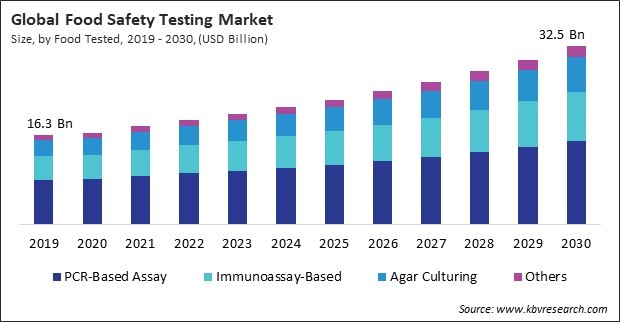

The Global Food Safety Testing Market size is expected to reach $32.5 billion by 2030, rising at a market growth of 7.1% CAGR during the forecast period.

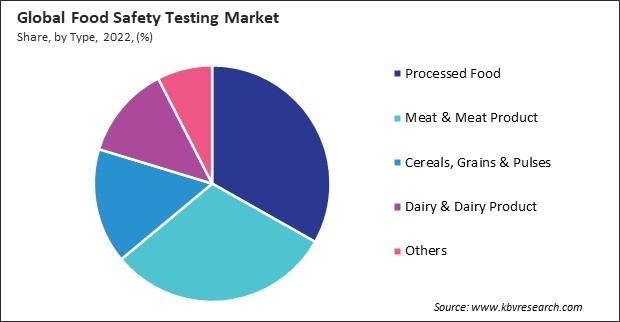

The diversity and complexity of these products necessitate comprehensive testing protocols to address the unique challenges associated with each type. Therefore, the dairy and dairy product segment captured $2,433.6 million revenue in the market in 2022. Testing methods need to be tailored to detect specific contaminants relevant to the dairy industry. Therefore, these factors will fuel the demand in the segment.

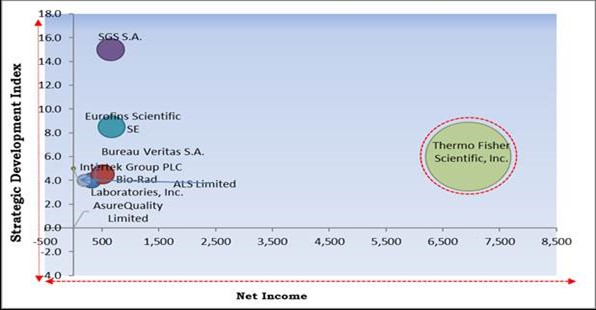

The major strategies followed by the market participants is Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November 2022, SGS S.A. took over Industry Lab, Laboratory in Bucharest, Romania. Through this acquisition, SGS S.A. would expand the range of testing services available for the food market in Romania.Additionally, In April, 2019, Bureau Veritas S.A. took over Shenzhen Total-Test Technology, a consulting and commercial services company. Through this acquisition, Bureau Veritas S.A. would extend its presence in the Chinese market for food safety and quality.

Based on the Analysis presented in the KBV Cardinal matrix; Thermo Fisher Scientific, Inc. is the forerunners in the Food Safety Testing Market In February, 2021, Thermo Fisher Scientific, Inc. took over Mesa Biotech, Inc., a privately held point-of-care molecular diagnostic company. Through this acquisition, Thermo Fisher would enhance manufacturing capacity, optimize cost-effectiveness, and expedite the introduction of diagnostics to the market on a larger scale. Companies such as Eurofins Scientific SE, SGS S.A. and Bureau Veritas S.A. are some of the key innovators in Food Safety Testing Market.

The rising concerns about foodborne illnesses and contamination have prompted government authorities worldwide to implement stringent food safety regulations. In response to these regulations, businesses operating in the food industry need to comply with rigorous testing protocols. The primary objective of stringent its regulations is to protect public health. Contaminated or unsafe food can lead to widespread outbreaks of foodborne illnesses, threatening consumers. Governments enforce regulations that mandate comprehensive testing throughout the food supply chain to mitigate the potential for contamination and protect public health. Additionally, the global nature of the food supply chain increases the risk of contamination events that can have widespread consequences. It is a preventive measure, helping identify potential contaminants before products reach consumers and preventing large-scale outbreaks. Traceability is essential in the global food supply chain to track the origin and movement of food products. Comprehensive testing contributes to traceability efforts, enabling rapid identification and containment of issues. Transparent communication about testing results builds trust among stakeholders. Protecting their brand and managing their reputation is crucial for food manufacturers in a global market. Implementing robust testing measures demonstrates a commitment to quality and safety, safeguarding the brand and maintaining consumer confidence. Hence, these aspects will help in the expansion of the market.

Acquiring equipment and infrastructure for molecular and DNA-based testing involves a substantial initial capital investment. Smaller food businesses operating with limited financial resources may find it difficult to allocate significant funds to purchase the required technology. Implementing molecular and DNA-based testing may necessitate developing or modifying laboratory infrastructure. This incurs additional costs for creating a suitable environment, including laboratory space, equipment, and safety measures, which can challenge smaller businesses. Smaller businesses may face challenges allocating resources for training programs to ensure staff competence. Thus, these factors will limit the expansion of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges On the basis of technology, the market is divided into agar culturing, PCR-based assay, immunoassay-based, and others. The agar culturing segment recorded a considerable revenue share in the market in 2022. Agar culturing remains a reliable and widely accepted method for isolating and identifying microorganisms. Its versatility allows cultivating a broad spectrum of bacteria, yeasts, and molds, making it a comprehensive tool in the testing. Agar culturing applies to various microorganisms, including pathogenic bacteria, indicator organisms, and spoilage microflora. This versatility makes it a valuable technique for assessing the microbiological quality of diverse food products. Hence, there will be increased growth in the segment.

Based on type, the market is segmented into pathogen, genetically modified organism (GMO), chemical & toxin, and others. The pathogen segment held the largest revenue share in the market in 2022. The rising incidence of foodborne illnesses, often attributed to pathogenic contamination, has heightened concerns about it. This trend has underscored the criticality of rigorous testing protocols to identify and avert the transmission of detrimental pathogens throughout the food supply chain. Pathogens such as Salmonella, Escherichia coli (E. coli), Listeria, and Campylobacter are associated with severe foodborne illnesses. Governments and public health agencies prioritize detecting and controlling these pathogens to protect public health and reduce the economic burden of foodborne diseases. Hence, these aspects will lead to increased demand in the segment.

Based on food tested, the market is divided into meat & meat product, dairy & dairy product, cereals, grains & pulses, processed food, and others. The processed food segment held the highest revenue share in the market in 2022. Processed foods often involve complex formulations and multiple ingredients. The diverse nature of these products, which can include additives, preservatives, and flavorings, necessitates comprehensive testing to verify the safety and quality of the final products. Thus, the segment will witness an increased demand in the upcoming years.

Free Valuable Insights: Global Food Safety Testing Market size to reach USD 32.5 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a considerable revenue share in the market. The European Union (EU) has established stringent its regulations and standards. Compliance with these regulations is mandatory for food producers and distributors, driving the demand for comprehensive testing to meet regulatory requirements. Therefore, these aspects will fuel the demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 19.1 Billion |

| Market size forecast in 2030 | USD 32.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.1% from 2023 to 2030 |

| Number of Pages | 267 |

| Number of Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Food Tested, Technology, Region |

| Country scope |

|

| Companies Included | SGS S.A., Eurofins Scientific SE, Intertek Group PLC, Bureau Veritas S.A., ALS Limited, TUV SUD, AsureQuality Limited, Agrolabo S.p.A., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc. |

By Food Tested

By Technology

By Type

By Geography

This Market size is expected to reach $32.5 billion by 2030.

Stringent regulatory standards in the food sector are driving the Market in coming years, however, High cost of advanced testing technologies restraints the growth of the Market.

SGS S.A., Eurofins Scientific SE, Intertek Group PLC, Bureau Veritas S.A., ALS Limited, TUV SUD, AsureQuality Limited, Agrolabo S.p.A., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc.

The expected CAGR of this Market is 7.1% from 2023 to 2030.

The PCR-Based Assay market is leading the Market by Technology in 2022; there by, achieving a market value of $15.3 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $10.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.