding services that can navigate the complex regulatory, logistical, and infrastructure requirements of cross-border trade. In conclusion, the growing scale and complexity of global trade and cross-border e-commerce have directly boosted the need for efficient, compliant, and scalable freight forwarding services.

Additionally, Technology has become a cornerstone in transforming freight forwarding operations, making it one of the most critical drivers of market growth. With increasing expectations for real-time visibility, rapid delivery, cost optimization, and streamlined communication, freight forwarders are investing heavily in digital platforms, automation tools, and smart logistics systems. Transportation Management Systems (TMS), Warehouse Management Systems (WMS), and Freight Management Software (FMS) are now integrated into operations, offering end-to-end visibility across the supply chain. Therefore, the integration of digital technologies across every node of the logistics ecosystem has not only increased operational efficiency but also enhanced service transparency and customer satisfaction.

One of the most significant restraints impacting the freight forwarding market is the persistent volatility in global trade dynamics and the growing frequency of geopolitical disruptions. Freight forwarding, by nature, is deeply tied to international commerce. It thrives on open trade routes, predictable policies, and stable economic relations among nations. However, over the past decade, the landscape of international trade has become increasingly unpredictable due to the proliferation of protectionist policies, trade wars, sanctions, and diplomatic rifts. In conclusion, the fragility of the global trade environment and persistent geopolitical uncertainties pose a major challenge to the freight forwarding industry.

The value chain of the Freight Forwarding Market starts with Market Demand & Customer Acquisition, identifying client needs and generating business. It proceeds with Quotation & Freight Negotiation to finalize costs, followed by Cargo Pickup & Inland Transportation for goods collection. Documentation & Regulatory Compliance ensures legal and procedural adherence, leading to Freight Execution. After Customs Clearance, goods undergo Cargo Handling & Storage, and Specialized Freight Solutions optimize transport. The process concludes with Last-Mile Delivery & Final Distribution, supported by After-Sales Service & Performance Monitoring, fostering customer satisfaction and continuous improvement.

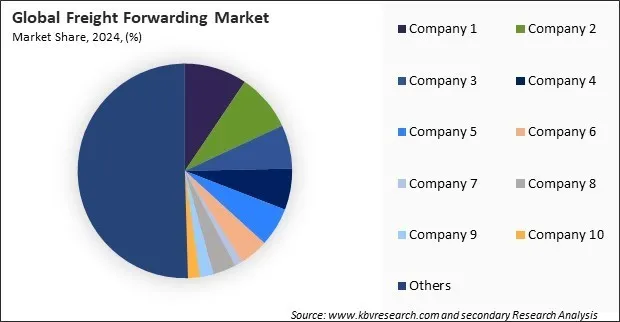

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Global Freight Forwarding Market size to reach USD 310.11 Billion by 2032

Based on customer type, the freight forwarding market is characterized into B2B and B2C. The B2C segment procured 46% revenue share in the freight forwarding market in 2024. This segment is designed to serve individual consumers, e-commerce platforms, and personal parcel shipments. Key features include handling small, frequent orders, streamlined order fulfillment, and efficient last-mile delivery solutions. Services commonly offer door-to-door shipping, user-friendly online booking platforms, transparent pricing, and real-time tracking updates.

| Category | Details |

|---|---|

| Use Case Title | Confidential |

| Date | 2025 |

| Entities Involved | Confidential |

| Objective | To enable fast, affordable, and traceable cross-border parcel delivery for individual consumers purchasing through eCommerce platforms in South Asia and Africa. |

| Context and Background | The rise of B2C cross-border eCommerce created demand for affordable shipping with reliable delivery timelines. Traditional freight models were unfit for high-volume, low-value parcels. Logistics tech players began to build scalable, algorithm-driven last-mile ecosystems optimized for the B2C segment. |

| Description | Shopify partnered with Delhivery and AliExpress to deploy a tech-enabled freight solution that connects Chinese and Southeast Asian exporters directly to end consumers in India and Kenya. The stack included:

|

| Key Capabilities Deployed |

|

| Benefits |

|

| Source | Confidential |

On the basis of mode of transport, the freight forwarding market is classified into road, maritime, rail, and air. The maritime segment recorded 25% revenue share in the freight forwarding market in 2024. Maritime freight forwarding is essential for international trade, especially for transporting bulk and heavy cargo over long distances. It is a cost-effective option for industries dealing with large shipments such as automobiles, electronics, industrial machinery, and raw materials. Ports act as key logistical hubs, supporting integrated supply chain functions like storage, customs handling, and distribution.

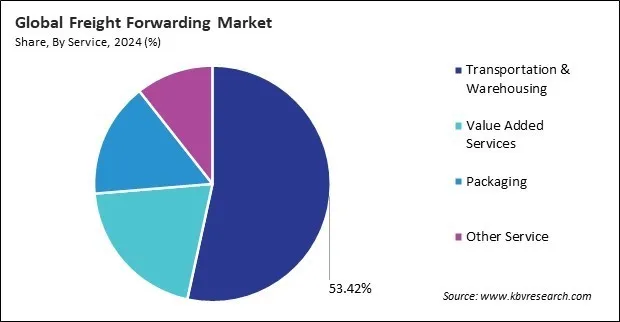

By service, the freight forwarding market is divided into transportation & warehousing, value added services, packaging, and service. The value added services segment garnered 20% revenue share in the freight forwarding market in 2024. Value added services in freight forwarding go beyond the basic transportation and storage offerings, enhancing the overall logistics experience for clients. These services may include customs brokerage, cargo insurance, documentation handling, tracking solutions, freight consolidation, and reverse logistics.

Based on application, the freight forwarding market is segmented into industrial & manufacturing, retail & e-commerce, food & beverages, healthcare, oil & gas, media & entertainment, and others. The retail & e-commerce segment acquired 18% revenue share in the freight forwarding market in 2024. The retail and e-commerce segment has seen rapid growth in demand for agile and scalable freight forwarding solutions. This sector requires fast, reliable, and cost-effective logistics to meet consumer expectations for quick deliveries and hassle-free returns. Freight forwarders help retailers and online marketplaces manage high shipment volumes, coordinate last-mile delivery, and optimize warehousing and inventory management.

Region-wise, the freight forwarding market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired 34% revenue share in the freight forwarding market in 2024. Asia Pacific represents the largest and most dynamic region in the freight forwarding market, fueled by rapid industrialization, high export-import volumes, and expanding manufacturing hubs. Major economies such as China, India, Japan, and Southeast Asian nations contribute significantly to global trade, requiring robust logistics support.

The Freight Forwarding Market remains highly fragmented and competitive, dominated by regional firms and specialized providers. Smaller companies compete on pricing, personalized services, and niche expertise in specific trade routes or industries. Technological adoption, such as digital platforms and real-time tracking, is crucial for differentiation. This creates opportunities for agile players to capture market share and build customer loyalty.

| Report Attribute | Details |

|---|---|

| Market size value in 2024 | USD 211.94 Billion |

| Market size forecast in 2032 | USD 310.11 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 5.0% from 2025 to 2032 |

| Number of Pages | 432 |

| Number of Tables | 504 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Customer Type, Mode of Transport, Service, Application, Region |

| Country scope |

|

| Companies Included | Kuehne + Nagel International AG (Kuehne Holding AG), Deutsche Post DHL Group (The Deutsche Post AG), Deutsche Bahn AG (DB Schenker), DSV A/S, FedEx Corporation, Nippon Express Co., Ltd., A.P. Moller - Maersk A/S, CEVA Logistics (CMA CGM Group), Uber Freight Holding Corporation (Uber Technologies, Inc.), and United Parcel Service, Inc. |

By Customer Type

By Mode of Transport

By Service

By Application

By Geography

This Market size is expected to reach $310.11 billion by 2032.

Expansion Of Global Trade And Cross-Border E-Commerce are driving the Market in coming years, however, Global Trade Volatility And Geopolitical Instability restraints the growth of the Market.

Kuehne + Nagel International AG (Kuehne Holding AG), Deutsche Post DHL Group (The Deutsche Post AG), Deutsche Bahn AG (DB Schenker), DSV A/S, FedEx Corporation, Nippon Express Co., Ltd., A.P. Moller - Maersk A/S, CEVA Logistics (CMA CGM Group), Uber Freight Holding Corporation (Uber Technologies, Inc.), and United Parcel Service, Inc.

The expected CAGR of this Market is 5.0% from 2023 to 2032.

The B2B segment captured the maximum revenue in the Market by Customer Type in 2024, thereby, achieving a market value of $162.8 billion by 2032.

The Asia Pacific region dominated the Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $110.3 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges