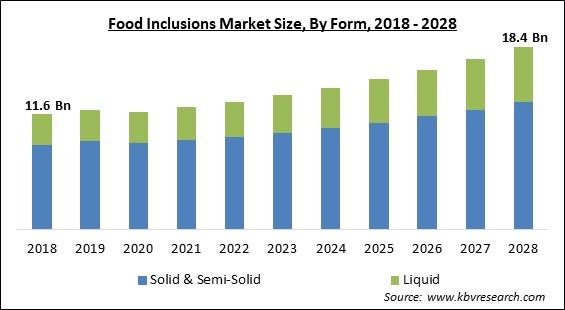

The Global Food Inclusions Market size is expected to reach $18.4 billion by 2028, rising at a market growth of 6.1% CAGR during the forecast period.

Food inclusions are ingredients that are found in food to enhance its organoleptic qualities or texture. The sensory characteristics of food products can also be improved by using food inclusions. Food inclusions are extra ingredients that give food products value. Food inclusions are getting more and more common because they can give food products any desired flavor and texture.

Food inclusions that contribute to a product's health benefits are gaining popularity. Additionally, food inclusions have a wide range of uses, including in bakery goods, breakfast cereals, dairy and frozen desserts, as well as chocolate and confectionery products. Food inclusions are substances that are added to food to improve its sensory, aesthetically pleasing, and organoleptic qualities.

Dry fruits, nuts, chocolates, fruit chunks, herbs, and spices are a few commonly used food inclusions. The ability of food inclusions to add flavor, color, aroma, and textural components to food products is attracting the consumers as well as manufacturers. The food inclusion market will be driven by consumers' growing preference for food products with added value, such as frosting with edible glitter and cake batter with candy confetti.

Customer interest in plant-based foods and healthy snacks is growing, which is driving demand for food products that contain nuts, seeds, and particular herbs. Consumers appear to be more open to try new things when they are added with a twist, such as melon seeds as well as lotus seeds in smoothie bowls, according to the food industry. To give the food products a variety of tastes, food inclusions come in a variety of flavors, including savory, chocolate, caramel, fruit flavors, and caramel.

The consumer's desire for new & innovative products to engage in different culinary adventures is also influencing market trends for food inclusions in an effort to break free from the monotonous routine imposed by the lockdown. Growing demand for fruits and nuts is anticipated in the coming years due to their potential for improving health. Since people are unable to travel & experience the exotic flavors of various regions & countries, travel restrictions are having an impact on flavor trends in food products and beverages. Therefore, despite having a negative effect on the production & supply of food inclusions, the COVID-19 pandemic has had a positive impact on market product trends.

The food and beverage industry is undergoing a number of innovations as consumer taste preferences shift. The food and beverage manufacturers are creating products with distinctive flavors because consumers are eager to try new and appealing products with flavor variety and other attributes. For instance, chocolate producers typically use fruits like strawberries, raspberries, and cherries, but they are now also incorporating peaches into their products. Similar to how hazelnuts, almonds, and peanuts are three of the most widely consumed nuts, chocolate producers are now also incorporating pistachio, flax, and sunflower seeds into their confections.

The demand for goods like food inclusions has accelerated as a result of the increased demand for processed foods with some kind of value addition. The market for food inclusions is being driven by a variety of factors, including changes in dietary habits, shifting consumer food consumption patterns, and rising consumer demand for and acceptance of creative recipes. The demand for food inclusions has increased as a result of factors like changing lifestyles, rising disposable income, and growing adoption of convenience snacks & confections.

Food inclusions are typically used in a variety of applications, such as bakery goods, cereal goods, snacks, and bars to enhance the flavor and nutritional value of the products; as a result, they are generally more expensive and directly affect the final cost of the finished goods. The high cost of inclusions' raw materials and their evolving use in food and beverage products are the main causes of their high price. Additionally, there is a need for distinctive products because consumer taste preferences are evolving.

Based on type, the food inclusions market is segmented into chocolate, fruit & nut, cereal, flavored sugar & caramel, confectionery and other types (biscuit & cookies, color & Bean and plant-based inclusions). The chocolate segment acquired a significant revenue share in the food inclusions market in 2021. One of the main food products that has enjoyed decades long popularity is chocolate, especially in the younger age groups. The majority of the products made with cocoa include dark chocolate, milk chocolate, white chocolate, semi-sweet or bittersweet chocolate, cocoa solids, cocoa powder, cocoa butter, and chocolate liquor.

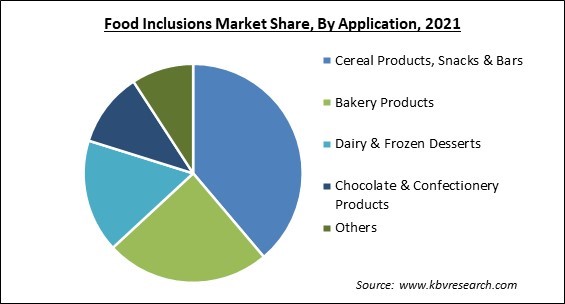

On the basis of application, the food inclusions market is fragmented into cereal products, snacks & bars, bakery products, dairy & frozen desserts, chocolate & confectionery products and other applications products. The bakery products segment acquired a significant revenue share in the food inclusions market in 2021. Cookies, bagels, buns, pastries, sandwiches, muffins, cakes, biscuits, pizzas, brownies, and other baked goods are examples of bakery products. For the topping, flavoring, decoration, and other uses, food inclusions are frequently used in bakery products.

By form, the food inclusions market is divided into solid & semi-solid and liquid. The solid & semi-solid segment led the food inclusions market with the highest revenue share in 2021. Included in the category of solid food inclusions are bits, chips, nuts nibs, crunchies, and flakes. Customers are much attracted towards nuts in their solid form, and they are frequently found in baked goods, confections, dairy products, snacks and bars, frozen desserts, cereals, and beverages.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 12.3 Billion |

| Market size forecast in 2028 | USD 18.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.1% from 2022 to 2028 |

| Number of Pages | 293 |

| Number of Tables | 493 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Form, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the food inclusions market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Europe region witnessed the highest revenue share in the food inclusions market. Due to its size, it continues to be a significant market for food inclusion companies. Leading nations in the European food inclusions market include France, Germany, and the U.K. Increased use of clean-level flavored and natural food products in diet foods has had an impact on the growth of the food inclusions market in this country as consumers in the region adopt healthier lifestyles.

Free Valuable Insights: Global Food Inclusions Market size to reach USD 18.4 Billion by 2028

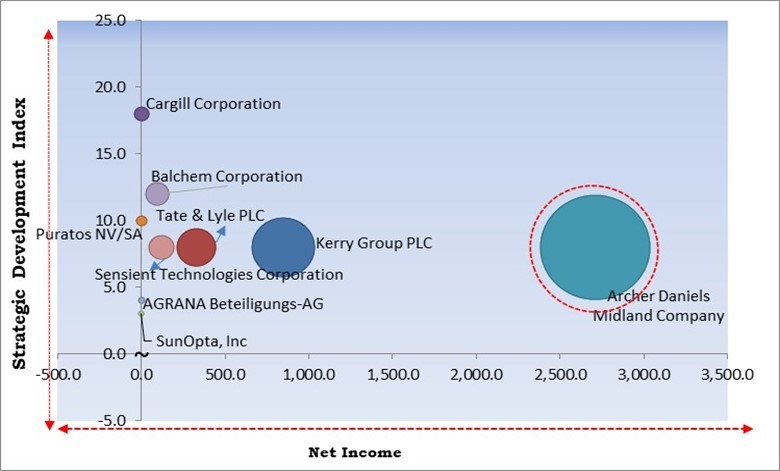

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Archer Daniels Midland Company is the forerunners in the Food Inclusions Market. Companies such as Balchem Corporation, Tate & Lyle PLC, Ltd., Cargill Corporation are some of the key innovators in Food Inclusions Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Kerry Group PLC, Cargill Corporation, Archer Daniels Midland Company, Tate & Lyle PLC, AGRANA Beteiligungs-AG, Puratos NV/SA, Balchem Corporation, Sensient Technologies Corporation, SunOpta, Inc, Chaucer Foods Ltd. (Pilgrim Food Group PLC), and Apple, Inc.

By Application

By Type

By Form

By Geography

The global Food Inclusions Market size is expected to reach $18.4 billion by 2028.

Evolving Flavor Profiles And Consumer Preferences are driving the market in coming years, however, The Consequent Rise In The Cost Of Finished Goods restraints the growth of the market.

Kerry Group PLC, Cargill Corporation, Archer Daniels Midland Company, Tate & Lyle PLC, AGRANA Beteiligungs-AG, Puratos NV/SA, Balchem Corporation, Sensient Technologies Corporation, SunOpta, Inc, Chaucer Foods Ltd. (Pilgrim Food Group PLC), and Apple, Inc.

The expected CAGR of the Food Inclusions Market is 6.1% from 2022 to 2028.

The Fruit & Nut segment acquired maximum revenue share in the Global Food Inclusions Market by Type in 2021 thereby, achieving a market value of $6.2 billion by 2028.

The Europe market dominated the Global Food Inclusions Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $6.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.